Where to Begin Trading Options

Have you ever heard about trading options, but didn’t know where to even begin? I’ll give you a quick introduction into option contract basics to get you started and lay out a basic trade. In later posts we will delve into slightly more complex option strategies. The goal is to give you several valuable additions to your trading toolbox. It can be intimidating at first, but it won’t take long to pick up the fundamentals so you can start to incorporate these flexible tools into your portfolio mix.

What is an Option

An Option contract gives you the right but not the obligation to trade an underlying stock or ETF. A Call is an option to buy 100 shares of the security and a Put is an option to sell 100 shares. There will be a Strike Price which defines the specific price at which the contract may be exercised as well as an Expiration Date at which time the option must either be acted upon or let expire worthless. Option Premium is the trading price of an option and the option can either be bought long (you pay a debit) or sold short (you collect a credit). In the Money [ITM] Calls have the underlying security trading above the option Strike Price while ITM Puts have the stock/ETF trading below the Strike Price. Otherwise, options not In the Money are said to be trading Out of the Money [OTM]. The Intrinsic Valueof an ITM Option is the difference between the security trading price and the option strike price. The Extrinsic Value or Time Value is the difference between the option premium and the Intrinsic Value. For more information, a comprehensive options tutorial can be found here: https://www.optionseducation.org/getting_started/options_overview.html

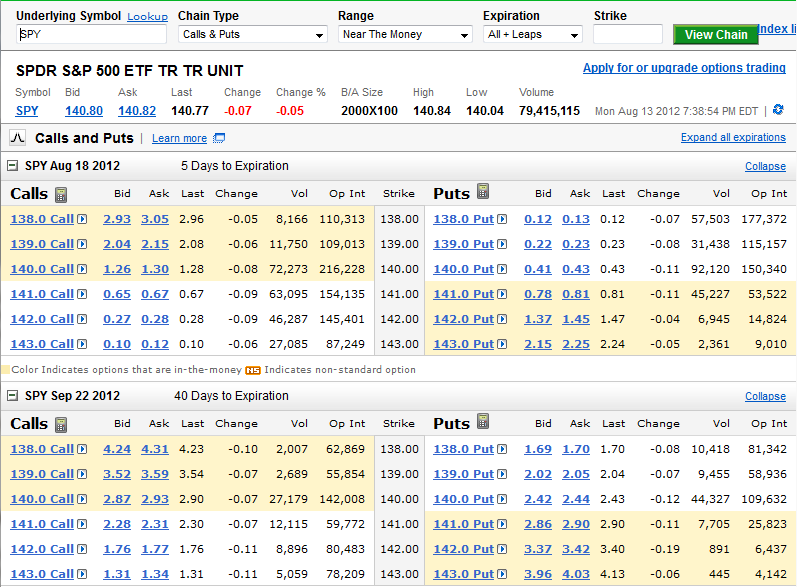

Let’s put it all together and view a typical Option Chain screen which presents most of the option information we need:

Look above at the SPY Aug 18 2012 Call with a 140.00 Strike Price. It would cost $130 ($1.30 asking price x 100 shares) to buy one option. That 140.00 Call is In the Money since SPY shares are trading above it at 140.77. The total option premium of $1.30 is divided between intrinsic value of $0.77 and extrinsic value of $0.53. The call expires on August 18th meaning if SPY is still trading above 140 that day, I can exercise the option and buy 100 shares of SPY at $140.00 per share no matter how much higher the SPY market price may be. If SPY trades below 140 at the end of that day and I haven’t sold the call to close the position then the option will expire worthless. The most I can lose on a call option purchase is the premium paid or in this case $130. My breakeven on the trade would be the strike price plus the option premium or $141.30. There is no limit on the profit if SPY trades over $141.30.

What do you need to do to get setup trading options

Most all brokerage accounts will allow you the privilege of trading options but it won’t be turned on by default. You’ll probably have to sign some compliance forms and waivers and also request an option trading level. Level 3 should be sufficient for all the strategies that I’ll be outlining in this forum. Level 2 allows buying calls and puts without owning the underlying security, but will not permit option spread trades which in my opinion are most useful. It’s also not a bad idea to call your trading firm and talk to a service representative about getting option privileges turned on for your account rather than trying to navigate the online activation. As well, consult a professional whenever necessary.

Why would you consider using options

Option trading provides many benefits and I use them for three different strategies:

1. Speculate with a directional bias on a security with strictly defined risk and at the same time tie up less trading capital than buying or selling shares of the stock outright.

2. Protect profits on longer term holdings and hedge my portfolio against potential market losses without having to sell off my positions.

3. Earn extra income on shorter term trades by selling option premium.

Breakdown a Simple Speculative Directional Option Trade

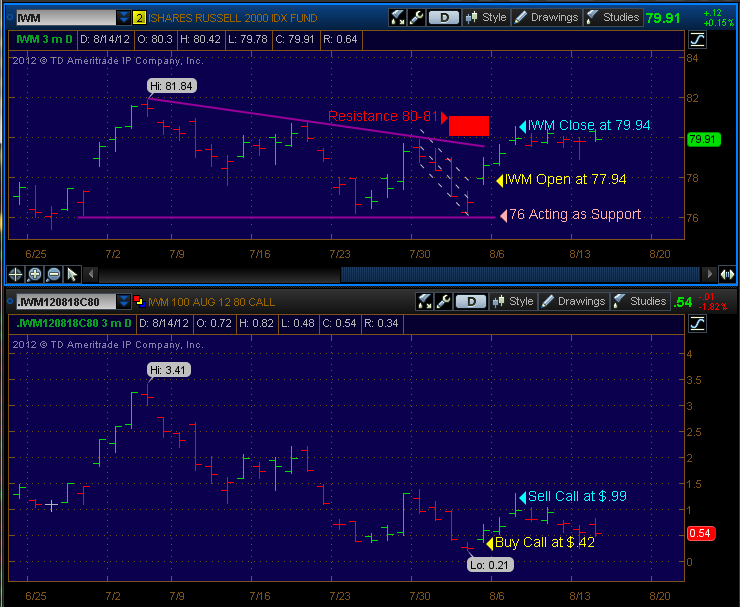

Let’s review a sample option trade and walk through all the basic steps in the calculation (reference below: a daily bar chart of IWM along with the chart of an Aug 18 2012 Call with an 80.00 strike price). Suppose I had been watching IWM at the end of July and wanted to be ready for a possible bounce off 76 support level and decent swing trade back to 80-81 resistance. On 8/3 IWM gaps up and over my regression channel and opens trading at 77.94. I could have initiated a standard long position at that time and bought IWM shares. However, let’s say I wasn’t comfortable with a stop all the way down at 76 because the potential $1.94 per share loss would mean I’d stress the long weekend trip to the lake worrying about headline risk and a gap fill before returning the next Monday night.

So instead of buying IWM shares, I open up the IWM option chain to see an Aug 80.00 Call trading for $0.42. I choose the 80.00 Call because there is plenty of volume which means better bid/ask spreads and nice liquidity when I close the option trade. I also know that options trading nearly in the money change in price faster than options farther out of the money. That is called a higher Delta for all who want to learn some useful option variables called Greeks. A .30 Delta means $1 change in IWM shares roughly translates to $0.30 change in the option price. Delta will go towards 1 deeper in the money and 0 farther out of the money. In the money calls are also more expensive demonstrating the classic tradeoff between risk and reward. Lastly, I choose August calls because I see there are 3 weeks to expiration and my bounce swing trades are typically going to last only a few days. I want to avoid buying calls with less than a week to expiration because most of the time value built into options premium vanishes close to expiration – that’s Theta loss to us Greek geeks.

Suppose I go ahead and buy 5 of those 80.00 Call option contracts for $210 (5 x 100 x .42). I could then take comfort defining that as my max risk and relax with little worries of European implosion over the weekend. I won’t profit nearly as much using the call option compared to an outright share purchase if I’m correct on the direction and timing of the trade, but the reduced risk is worth it in light of the fact that I’m only tying up $210 in my account instead of $38,970 (500 shares x 77.94) in a normal position.

Now fast forward several days to August 7th – I’m rested and refreshed from the stress free vacation and happy to see IWM acting well. It has popped to 80.50 which is at my target. I could sell my 5 call contracts at the end of the day for $0.99 each. Net profit is calculated to be $285 before commissions ( 5 x 100 x [.99-.42] ). Again that profit isn’t nearly as much as a standard share purchase – (500 x [79.94 – 77.94] = $1000), but expressed in percentage terms against the capital used in the trade is much greater -> 285 / 210 = 135.7% return vs. 1000 / 38970 = 2.6% return.

Try options out with paper trades first

That is the basics behind a directional option trade. I rigidly defined my risk, tied up a tiny amount of precious trading capital, and in exchange gave up a portion of the potential gains. The trade earned a whopping 135% return on capital, but in all fairness, the losses in options trades will be giant percentages as well, so don’t fall into that math trap because leverage cuts both directions. Just like typical share transactions you still need a solid trading plan and have to execute well in order to profit at the end of the day.

Take some paper option trades and compare the simulated results to regular share trades. Trade very small at the start. Avoid the temptation to trade huge option positions under the spell of seeing less funds invested – it would be insane to assume that if you normally took $40k trade positions buying shares you could buy $40k worth of options for similar risk. A better sizing method is to first calculate the number of shares you would normally trade, then divide by 100 and maybe add a few contracts if using out of the money options. Also it’s imperative to avoid the tendency to take marginal setup trades with options. Over trading is bad trading no matter if you are using shares or options.

Hopefully this primer will help you get started with options contracts. In the coming weeks we’ll dig into other common option strategies and before you know it, you’ll get a feel for them as versatile trading tools at your disposal.

———————————————————

Twitter: @BBTompkins and @seeitmarket Facebook: See It Market

Hedge position in SPY puts at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.