Donald Trump’s rhetoric about current and future trade policy has been strong (and critical). And considering that this has been one of his major talking points, it’s important for investors to understand the full scope of implications. Herein, we provide in-depth research on how Trump’s trade policies may effect stock prices.

Hoover’s Folly

In 1930, Herbert Hoover signed the Smoot-Hawley Tariff Act into law. As the world entered the early phases of the Great Depression, the measure was intended to protect American jobs and farmers. Ignoring warnings from global trade partners, the new law placed tariffs on goods imported into the U.S. which resulted in retaliatory tariffs on U.S. goods exported to other countries. By 1934, U.S. imports and exports were reduced by more than 50% and many Great Depression scholars have blamed the tariffs for playing a substantial role in amplifying the scope and duration of the Great Depression. The United States paid a steep price for trying to protect its workforce through short-sighted political expedience.

On January 3, 2017 Ford Motor Company backed away from plans to build a $1.6 billion assembly plant in Mexico and instead opted to add 700 jobs at a Michigan plant. This abrupt reversal followed sharp criticism from Donald Trump. Ford joins Carrier in reneging on plans to move production to Mexico and will possibly be followed by other large corporations rumored to be reconsidering outsourcing. Although retaining manufacturing and jobs in the U.S. is a favorable development, it seems unlikely that these companies are changing their plans over concerns for American workers or due to stern remarks from President-elect Trump.

What does seem likely? Big changes in trade policy occurring within the first 100 days of Donald Trump’s presidency. The change in plans by Ford and Carrier serve as clues to what may lie ahead and imply a cost-benefit analysis. In order to gain better insight into what the trade policy of the new administration may hold, consideration of cabinet members nominated to key positions of influence is in order.

Trump’s Trade Appointments

As we close in on Donald Trump’s inauguration, his cabinet and team of advisors is taking shape. With regard to global trade, there are three cabinet nominations that most capture our attention:

- Peter Navarro is a business professor from the University of California-Irvine. Mr. Navarro has been very outspoken about China and the need to renegotiate existing trade deals in order to put America on a level playing field with global manufacturers. The author of the book, “Death by China”, will lead the newly created White House National Trade Council.

- Wilbur Ross is a billionaire investor who made his fortune by resurrecting struggling companies. In the words of Donald Trump, Mr. Ross is a “champion of American manufacturing and knows how to turn them around”. The long time trade protectionist will now serve as Commerce Secretary.

- Robert Lighthizer is currently a lawyer with a focus on trade litigation and lobbying on behalf of large U.S. corporations. Earlier in his career, he served as deputy U.S. Trade Representative under President Ronald Reagan. Mr. Lighthizer has been very outspoken about unfair trade practices that harm America. In his new role he will serve as Trump’s U.S. Trade Representative.

Donald Trump said that Mr. Lighthizer will work “in close coordination” with Wilbur Ross and Peter Navarro. The bottom line is that these three advisors have strong protectionist views and generally feel that China, Mexico and other nations have taken advantage of America.

Gettysburg and other Rhetoric

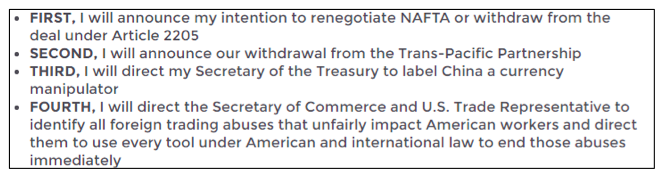

On October 22, 2016 in Gettysburg Pennsylvania, Donald Trump delivered a litany of goals that he hopes to accomplish in his first 100 days of office. Within the list are seven actions aimed at protecting American workers. Four of them deal with foreign trade. They are as follows:

These four proposals and other trade-related rhetoric that Donald Trump repeatedly stated while running for president suggest that he will take immediate steps to level the global trade playing field. At this point, it is pure conjecture what actions may or may not be taken. However, the article, “We need a tough negotiator like Trump to fix U.S. trade policy”, penned by Peter Navarro and Wilbur Ross from July 2016 offers clues.

continue reading on the next page…