Starbucks stock price has been in rally mode for the past several weeks… months… years. And for good reason. Coffee prices are suppressed and the business has been performing well. That said, pattern analysis may be calling for some caution here. Perhaps the Starbucks rally is getting long in the tooth.

As Starbucks stock (SBUX) continues its monster rally off the ’09 lows, it’s probably a good idea to remind ourselves about prudent risk management.

As you’ll note below, we have hit the first target on the Starbucks (SBUX)/Coffee Futures ratio. There are still some higher targets a little above this BUT this run in SBUX should be coming to an end soon.

With that in mind, I am waiting for (and would recommend waiting for) a signal reversal candle (on a weekly basis) before attempting to enter any short positions on Starbucks stock.

Also, the red log trend line (in the 3rd chart below), coming in around 55-57, is a good benchmark to watch for a weekly close below.

Here’s a series of Starbucks Charts / Analysis

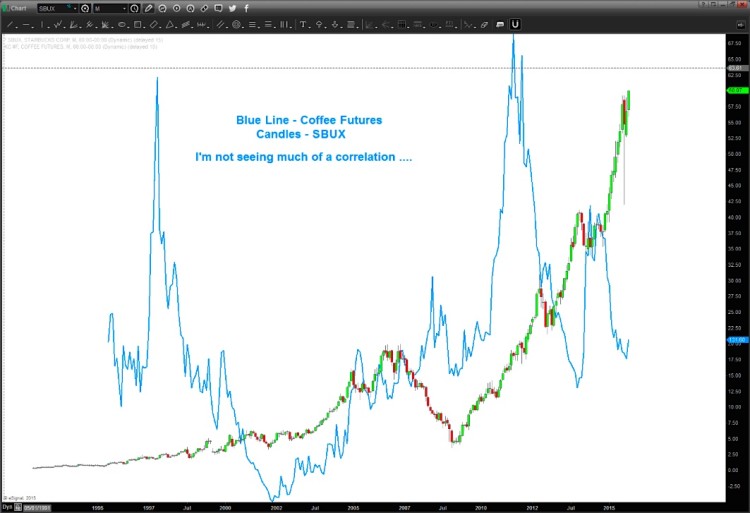

One would think that IF the price of coffee is going up THEN it would have an impact on Starbucks operations? In the chart below, see Starbucks stock (SBUX) candles vs Coffee Futures blue line. Problem is, I don’t see much correlation vs coffee prices (futures).

BUT in the next chart you’ll see a better way to look at this via ratios.

continue reading on the next page…