Inovalon Holdings (INOV) is a $2.85B Company that recently caught my eye as I scour the Software industry for potential M&A targets. INOV is a name that came public in February of 2015 and traded as high as $33.75 in a volatile opening week, but soon found the tough environment of the Summer of 2015 when high growth/multiple Tech names sold off sharply in a risk-off environment, and shares traded down just under $16 to end 2015.

INOV shares have spent the last 6 months in the $16/$20 zone building a strong base from which shares will look to move higher, already having cleared the 2015 downtrend (chart below).

INOV is a Tech company focused in the Healthcare sector empowering healthcare clients to improve patient care and financial returns through the analysis of data and has more than 400 clients including Health Plans, Pharma Co.’s, Academic Institutions, and Regulatory Organizations. Data and Analytics in Healthcare has an estimated total addressable market of $83.8B. A number of tailwinds are a positive for INOV’s potential future growth including rising Healthcare Costs, Patient Population Growth, Plan Premium Growth, and Rising Drug Costs. INOV is in the early stages with just 5% market penetration, approximately 15% wallet share from 30% of its core markets. INOV is also expanding into new technology such as data diagnostics allowing for on-demand real-time analytics to the point of care.

INOV shares are trading 26.45X Earnings, 6.4X Sales, 3.77X Book and 52.6X FCF with more than $725M in cash and equivalents on hand and just $282M in long term debt. INOV has posted a 20% revenue CAGR from 2010 to 2016 and 28% EBITDA CAGR. Cash Flow from Operations are expected to jump 26% in FY16 from FY15 levels. In terms of INOV long term goals the Company is targeting $1B in revenues by 2020, expanding EBITDA margins to 40%, and diversifying its customer base. At 4.4X EV/Sales for a Company expecting to double revenues by 2020, shares are fairly attractive.

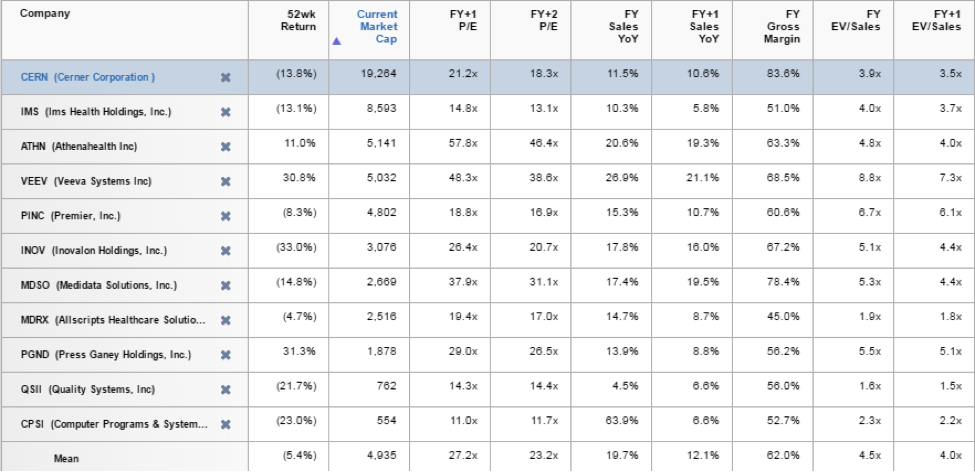

The table below shows other players in Healthcare IT with some exposure to cloud/analytics:

The other top growth player Veeva (VEEV) that is closely related trades 7.3X FY17 EV/Sales. Cerner (CERN) is a larger cap player and the margin leader while trading at a discount to peers at 3.9X EV/Sales, and a name that has seen sizable call buying accumulate in September open interest.

In closing, Inovalon (INOV) is a Company that has only been public just over a year, but due to the timing has been a laggard and now a forgotten name. INOV offers a clear runway to achieving strong growth for multiple years to come in a sector not only having a massive market opportunity, but also likely to come under a wave of M&A as many other software verticals are seeing. For these reasons I think INOV is a compelling opportunity at these levels that can offer a 50% return over the next year.

Thanks for reading.

Twitter: @OptionsHawk

The author has a position in INOV at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.