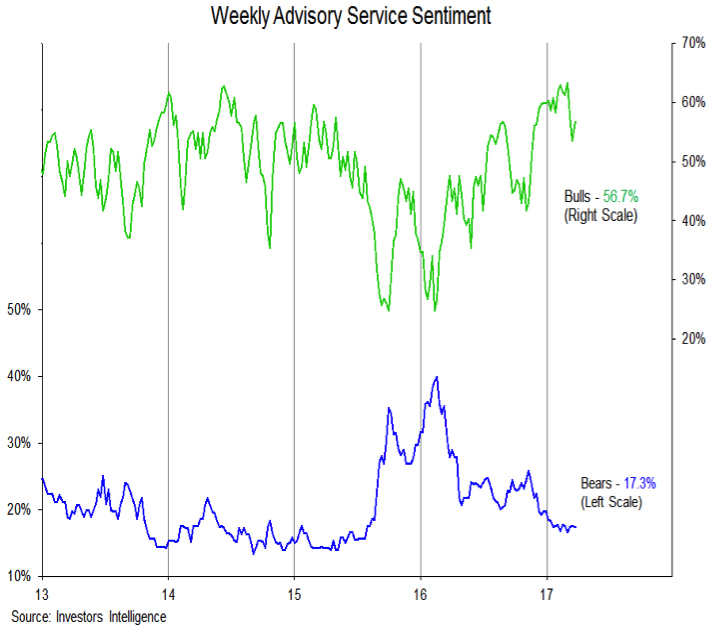

Investor Sentiment remains bearish amid signs that optimism is reversing from excessive levels.

The weakest period for the stock market tends to be after a significant peak in optimism (hence the adage, go with the crowd until it reverses at extremes). That appears to be the situation in which we currently find ourselves. Based on the Investors Intelligence survey of advisory services, bullish sentiment moved to a 30-year high in early March and has since begun to retreat. Similarly, the NAAIM survey shows that equity exposure among active investment managers reached its second-highest level on record. The key now is how quickly pessimism and skepticism can be rebuilt. The Advisory Services data has shown no uptick in bears, but the NAAIM data has already seen a shift toward more defensive equity positioning.

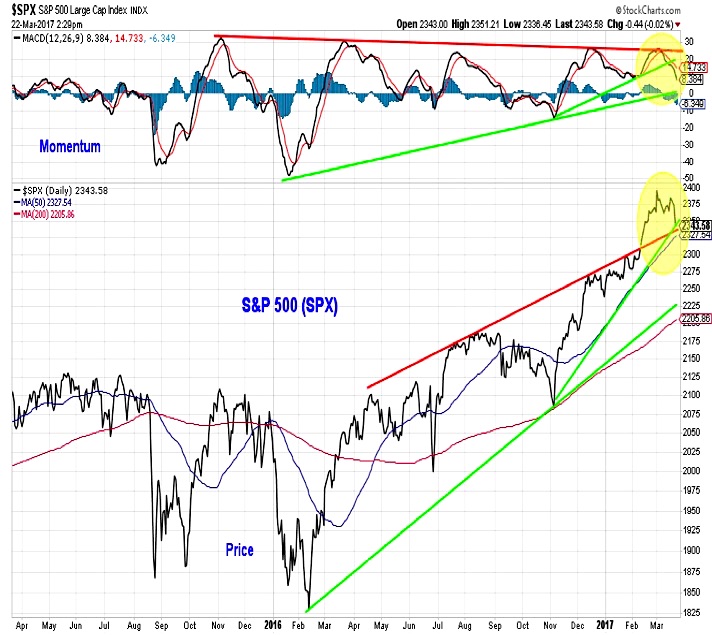

Seasonal Patterns/Trends are bullish. The overall seasonal pattern, based on the one-year, four-year (Presidential) and 10-year cycles, suggests stocks enjoy a tailwind into mid-year. This is confirmed by the weekly chart that shows both price and momentum still trending higher for the S&P 500. Of some concern is the daily chart for the S&P 500. On a daily basis, momentum is fading after failing to break above resistance. Price has pulled back to a confluence of trend-lines. If those levels do not provide support, the S&P 500 could be set up for a test of the trend-line off of the February 2016 lows, as well as the 200-day average. Given the lack of volatility seen of late in the market, such a move could hasten the emergence of bearish sentiment and would likely be short-lived. Even if day-to-day volatility re-emerges, it need not have bearish implications for the longer-term trends.

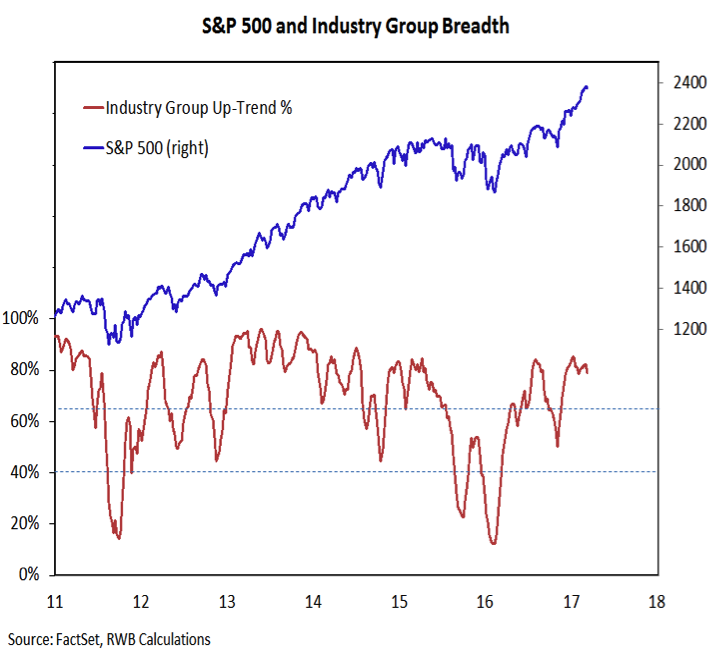

Broad market trends are bullish. Most areas of the domestic market are in up-trends and the S&P 500 has had plenty of company making new highs so far in 2017. Near-term breadth indicators have cooled recently, but 80% of the industry groups that comprise the S&P 1500 remain in up-trends. Breadth has improved overseas as well. The percentage of global stocks trading above their 200-day averages has climbed steadily over the last year and is now approaching 75%. Improving trends overseas provide support for the U.S. stock market and also an opportunity to add international exposure for tactical investors.

So, What To Do Now?

As correlations across asset classes retreat from the elevated levels of recent years, the opportunity for changing relative leadership trends becomes more pronounced. For long-term investors this may mean renewed benefits from diversification and attention to asset allocation. Periods of volatility will still exist, but a diversified portfolio may help cushion, rather than exacerbate, these moves.

For more tactical investors, declining correlations suggest the tendency to lurch between risk-on and risk-off of the past few years may morph into opportunities to identify sustainable relative leadership trends between risky assets.

For the past few years, U.S. stocks have been in a meaningful and sustained up-trend relative to international stocks. Diversifying away from U.S. equity exposure, particularly for dollar-based investors, has meant worse returns and more risk. That appears to be changing. International stocks have taken a leadership role so far in 2017, and relative momentum is shifting in favor of international stocks.

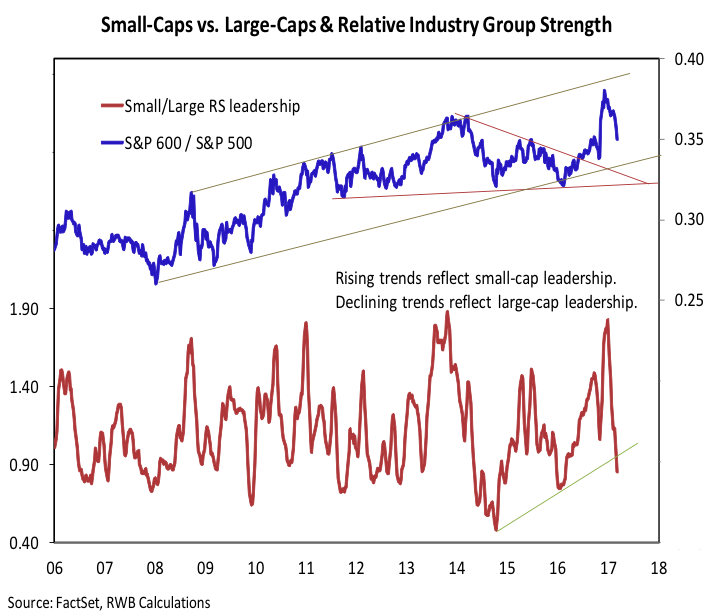

Small-caps (i.e. Russell 2000 – INDEXRUSSELL:RUT) were relative leaders, in terms of both price action and industry group strength, coming into 2017. That has faded also. The deterioration in small-cap leadership at the industry group level has been particularly pronounced.

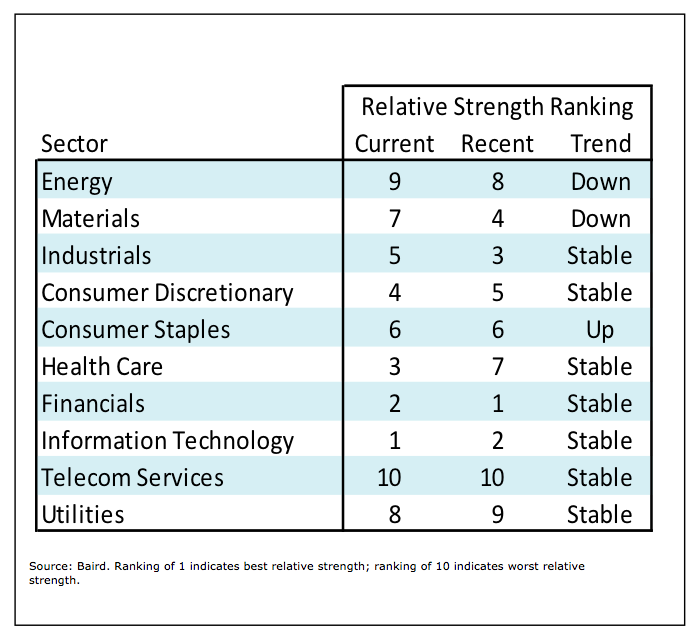

Recent sector leadership has come from a perhaps unlikely trio of Technology, Financials and Health Care. Health Care has been a recent addition to the leadership group. Energy and Materials have slipped in the rankings while Consumer Staples has actually improved. Industrials remain in the leadership group but sub-industry trends suggest its time there may, for now, soon be coming to an end.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.