The landscape of international investing has become more complex than ever, particularly for ETF investors. The reason for this is actually a good thing – there are now more choices than ever when it comes to varying country, regional, economic development, or currency exposure than ever. So there are a wide variety of international ETFs to choose from.

The hottest trend right now is in currency-hedged ETFs that hold a diversified basket of international stocks with short positions in the underlying local currency. Essentially this type of fund is designed as the perfect overseas investing vehicle for a quantitative easing-style world in which the local currency is falling, while equity prices are rising.

Europe is a great example.

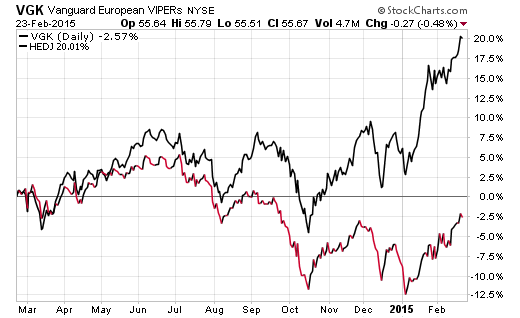

The WisdomTree Europe Hedged Equity Fund (HEDJ) has taken in over $4.6 billion this year alone and leads all ETFs in total inflows. That’s an impressive statistic and even more interesting when you consider that investors have been rewarded with a total return of 13.74% on a year-to-date basis as well. That’s more than double the performance of the unhedged Vanguard Europe ETF (VGK), which has only gained 6.22%.

A one-year chart shows an even wider divergence as the trend of a rising U.S. dollar and falling euro has separated these indexes.

The question most investors in conventional international ETFs are now asking themselves is whether or not it’s too late to get into the currency game. After all, these sophisticated hedging products will actually underperform their traditional peers when the local currency is strengthening.

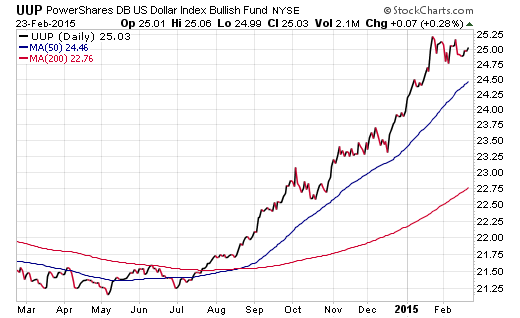

A look at a chart of the PowerShares U.S. Dollar Bullish ETF (UUP) shows how this index has flattened in price over the last month despite a tremendous push higher since last July. This has been the tailwind that has helped boost funds such as HEDJ.

Trend followers will likely point to the strength in the U.S. Dollar as an optimistic catalyst to continue holding investments that are positively correlated with this currency theme. Conversely, those that prefer to monitor sentiment and relative value may feel that this trade is overcrowded and ripe for a reversal.

Either way, it may be a better question to ask whether or not you are qualified or sophisticated enough to delve into the currency markets given the unique dynamics of this trade. There are forces at work in this non-correlated asset class that will require extra vigilance of global macro-economic trends. And these uniquely effect

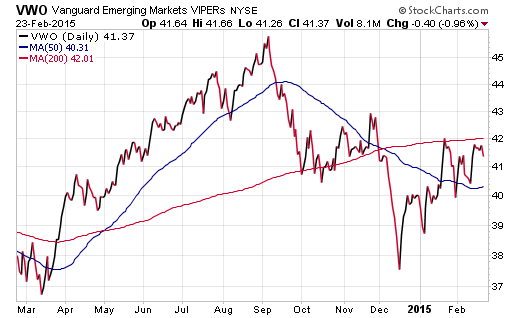

Okay let’switch gears to another niche of International ETFs: Emerging Markets. The EM space has shown some signs of life, but still remains fractured in their respective country momentum. The Vanguard Emerging Market ETF (VWO) has gained just over 3% this year with countries such as Russia (RSX) and India (INDA) leading the way. On the flip side, Brazil (EWZ) and Singapore (EWS) have weighed on returns and continue to lag their peers.

Clearly the big money is flowing to countries and regions that are being supported through central bank intervention rather than the prospects for high growth rates in developing nations. In addition, the ongoing deflationary environment in commodities may make natural resource-heavy economies less attractive as well.

Nevertheless, having some exposure to international ETFs has proven to be a positive divergence from U.S. stocks on a total return basis in 2015. The SPDR S&P 500 ETF (SPY) has gained just 2.76% so far this year.

Follow Dave on Twitter: @fabiancapital

Disclosure: Clients of FMD Capital Management own VWO and VGK at the time this article was published.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.