The following research was contributed by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary

- Wall Street Horizon launched Interim Calendar featuring key dates and information between earnings announcements – we look at 2 firms with upcoming interim events

- Dividend policy changes are positive this year, but there is a caution flag waving

- A Consumer Discretionary name with a sputtering share price is profiled as an earnings outlier

Wall Street Horizon launched Interim Calendar on September 14. This expansive new dataset contains dates and information about recurring announcements made by companies between their quarterly or semiannual earnings reports. Figures such as sales, production, services levels, and financial condition updates are contained in the Interim Calendar.

Upcoming Interim Events

Fastenal Co (FAST) is a $30 billion market cap Industrials company based in Minnesota. It’s a strong proxy for what’s happening in the important manufacturing sector of the US economy, but its business overseas also sheds light on global activity. FAST provides monthly sales updates between its quarterly earnings reports—September revenue figures will be released on the morning of October 12. The following month’s sales update posts November 4 before the Baird 2021 Global Industrial Conference where Holden Lewis, EVP & CFO is scheduled to speak.

Getlink SE (GET.FR) is a leading Transport company headquartered in France. Interim updates are arguably more vital for international firms since many of these companies report earnings just twice a year. Interim Calendar has two notable events in October: monthly Shuttle Traffic information Unconfirmed on October 7 (based on reporting history) and semi-annual revenue and traffic figures Confirmed on October 21. Unconfirmed events will be Confirmed once the company announces the event or will be confirmed on the date of the event.

The Interim Calendar provides valuable corporate event information that drives stock price volatility in markets around the world. Amid an uncertain macroeconomic environment, corporate executives are quickly pivoting to evolving trends. Short-term business updates are more important than ever.

A Check on Dividend Trends

Given this uncertainty, what signals are we getting from firms by way of dividend policy? Dividend announcements and payments are among the more than 40 corporate event types Wall Street Horizon covers, therefore, keeping our fingers on the pulse of corporate sentiment. When firms are optimistic, they tend to raise dividends. When tough times lie ahead, we see dividend cuts.

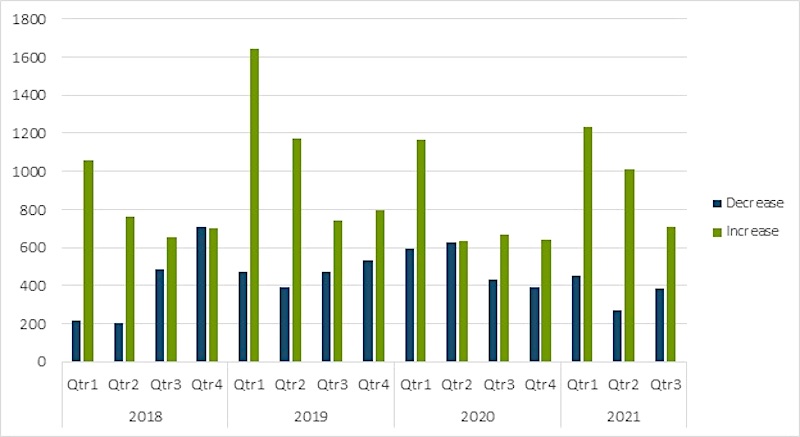

How is 2021 shaping up? It’s a year of rebound and optimism despite ongoing challenges such as COVID-19 lingering and inflation shooting to multi-decade highs. Our data show more dividend increases announced this quarter versus Q3 2020. It continues a strong trend that began last summer. This is a metric market participants should continue to monitor as there has been an uptick in dividend decreases quarter-on-quarter. That could be a warning sign as we head toward 2022.

Figure 1: Dividend Changes Among Global Firms (Q1 2018-Q3 2021)

Earnings Outlier: Herman Miller (MLHR)

MLHR is a Michigan-based $3 billion market cap Consumer Discretionary stock. This small cap firm designs, manufactures, and distributes furnishings for offices, educational, and residential settings. MLHR sales are slightly negative year-on-year. The company is not a pure-play return-to-office name since it covers both home and office, but price-action in 2021 suggests the firm stands to benefit from businesses reinventing and refurnishing office life.

After a strong rally to start 2021, shares of the consumer company went south starting in early June. The re-opening theme petered out about that time when concerns around the Delta variant hampered high beta and consumer-related industries.

Figure 2: MLHR Stock Price History (1-Year)¹

Merger Details

The big news with Herman Miller came on April 19 when a merger with Knoll was announced. The new entity will be named MillerKnoll. Wall Street Horizon notified clients on the morning of the merger. MLHR stock initially dropped more than 10% with heavy volume on the announcement date, but buyers stepped in aggressively to soften the blow. The bulls were back in charge weeks later as the stock climbed to fresh highs.

Outlier Analysis

MLHR has historically reported Q1 results between September 16 and 19 with a strong Wednesday trend.

- June 29 – Wall Street Horizon set an Unconfirmed earnings date of September 15 After Market based on reporting trends

- September 7 – MLHR announced it would report Q1 2022 results on September 29 After Market. WSH changed the earnings date and status to Confirmed. A conference call webcast takes place following the earnings announcement. In July, MLHR finalized its merger with Knoll Inc and changed its name—these events likely pushed out its reporting pattern.

MLHR has been extremely consistent in its earnings report schedule for the past five years, so this high Z-score earns an “A” confidence rating. Traders should monitor the upcoming report for additional merger-related news.

Conclusion

Meeting season and corporate conferences are always on the September agenda. This year, like a year ago, many companies made the tough choice to go virtual. We highlighted three stocks facing important macro and firm-specific issues. Investors should monitor upcoming shareholder meetings for a gauge of corporate optimism and how to traverse emerging challenges. Wall Street Horizon tracks key corporate events such as shareholder meetings & conferences, stock splits, and earnings dates for clients so they can effectively manage risk.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Sources:

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.