“Past performance is no guarantee of future results,” or a similar iteration, is likely the most common phrase found among investment disclaimers.

To say this phrase falls on deaf ears would be an understatement, and we are pretty sure it is just about everyone’s fault.

One of the easiest and most common go-to questions for investors when looking at a new investment strategy for inclusion into their portfolio is simply “how has it performed?” This is often an easy short cut to more detailed due diligence – measuring the past performance outcome as efficacy of a superior or inferior investment process or strategy. It is really easy. And the financial industry does everything it can to feed this behavior.

Investment performance is everywhere…

During RSP season, take a walk through the underground path (if in Toronto) or above ground (like the Plus 15 in Calgary) and you will see many ads featuring mountain charts of investment funds that rise up and to the right. They are trying to capitalize on the “fear of missing out” (FOMO) behavoural bias. Or look at any of the mutual fund monitoring/rating websites and you will notice the majority of the most prominent information is largely investment performance based.

We would not suggest investors or advisors ignore investment performance in their due diligence process, but it clearly receives a much greater emphasis than it should.

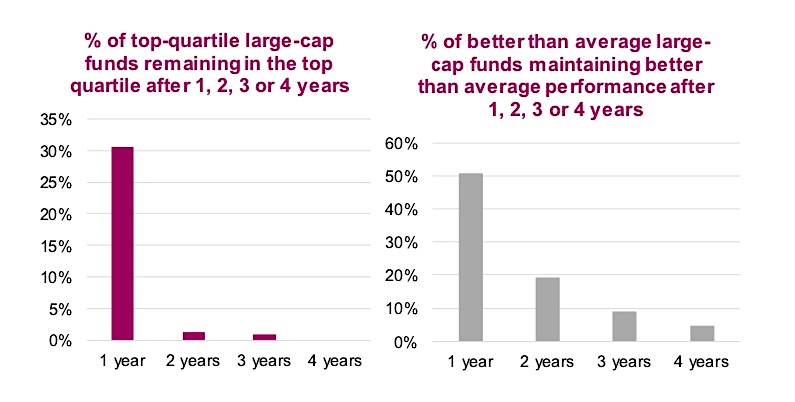

The unfortunate fact is that top-quartile funds usually don’t remain top quartile for very long. S&P Dow Jones Persistence Scorecard tracks how U.S. funds are ranked from one period to the next. As you can see in the charts below, being a top quartile or even just being better than average does not appear to be a recipe for consistent out-performance. In fact, these scores are even below what they should be if it were totally random.

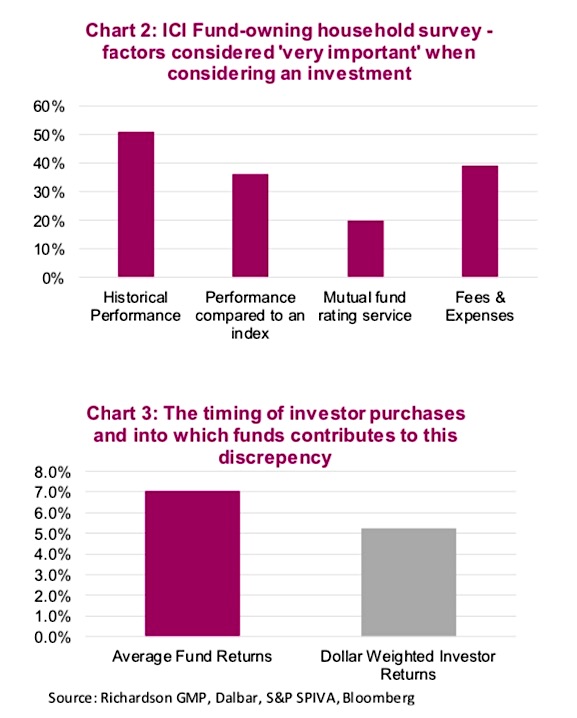

Random expectations should have 6.25% of above-average funds remaining above average after four years, yet only 4.7% make the cut. And yet a survey by the Investment Company Institute (ICI) showed investors weigh historical investment performance as “very important” when considering a fund over all other criteria.

This reliance on historical performance as the dominant factor when considering an investment is likely the biggest contributing factor to the gap between average fund returns and the average investor experience when investing in funds. Over the long term, DALBAR reports indicate that investors experience a return almost 2% below that of average fund returns.

Understanding performance in proper context

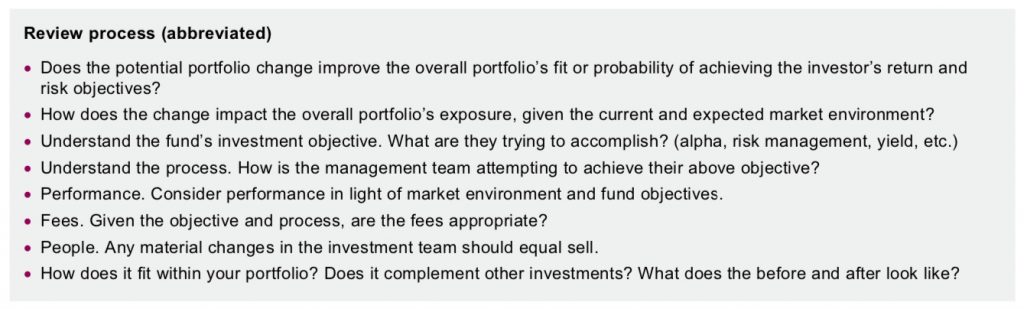

We suggest investment performance be more critically analyzed to gain insight into why performance is either good or bad, before jumping to any conclusion on the investment merits. Consider what is driving the performance and what is more likely to drive future performance. Plus, how does an investment fit within a portfolio? From an overall portfolio perspective, the addition or deletion of an investment is likely more important than the individual contribution.

The key is how it all fits together.

It is more important to understand the strategy, the style and the market. The key is to find quality managers utilizing various investment styles and approaches to provide diversification. In a Momentum market, you want your Quality managers to under-perform. If they’re not, they may have changed styles to chase what is hot – this is the last thing you want for portfolio construction. Here are some key criteria to consider before adding or removing an investment mandate:

All charts are sourced to Bloomberg L.P. and Richardson GMP.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.