The rally in the equity markets stalled last week with the Dow Industrials and S&P 500 (INDEXSP:.INX) basically flat for the period while the NASDAQ (INDEXNASDAQ:.IXIC) showed a fractional gain.

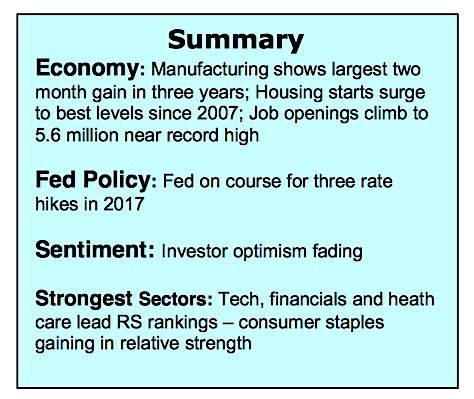

The relatively weak performance was surprising given that stocks had good support from economic data that included a report showing manufacturing activity climbing above trend for the second month in a row. Perhaps investor sentiment / optimism has something to do with this (read further below).

The Conference Board’s Leading Economic Index (LEI) climbed sharply for the third month in a row with new orders adding to the surge. Additionally, the Reuters/University of Michigan Consumer Sentiment Index showed confidence at the highest level since 2004. Fed Chair Janet Yellen, while noting the economic progress, suggested that the normalization of interest rates would continue at a measured pace. The combination of better-than-expected business news and a moderate Fed provided the markets with a very positive environment. The fact that stocks failed to respond and the slowing rate of gains overall in March suggests a period of consolidation is likely in the second quarter. The focus of attention the next few weeks will shift to corporate earnings where profit growth is considered essential to support the elevated valuation levels.

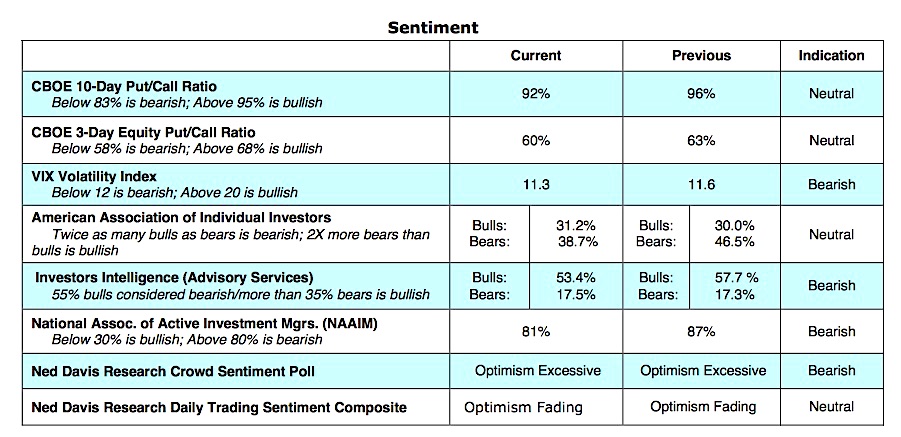

The weight of the technical evidence supports the thesis that stocks have entered a consolidation phase that is likely to carry into the second quarter. Investor sentiment indicators that showed optimism had reached an extreme earlier in the year are beginning to fade.

Once optimism peaks it typically means that stocks are vulnerable to a pullback or sidewise action over the near term. After reaching a 30-year high in bulls, the latest Investors Intelligence (II) data shows a substantial drop in bulls to 53% from 63% three weeks ago. A survey of professional investors supports the prospects that confidence has peaked. The most recent data from the National Association of Active Investment Managers (NAAIM) shows a drop in the allocation toward stocks to 81% last week from 101% (second-highest reading in history) two weeks ago. On the contrary, measures of investor psychology including the flow of funds into equity mutual funds and ETFs continue to indicate a high level of optimism. Although we anticipate a new leg up in the bull market this summer, it likely will be preceded by further deterioration in investor confidence. Evidence of this would include the bulls in the II data base falling below 50%, the allocation to stocks in the NAAIM numbers to below 70% and a sharp drop in weekly inflows to equity funds.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.