When interest rates fall, bond prices rise. And while it has been some time since we’ve been able to say interest rates are dropping, the past few months have done just that.

The pullback in interest rates is coinciding with investors optimism that the Federal Reserve is done raising rates and inflation is subdued.

Taken together, this has had a very positive effect on bond prices over the past few months.

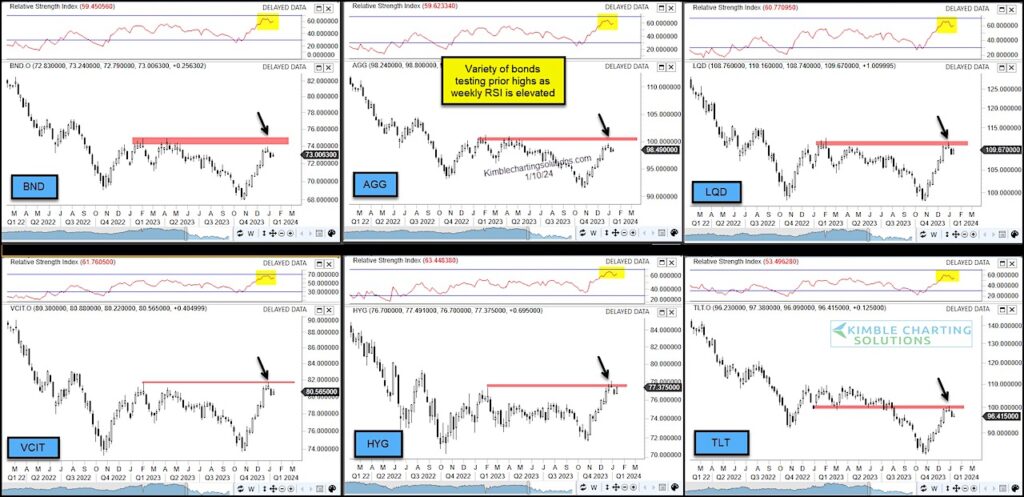

And we can see this in today’s chart 6-pack of important bond ETFs (that range from junk to corporate to treasury bonds).

That said, the rally from the October lows has each ETF nearing overhead resistance. And this is also occurring while the RSI indicator is near 2 year highs for each asset.

It will be important how these bond ETFs handle this resistance. Stay tuned!

Chart 6-Pack of Bond ETFs

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.