Key Stock Market Takeaways:

– Consumer confidence is near its highs and the percentage of consumers looking for stocks to move higher remains elevated. Meanwhile the S&P 500 Index INDEXSP: .INX remains well off its summer highs.

– Shorter-term measures of investor sentiment display some (though not widespread) caution.

– Investor sentiment is mixed message which may imply that longer-term risks remain high even as recent rise in pessimism could limit near-term downside.

If the message from this market commentary seems a little muddled, it probably means it is doing a good job of capturing the currently mixed sentiment backdrop.

Individual indicators are sending conflicting signals. The goal here is to take that and provide context and perspective – to observe broadly and offer interpretation.

There is some evidence that near-term pessimism has risen of late, but this is within a longer-term backdrop characterized by optimism and complacency.

Putting aside anecdotes, the data suggests the current environment is more marked by entrenched investor optimism than deep-seated pessimism.

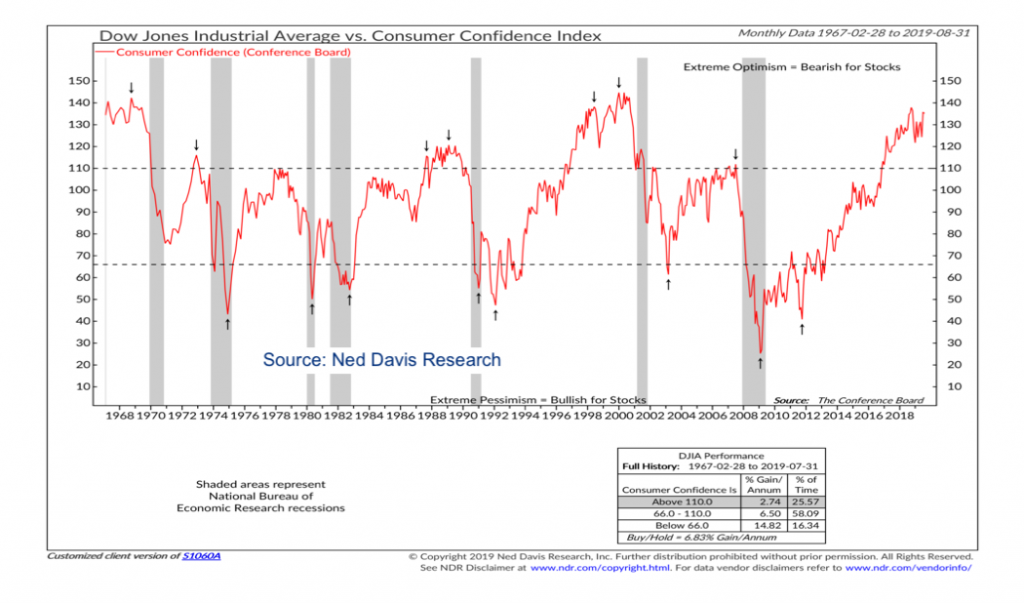

The Conference Board’s monthly look at consumer confidence was released this week. It showed a slight decline, but was stronger than expected and remains in a zone that has been marked by sub-par stock market returns in the past.

Daily and weekly data provide a different perspective. Sentiment composites published by Ned Davis Research have sentiment somewhere in the neutral (Crowd Sentiment Poll) to excessive pessimism (Daily Trading Sentiment Composite) zone. The Trading Sentiment Composite is on a buy signal, though the signal strength from this indicator has been muted over the past few years (perhaps an indication that too many are trying to be contrarians right now).

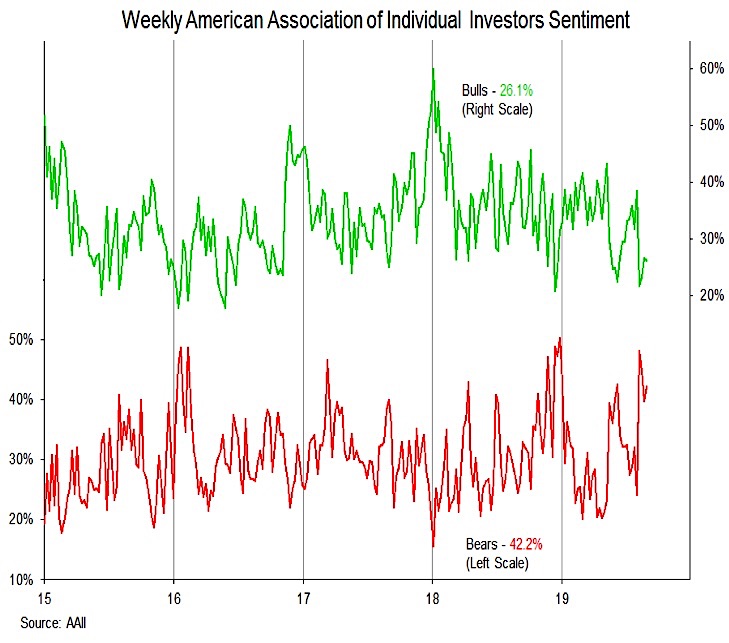

The AAII survey has gotten attention in recent weeks for seeming to show a surge in pessimism among individual investors. For the fourth week in a row it shows more bears than bulls.

This professed concern among individual investors does not mesh with the consumer confidence data discussed above. Nor is it consistent with the asset allocation data also collected by the AAII which shows stock vs cash allocations near their highest levels on record.

A more rigorously assembled view of investor views on stocks comes from the University of Michigan’s consumer sentiment survey. The latest data (from July) shows that 64% of consumers expect stocks to rise over the coming year. Forward stock market returns have been muted in the wake of such optimism.

continue reading on the next page…