Illumina (ILMN) has been a red hot stock of late, riding momentum to new all time highs this week. But we should learn a lot more about the recent price action when Illumina reports earnings after the market close today.

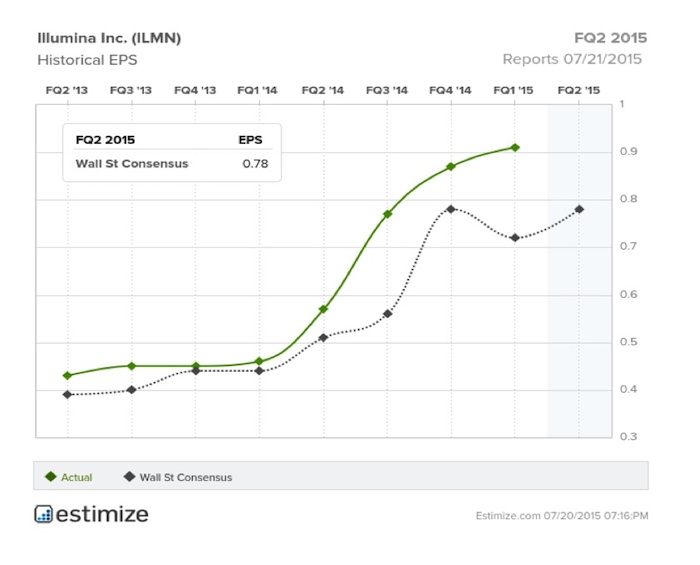

According to estimize, analysts are expecting Illumina earnings of 0.78 EPS on $542 Million in revenue.

Illumina does a fantastic job consistently beating earnings and revenue expectations quarter after quarter. Here’s a quick look at earnings expectations relative to results for the last two years. The question is, has the market priced in a homerun?

The continuously impressive earnings beats, in part, explain why the stock has risen over 800% in less than four years. As you can see, shares have recently left a tight base on it’s way to fresh all time highs.

Looking at the one year daily chart we see numerous potential levels to note if a pullback were to materialize post Illumina earnings.

Price areas of interest include: 223, 213, 200, 180. Based on the July at the money straddle pricing, the market expects a move of roughly $16.50 out of earnings. That would line up nicely with the pivot level at the top of the prior base and rising 20 day moving average.

Illumina (ILMN) is in a strong trend higher and ILMN leading stock in an explosive growth business. Any significant earnings pullback (barring disaster) would likely be a gift.

Thanks for reading!

Twitter: @ATMcharts

The author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.