There have been some amazing stock moves already this year.

The rally off the lows with very little give back has been incredible.

However, looking under the hood there hasn’t been a ton of excitement or risk appetite among investors. Defensive stocks have been in favor just as much as riskier groups.

Now, we’re seeing evidence of a tectonic shift.

The High Beta Stocks ETF (NYSEARCA: SPHB) relative to Low Volatility Stocks ETF (NYSEARCA: SPLV) suggest risk appetite hasn’t been strong. After an initial surge in January, the ratio has stagnated for months.

That’s now changing a bit as this ratio is breaking out simultaneously with the consumer ratio.

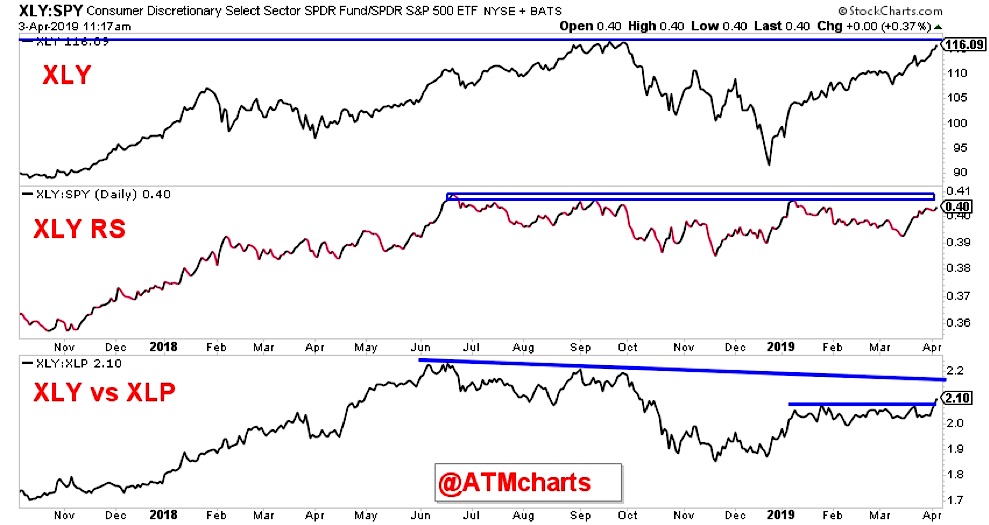

Consumer Discretionary has shown solid strength on an absolute and relative basis (vs the S&P 500), but for months it had shown no strength relative to its defensive cousin Consumer Staples.

So while risk-on stocks have caught amazing bids, the defensive names were seeing similar bids as well. That now appears to be changing with XLY vs XLP breaking out of the tight range.

You can argue that it’s a capitulation of sorts, but that’s a hard sell. Leading groups like Semiconductors are making new all time highs and breadth is so strong minor divergences mean nothing.

Thanks for reading and trade ‘em well!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.