As we embark on a four-year journey with President Trump at the helm of the world’s largest economy, there are both knowns and unknowns.

Given the sizable sweep of all three branches of government, policy will be easy to implement. From a market perspective, the clearest known is there will likely be lots of headlines. Many probably inflammatory and with the likelihood of moving markets, at least temporarily. Currently, the big topics are tariffs, regulation and tax/spending.

But who knows which announcements will move markets the most?

Investors clearly have a positive memory of Trump’s first term, based on market gains. And as humans, we all like causal relationships – it makes us feel better and more in control. Unfortunately, this is rather simple thinking.

In our opinion, markets started to perform better earlier in 2016 before the election because, for the first time since before the 2008 financial crisis, we had global synchronized economic growth. After ’08, the U.S. and Asia started to recover, but Europe faltered. Then, when Europe improved, the U.S. hit a soft patch economically. Then, when the U.S. re-accelerated, Asia fell flat. But in 2016, the three major economic zones started all growing together! That is what moved markets higher over the coming years.

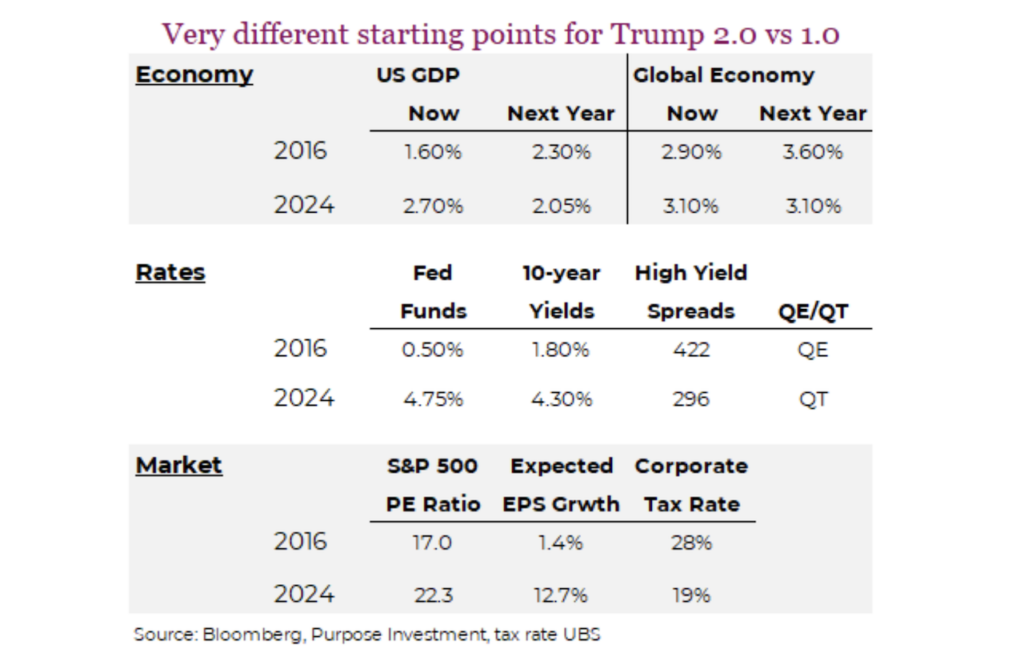

The other challenge is starting points; they really matter. Looking at the economy, GDP growth for the U.S. and globally was moving from a tepid to a higher growth pace in 2016. Today, economic growth is decelerating. Back in 2016, interest rates were super low and accommodative, and quantitative easing was flowing. Today, they are much more restrictive and higher yield, with quantitative tightening on the go. And then the equity markets. In 2016, equity markets were much cheaper and had modest earnings growth expectations. Today, it is more expensive with high growth expectations. The tax cuts in 2016 were a lift because corporate taxes started so high. Will we get the same impact trying to cut corporate taxes from a much lower start point?

Trump game plan

We think there are two choices here: Act or Watch.

Act

The act option is to take announcements at face value and try to adjust exposures quickly. For instance, at the time of writing in late November, Trump announced tariff plans that would hit Canada and Mexico. If you took it at face value, that would have us reduce Canadian equity exposure, notably exports (think there are still a few) or reduce exposure to the Canadian dollar. This approach has some benefits, including the positive emotional impact of taking action, and it may sound smart.

But we think there are a number of challenges with this approach. Trump is going to say a lot of things over the next four years, and based on the previous term, many of these will not come to reality. Or the policy announcement is the first move in a longer process that will become evident over time. For instance, the recently announced 25% tariff on Mexico may turn out to be a bargaining chip in future discussions to see if Mexico will aid in border security. We also think the frequency of announcements will make it really challenging to try and react. You could very easily just be chasing your tail.

Watch

There are very few constants when it comes to investing and the markets. However, one constant is the markets often overreact in the short term. We could blame the financial media, which will cover the bejesus out of anything Trump-related but lightly glance over important economic news. One is more fun to talk about and certainly gets more clicks/eyeballs. We could blame fast money algorithm trading systems. It doesn’t matter though.

Watch the market, and only if it really overreacts should any action be taken. Of course, we are not sure how much the market will react under Trump Term 2.0. Markets adapt pretty quickly, and in the first term, the style of announcement and frequency was unprecedented. That increased the market reaction function. Now, we are all a bit more numb to the headlines, as is the market.

Nonetheless, we can expect to hear more announcements that grab the headlines, which could increase the noise in the market. Underneath this noise, there is the economy that drives earnings, and earnings drive the market. Policy can nudge the economic path, but the macroeconomic forces are likely much more powerful.

Of course, listen to the noise, but don’t necessarily react. In fact, watching to see if the market materially overreactions and then acting may prove better for your portfolio.

Equities – Can U.S. exceptionalism persist?

2024 turned out to be one of the best years for equity investors in recent and even not-so-recent years. While we’re writing (the year is not done), the S&P/TSX Composite is up 25%, while the S&P 500 is up 27.5%. Add on another 7% when you factor in currency moves. Pretty impressive. This marks back-to-back 20%+ return years for the S&P 500, a run that’s occurred just four times in the past 100 years. It also marks the fourth 20%+ return in the past six. Obviously, one of the biggest questions from an equity positioning standpoint is whether this run of U.S. exceptionalism can continue.

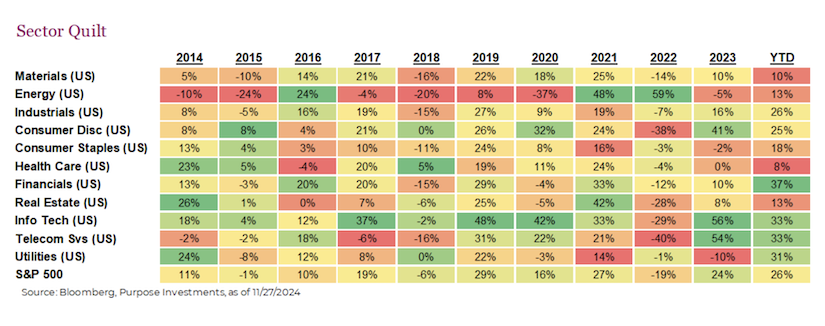

Below, we break down the historical U.S. sector returns. This quilt is a good way to easily spot the winners. It should also be pretty clear that sector winners can drastically change one year from the next. Surprisingly, Technology isn’t in the top spot in 2024, as Financials are now the best-performing sector this year, up 37%. Big Tech is still no slouch up 33%, nearly on par with its average returns over the past six years. It’s noteworthy that it’s consistently been one of the best in recent years (we’ll ignore 2022).

Earnings to be tested – Compared to the past couple of years, expectations for earnings growth are more subdued for 2025. Ever since 2022, there has been a forecasted earnings slowdown or economic slowdown that continually keeps getting pushed out. Hat tip to the central bankers which, whether it’s by their own doing or not so far, who have kept North American economies remaining on a steady path. 2025 EPS estimates are expected to grow 13.1% in the U.S. and 13.5% in Canada. It’s worth noting that these estimates are likely lofty, and both countries are already seeing 2025 earnings estimates continue to trend lower. Margins are already just about back at all-time highs, so top-line growth is going to be rather important. Is 2025 going to be the year of moderation? Perhaps, especially with a new president who’s determined to shake things up. One trend that will surely continue into next year is the resilience of the consumer and adaptability of businesses.

How much are you willing to pay? – The S&P 500 is currently trading at 22.4 times blended forward earnings, a significant premium to the average forward P/E of 18.4 seen over the last ten years, and even more expensive if you look back further. Any way you slice it, U.S. markets are overvalued. Canada is decidedly less so, trading at just 15.6 times forward earnings, which is just above its 10-year average. To put this into perspective, U.S. markets have only been this expensive for 2% of the time since 1960. The only other times were in late 1999 and early 2000. We’re not going to get into the compare and contrast to the dot-com bubble. We’ve all heard about it for the past few years, and so far, there has been no ‘pop’. The megacap tech companies largely responsible for the elevated earnings are making buckets of money, unlike then.

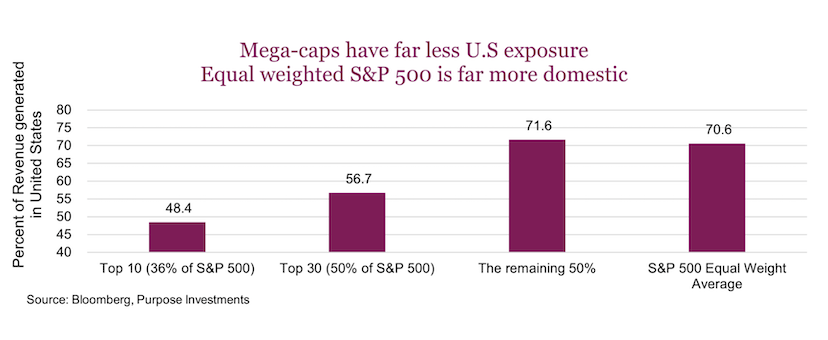

Valuations don’t always matter; they matter most at turning points. For now, the only thing that matters is how much investors are willing to pay. We can’t predict how others will spend their money, but we see far better value in the equal-weighted index, which is trading at just 18.5 times forward earnings. The index does not have the same exposure to AI, but it is still trading at reasonable valuations. One added benefit is that the equally weighted index is considered more domestically focused as it dilutes the influence of large globally oriented companies and gives more weight to smaller companies which generate more of their revenue from inside the United States. If 2025 is going to be all about making America great again and bringing back trade wars, this domestic focus should be rewarded.

How to position

Fervent risk appetite is pushing markets to a strong finish in 2024. Heading into next year, investors should stay flexible in their pro-growth positioning. Despite high valuations and tempered earnings expectations, the market momentum remains strong. Everyone has a plan to get out or reduce risk before the inevitable correction. That rarely happens. We prefer a defensive tilt in our equity exposure and have a slight underweight to U.S. equities with a specific focus on broad equal-weight exposure. We also favour dividend stocks, focusing on valuations and favouring defensive sectors. During periods of volatility, being active and pivoting towards increased risk exposure might be warranted should macro conditions remain supportive.

2024 was a year with not much equity market volatility. The VIX has averaged just 15.5, the lowest since 2019. Neither the S&P 500 nor the TSX saw any “official” corrections. The largest drawdowns for each were -8.3% and -5.3% respectively. Compared to this year, we’d expect elevated levels of volatility next year as markets adjust to more erratic government policy. Big changes in tariffs, immigration policy and yields will likely be influential at these lofty valuations.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.