An Iron Condor is an options trading strategy where the seller of the Iron condor is looking for the price of the underlying security to remain in a relatively tight range and the buyer is looking for the price to move out of a defined range.

To understand the Iron Condor risk, you must be somewhat familiar with options risks, and understand vertical spreads.

Vertical Spread

An Iron Condor is made up of two vertical spreads.

A vertical spread is an option strategy where you are entering a position that is comprised of two similar options. The only difference between the options is the strike price. The vertical spread will either be two calls or two puts, and the expiration date is the same. The idea is to purchase a call and simultaneously sell another call or purchase a put and simultaneously sell another put. The number of contracts that you buy and sell are the same.

When you are selling an Iron condor you are selling two credit spreads. Both credit spreads are out of the money. A credit spread strategy is one that can be used to generate income on a consistent basis. The bear call credit spread is a strategy where two calls are used to initiate a position, and the bull put credit spread is a strategy were two puts are used. Generally, to construct a bear call credit spread you will sell an out of the money call and purchase a future out of the money call, or sell an out of the money put and purchase a further out of the money put.

Payout and Risk

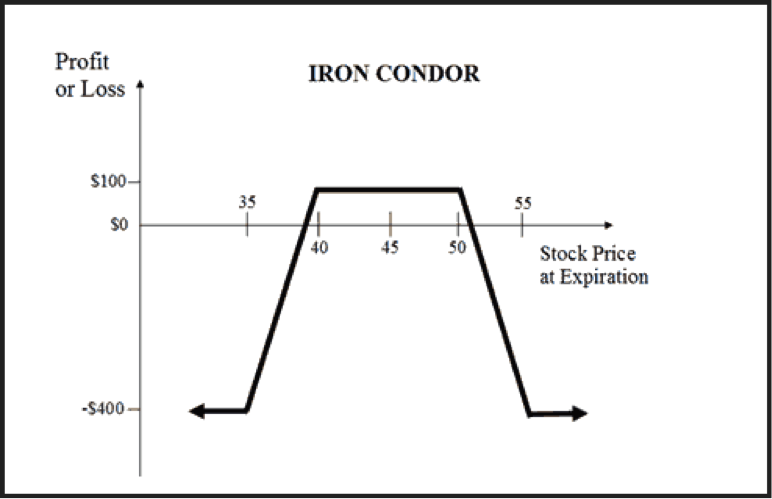

One of the best ways to understand what you are doing when you transact a credit or debit spread is to evaluate it using a payout graph. The payout for a debit spread is the difference between the two strike prices minus the premium you receive. So if the strike price differential is $5 and the premium for the call and put spread combined are $1, then you max risk is $1 and your max gain is $4. The chart of the Iron Condor shows you how you would profit based on the movement of the underlying stock at expiration for a short iron condor trade.

ALSO READ: How To Manage An Iron Condor Trade

For this example of XYZ stock assume you are selling a $40-$35 put spread and selling a $50-$55 call spread, and receiving $1. If the price of the underlying stock stays between $40 and $50 you keep your entire premium. If it falls to $39 or climbs to $51 you break even. For every change below $39 or above $51 you begin to lose money. When the price falls below $35 your losses stabilize, and if the price moves above $55 your losses stabilize.

The risks of an iron condor differ if you are the buyer or the seller. The buyer is looking for the price of the underlying stock to break out of a range, and you are only risking the premium you paid. If you are the seller of an iron condor and are looking for the shares to remain in a specific range, your risk is the difference between the strike prices minus the premium you received.

Example

The following example is from earlier in 2017. AAOI had suffered a couple of severe drops, from $105 down to $65 and then again from $60 down to nearly $40.

After the first drop, the stock traded more or less sideways for a few months.

After the second drop, I took the view that it might do the same again. On October 18th, I opened the following trade:

Date: October 18th 2017

AAOI Price: $42.18

Trade Details:

Sell 5 December 15th 2017 $55 Calls @ $1.15

Buy 5 December 15th 2017 $60 Calls @ $0.50

Sell 5 December 15th 2017 $35 Puts @ $2.93

Buy 5 December 15th 2017 $30 Puts @ $1.50

Premium Received: $1,040

Capital at Risk: $1,460

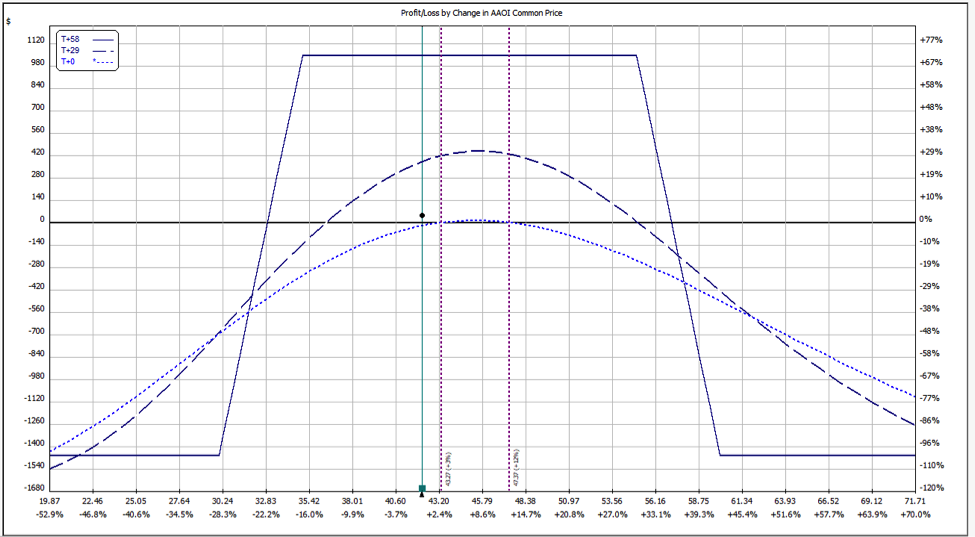

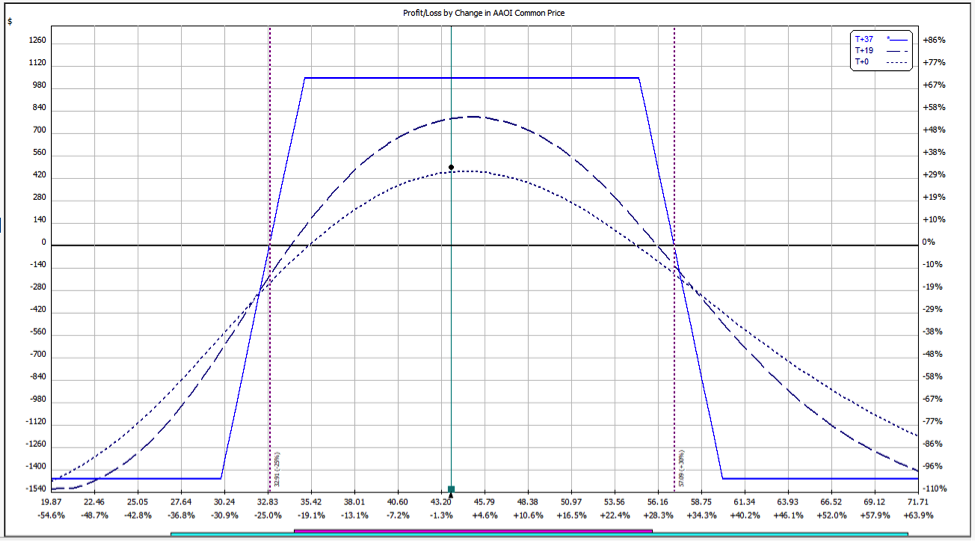

Here is what the risk graph looked like:

3 Weeks later, the stock had stayed within the range and I closed the trade for a $490 profit, a return of 33.5%.

You can learn more about Iron Condors here.

Author Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Options trading involves risk and is not suitable for some investors. Check with your financial advisor before making any investment decisions.

Twitter: @OptiontradinIQ

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.