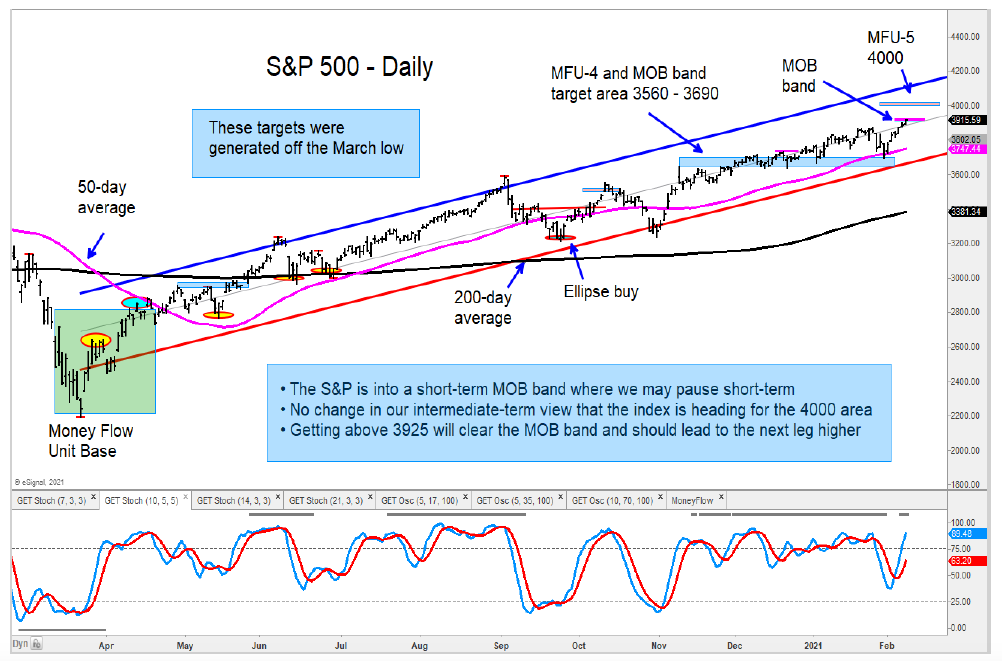

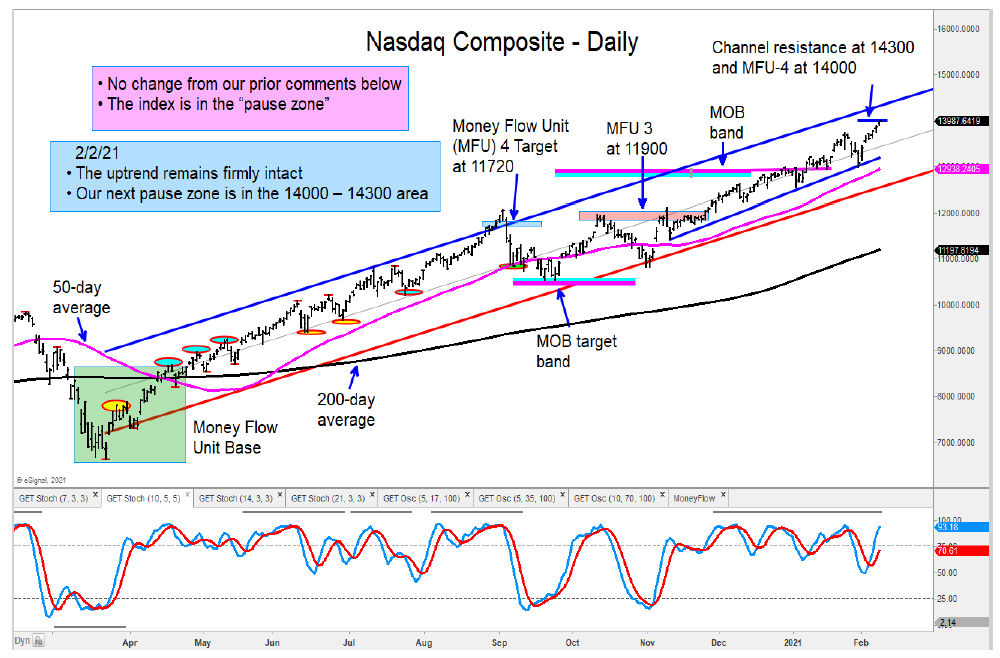

The broad U.S. stock market indices have been red-hot, rallying to new all-time highs day after day of late. This is right in line with our forecast and analysis. But active investors should be aware that we are fast approaching MOB band and Money Flow Unit price targets on several indices.

And this could trigger a pause and/or correction for stocks.

The S&P 500 Index is rallying into a short-term MOB band resistance target, which may result in a pause for the index. However, once this zone is cleared I expect price to tag the 4000 target level identified by our Money Flow Unit (MFU) analysis.

The Nasdaq composite is rallying into the MFU-4 level of 14000, and I think there will be a pause in the advance. I will need to see how the tech index trades in this zone in the coming days to determine if it’s something more than a pause or a breakout above this level.

I continue to favor the Mid and Small cap stocks and market indices- both the Russell 2000 and Mid-Cap Indices have strong upside momentum

The Dow Transports index has moved above its 50-day average, and I see more upside to come. I favor the airlines and list five long ideas on page 9, where review the Airline Index (XAL).

Update on the Oil & Gas Exploration & Production ETF (XOP): The energy sector is getting more media attention as many of the stocks have seen high single to double-digit returns in a day. Our Money Flow Unit work helped me identify the bullish flow in mid-November, and I continue to be bullish. I see another +10% upside from here.

Natural gas has a bullish base developing which complements a recent bullish note I had on WTI Crude Oil.

The author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.