As I reviewed several stock charts this weekend and pulled out the ones that seemed to offer good risk-reward on the long and short side. As always, I viewed each stock chart from a risk discipline perspective, understanding that stops and targets are key.

Below are 5 stock charts that I found interest in. Each stock chart is annotated and highlights my thoughts on each to the stocks.

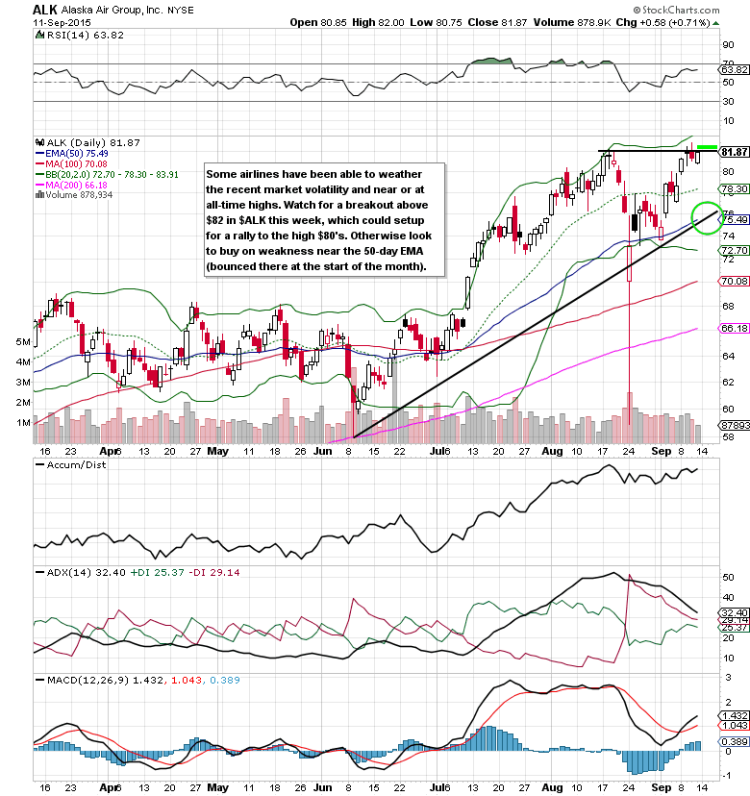

1. Alaska Air Group (ALK)

Some airlines have been able to weather the recent market volatility better than others. And Alaska Air Group (ALK) seems to be one of those stocks.

Watch for a breakout above 82 in the coming days. This could setup a rally into the high 80’s. Another ideas would be to buy on weakness near the 50 day exponential moving average (ema).

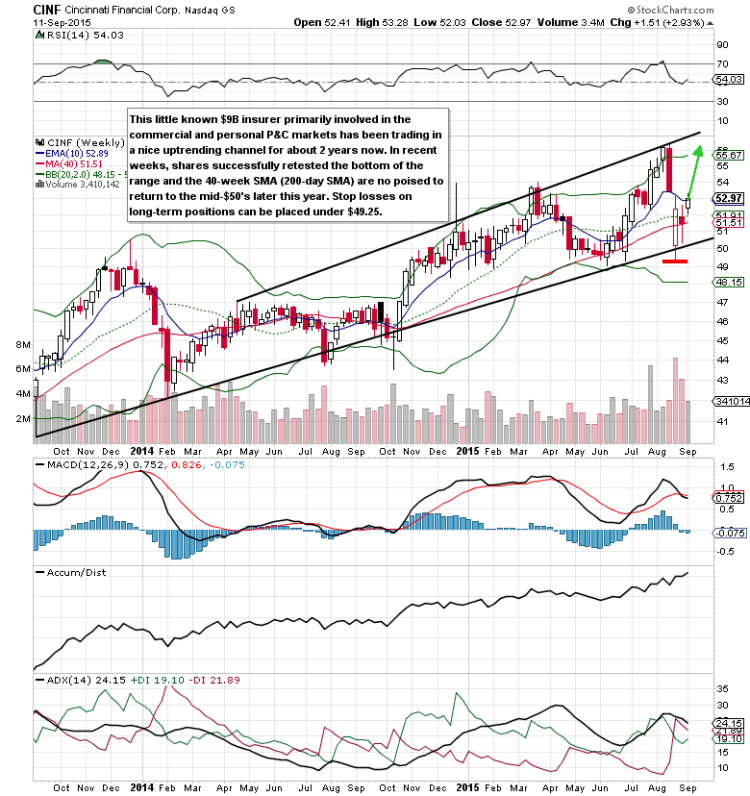

2. Cincinnati Financial Corp (CINF)

This little known $9 Billion insurer is primarily involved in the commercial and personal P&C markets. Cincinnati Financial (CINF) has been in a nice uptrend channel for a while. A return to the mid-$50’s may be possible with continuation to the upside.

3. CenturyLink, Inc. (CTL)

This stock has been mired in a downtrend for some time. And it remains in the bearish 30-50 RSI range (relative strength indicator). Could $24-25 be its next stop?

continue reading for more charts…