3. A maturing cyclical bull market heading into mid-term elections.

While the first year of a new president’s term is usually bullish for stocks, mid-term election years become more challenging. The hopefulness of a new administration’s attempt to fulfill campaign promises yields to a new round of campaigning and electoral grievances. 2018 could shape up to be an epic example of this.

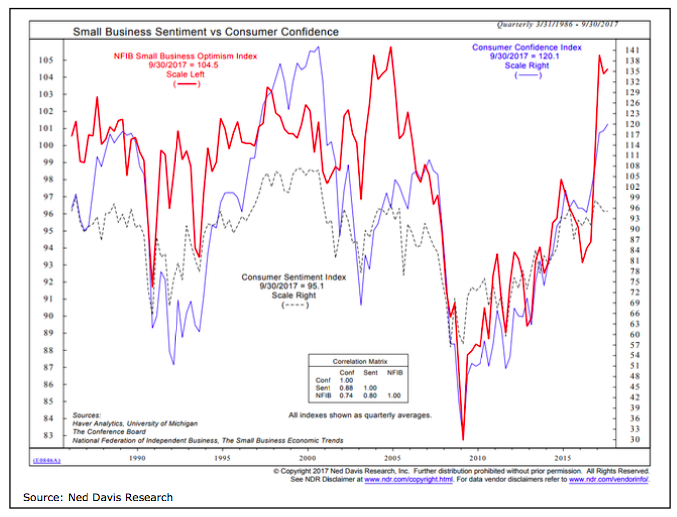

Mid-term elections tend to be cast as a referendum on the new president, and with the low approval ratings of the current president, his record could face widespread challenges. Republican incumbents have already bowed out in multiple races in contested states and districts. While not wanting to offer a prediction on the ultimate outcome of the November elections in terms of congressional control, it seems safe to expect the campaign season and related uncertainty could have at least its normal impact on stocks. While this may ultimately offer opportunity for tactical investors, the getting there could be a bumpy ride.

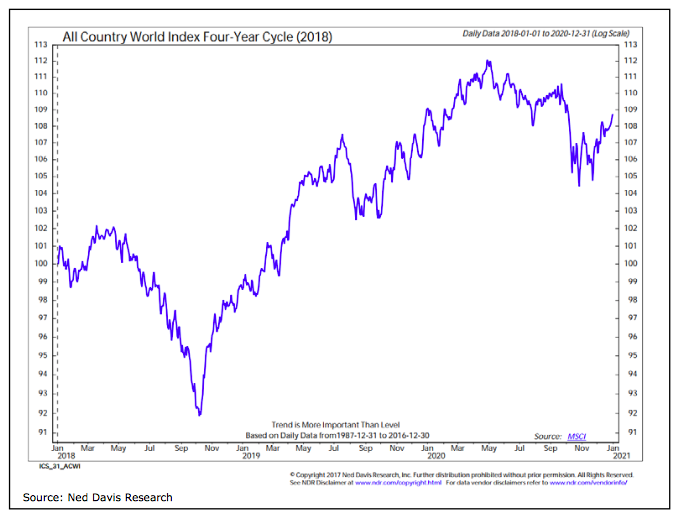

These electoral headwinds, which begin to blow with more intensity in the second quarter of the year, come as the current cycle bull market approaches maturity. Within secular bull markets (which is where we seem to find ourselves), cyclical rallies last on average just under 2 ½ years and see gains of 77%. The current rally will celebrate its second anniversary in February, and at the time of this writing (in late 2017) the S&P 500 is more than 40% above its February 2016 low.

For perspective, cyclical declines within secular bull markets last eight months on average and see declines just shy of 20% (although the two most recent cyclical declines have been somewhat less severe).

Two related factors bear watching and could be offsets to some of these cyclical concerns. First, President Trump has never enjoyed broad favorability as reported in the Gallup presidential approval poll. Attempts to tarnish his reputation and move voters against what will be portrayed as his proxies in Congress may not have a significant effect, especially if economic confidence remains high. Secondly, the late 2017 stock market strength has come on a rotation away from Technology leadership and toward areas (like the Dow Transports and the Broker/Dealer Index) that typically lead to additional stock market gains. While breadth has improved into this rally, we have not (yet) seen a sustained spike in the ratio of advancing issues versus declining issues. If we do see such a breadth thrust, it could be evidence that the cyclical rally has a new lease on life and could presage another significant leg higher for stocks.

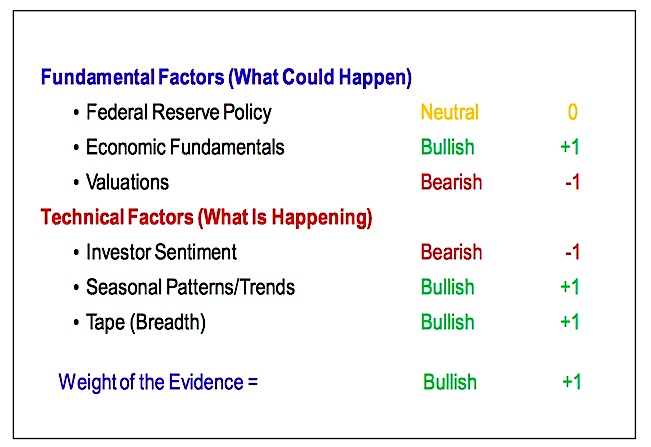

While we can discuss themes and have identified potential problems on the horizon, we need to steer clear of taking an investment stance that is strictly forecast-based. We also need to consider the evidence currently at hand, balancing what could be tomorrow against what is today. While there are potential pit-falls in store for 2018, the weight of the evidence as we move toward the New Year remains bullish. If and when the indicators argue for a more cautious view on stocks, we will follow suit. Moving prematurely runs the risk of being held hostage to our cognitive biases. With the weight of the evidence still bullish, the cyclical up-trend that emerged in 2016 continues to get the benefit of the doubt. The shift toward international equity leadership (both developed and emerging markets) remains ongoing and could continue into 2018.

Given the expected shift toward a more volatile investing environment in 2018, taking time now to re-assess risk tolerances, making asset allocation adjustments as necessary, may be the most prudent course for many investors. Beyond that, increased self-awareness (knowing the cognitive bias and pet concerns that always pester us) and a healthy dose of humility (keeping an open mind and being more willing to reconsider what we know to be the case) may be important as we navigate what could be a bumpy 2018. Thanks for reading, now let’s go find someone to listen to.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.