Rising food and energy costs, coupled with supply bottlenecks are adding to inflationary pressures.

Let’s take a closer look at how inflation will effect equities, while overlaying some market cycle tools and analysis (read our full research note on the current market cycle).

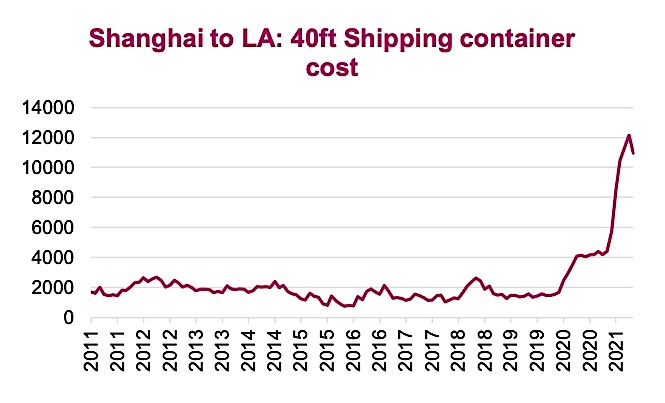

Supply chains

We believe that while supply chains issues are responsible for much of the “transitory” inflation, the lessons learned from the COVID disruption as well as previously entrenched trends in global trade will lead to more onshoring and more robust supply chains. That means more capacity and fail-safes, which also means less economic optimization. This transition will cost more. Not all is to be feared, though. Closer to home, more modern manufacturing and logistics will bring efficiencies too. Modernization of manufacturing and service delivery is a persistent and massive deflationary force.

The 1990’s MBA lessons of just-in-time delivery and low inventories may not be the most efficient way to operate a business through an inflationary cycle, where disruptions can cause shortages and gaps in sales. We are still waiting to see how this plays out.

The takeaway? Companies less reliant on supply chains should fare better than those that are not. Companies who control their own supply chains will be better positioned than those that rely on external providers.

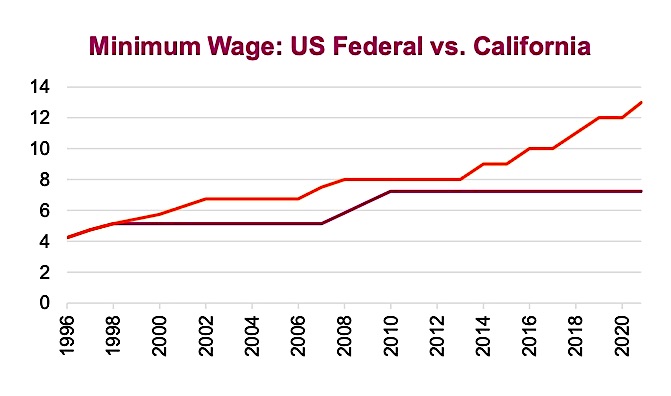

Labor costs

In previous publications, we have outlined our belief that the political landscape is shifting to favour labor over capital, which we believe will simply make labor more expensive going forward. Companies reliant on labour will need to find ways to hire and pay more. This favors companies that can automate and don’t need a lot of employees.

Materials costs

We take an optimistic tone here and will note that material input shortages are almost always followed by gluts, so this is the transitory part. Expect these to be short-term problems, followed by tailwinds. There is also a healthy substitution effect that allows certain inputs to be replaced by less expensive ones.

Duration

Of all the factors, this is the most important. Duration drives multiples which are the lever that drives equity markets. If a business expects a dollar of revenue tomorrow, it is worth more than a dollar of revenue in five years. This is exacerbated in inflationary environments. We have been in a market that has increasingly favored future dollars for a decade. The jokes about funding startups without revenue, and avoiding those that are profitable are the epitome of that sentiment. If that trend changes, we will start to see big headwinds facing those “long duration” companies. Flows will move towards “short duration” companies with high positive cash flow. These are generally also known as “value companies” and this forms the basis for our call to be cautious when allocating using backwards-looking trends.

Bottom Line: We would lean towards low duration and value equities. Fade the growth companies as policy shifts to tightening.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.