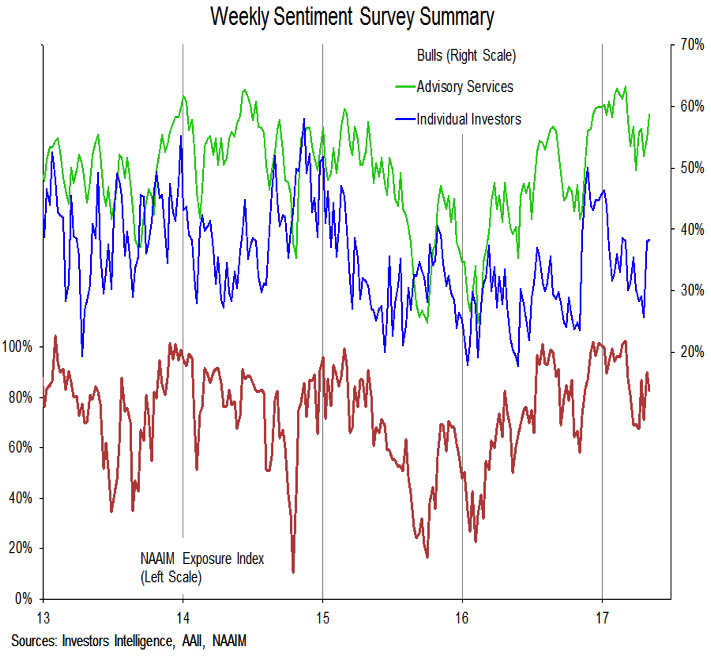

Investor Sentiment – Sentiment is now neutral. We have been watching the sentiment surveys for evidence that excessive optimism has been unwound.

After relatively modest pullbacks among Advisory Services Bulls (which dropped from 62.7% to 49.5%) and the NAAIM exposure index (which declined from 102.1 to 67.5), optimism has rebounded in recent weeks. Individual investors saw a more complete unwinding in optimism, with bulls dropping form a post-election peak of 49.9% to a recent low of 25.7%, but here too optimism is again rising. A more complete unwinding of optimism (and perhaps more importantly, a sustained uptick in pessimism) could have helped clear the way for a meaningful upside move for stocks. History suggests stocks market gains can be hard fought when the crowd is lined up in the bullish camp.

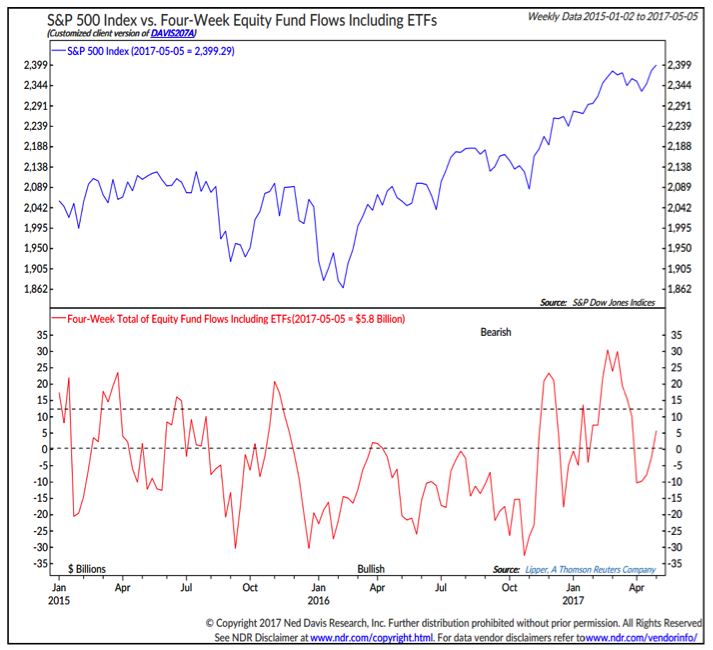

Fund Flows – In contrast to the sentiment surveys, fund flow data suggest investors have turned more skeptical on equities, particularly U.S. equities. After seeing net outflows for the first three quarters of 2016, equity funds experienced a surge in inflows in the fourth quarter of last year, with the four-week total of inflows peaking at $30 billion in the first quarter of 2017. Since then flows have ebbed considerably as investors took a more cautious view on equities. U.S. equity funds have the largest outflows in more than a year and a money manager survey suggests exposure to U.S. stocks reached a nine-year low in April. The more cautious data from a fund flow/allocation perspective offsets the rising optimism in the surveys, suggesting sentiment overall is neutral.

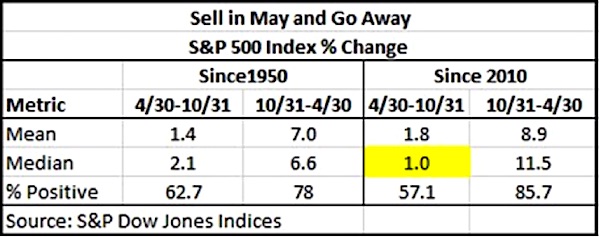

Seasonal patterns and trends have been downgraded to neutral. Usually by the time a tendency becomes widely enough known to have its own cliché, the effects of the tendency become more muted. The “Sell in May” mantra gets lots of attention every year, but apparently deservedly so. There is little evidence that recent years have seen a diminishing in effectiveness of this seasonal switching strategy. Stocks have tended to see the bulk of their yearly gains between November and April, with the May to October time period posting relatively meager gains and rising less than 60% of the time. This year it comes with well-advertised composite cycle headwinds becoming pronounced in the second half of the year.

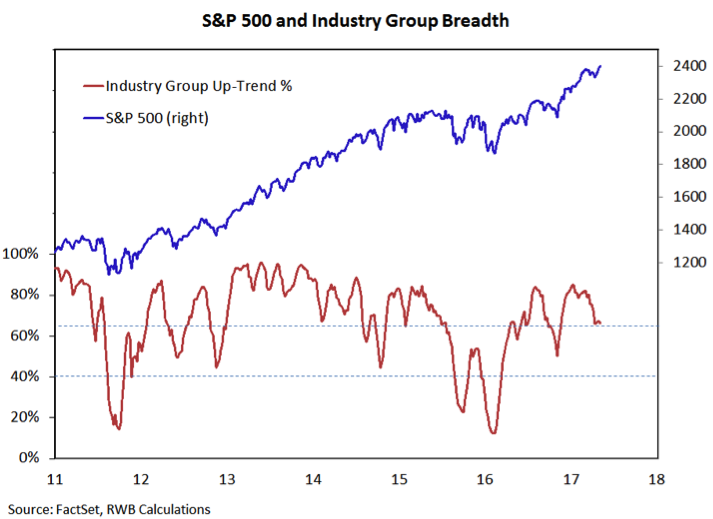

Breadth remains bullish, but robustness of the rally is getting frayed around the edges. The good news is that even as the S&P 500 has drifted largely sideways for the past two months, the percentage of industry groups in up-trends has remained relatively strong at 65%. From a more cautious perspective, the number of individual stocks (and sectors) making new highs has been muted even as the indexes have made at least marginally higher highs. While not yet rising to the level of a red flag, the lack of new highs suggests the S&P 500 may not yet be set to break out to the upside. An expansion in the number of stocks making new highs would argue that the cyclical rally is set to resume, while further deterioration in the percentage of industry groups in up-trends would suggest further consolidation at the index level is needed.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.