After the closing bell, we were greeted with another slew of earnings reports to sift through. One after hours mover that caught my eye was Intel (INTC). The Intel earnings report was applauded with a 3 percent rise in after hours trading.

By the numbers: Intel earnings came in at $0.41 on $12.78 Billion in revenue. The consensus was $0.40 on $12.83 Billion in revenue.

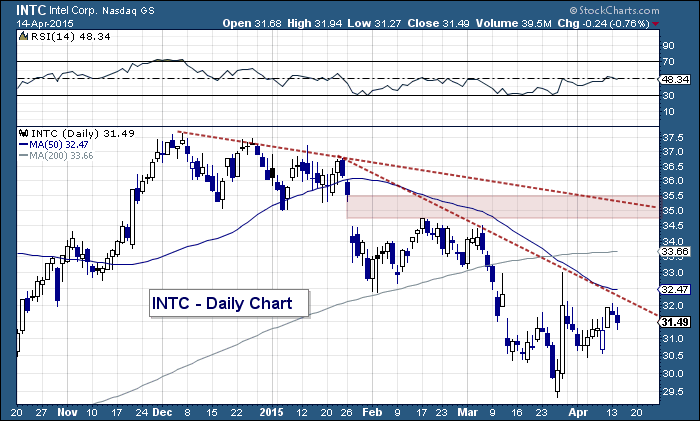

So what’s the big deal? Well, as most seasoned investors know, it’s all about expectations. Intel’s closing price today was $31.49, which is 17 percent lower than its December highs (also 52 week highs). Considering that back drop, expectations were likely in check. So it remains to be seen just how excited the big money is about the Intel earnings report.

But it’s a start. A key test will come tomorrow as the stock will likely test its 50 day moving average and downtrend line. A closing price above $32.50 would be constructive and potentially set the stock up for a run at the $34.50 level (the February highs and open gap).

But before we get too bullish, it’s important to note that the stock has been mired in a downtrend and this creates overhead supply issues (investors selling into overhead resistance levels trying to make up for bad entries, losses, or lost gains).

Intel (INTC) Stock Chart

It remains to be seen how Intel will trade tomorrow, much less in the days ahead. But if the stock trades higher tomorrow off its earnings report, investors will be glued into the 50 day moving average and how the stock responds at that key price level. Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.