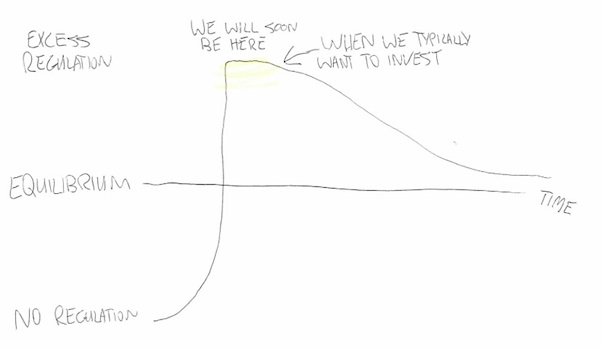

U.S. lawmakers are in a rush to regulate drones. Odds are pretty good that regulations will be unduly harsh at first. A heavy-up on rules is probably overkill, but regulations and rules are being thrown in left and right at this point. I drew a quick diagram to explain the apparent path of U.S. drone regulation over time and how that may affect investing in drones and related stocks to that business line.

It could take years for regulation to ease as we have to find out what exactly is necessary and what isn’t via trial and error. The trajectory of the U.S drone market is uncertain and uncertainty tends to breed opportunity.

The great part is investors can wait a for quality bases to form in their favorite drone and drone component stocks. But no doubt, investing in drones will take some research.

Here are a few stocks to keep in mind with brief companies bios via investors.com:

Aerojet Rocketdyne (AJRD) – Manufacturers satellite and weapon propulsion systems.

AeroVironment (AVAV) – Manufacturers unmanned aircraft and test systems for the US government.

InvenSense (INVN) – Manufactures motion processing chips and software

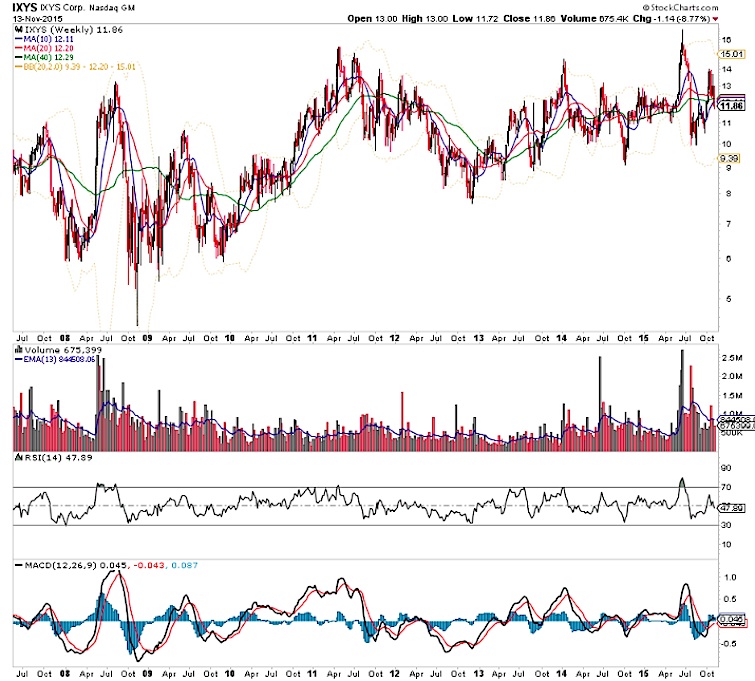

IXYS Corporation (IXYS) – Manufactures complex signal power management chips

On a somewhat related note from the aforementioned article, the U.S. isn’t even the cradle of drone innovation and investing in drones. Phantom, the world’s leading consumer drone is made in China. Not only made in China but by a Chinese company. An interesting tidbit when thinking about the very long run.

Thanks for reading.

Twitter: @ATMcharts

Author has a position in AJRD at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.