You may have read that investor sentiment improved too rapidly in recent weeks and we should be concerned about a market peak.

Do the historical facts align with that bearish hypothesis?

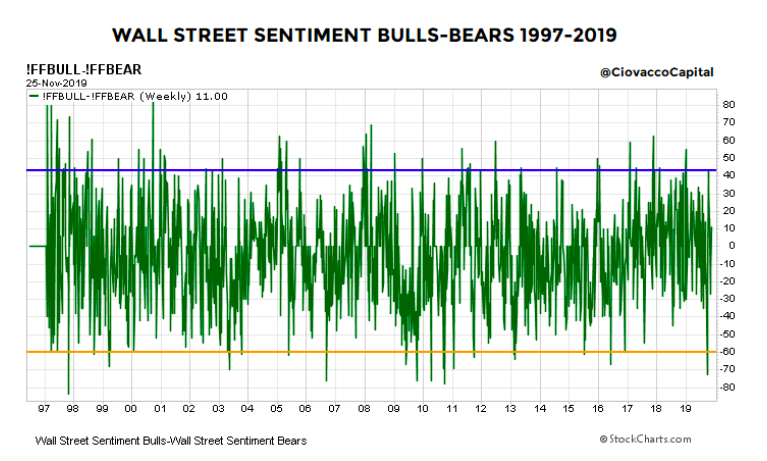

To answer that question, we studied data from the Wall Street Sentiment survey.

Recently, the Wall Street Sentiment Bulls-Bears moved from a relatively bearish reading below -60 to a relatively high bullish reading of 43.

Since sentiment improved quickly between the low reading on September 27, 2019 to the high reading on October 11, 2019, we looked for historical cases that featured similar moves from below -60 back to 43 or above that took place in less than 100 calendar days.

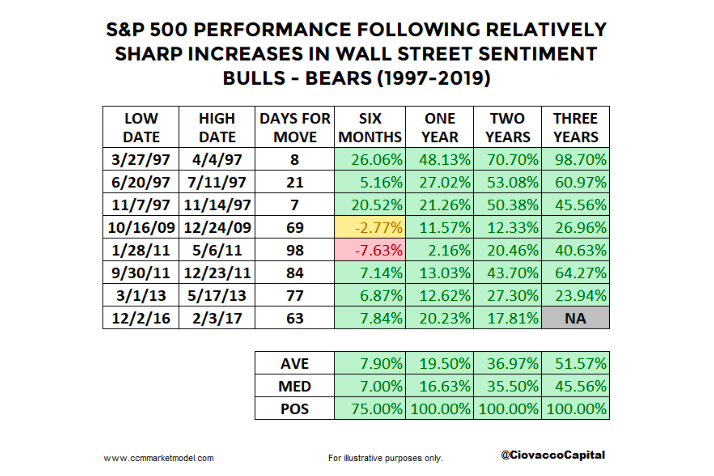

Dating back to the survey’s inception in 1997, there have only been eight other periods that featured a similar rapid increase in bullish sentiment relative to bearish sentiment.

In every case, the S&P 500 Index INDEXSP: .INX was higher one, two, and three years later, with average returns of 19.50%, 36.97%, and 51.57%.

Improving Sentiment Can Be Bullish

Like many fundamental and technical tools in the world of investing, the utility of investor sentiment changes based on market conditions. When sentiment has been depressed, it speaks to large cash positions and more defensive investment allocations. When investor sentiment begins to improve, it speaks to the early stages of redeployment of cash and shifts toward more growth-oriented allocations.

The Case For A Major Bottom vs. A Major Top

This week’s stock market video looks at factual evidence supporting the case that December 2018 was a major stock market bottom relative to the evidence supporting the case the stock market is currently forming a major top. After reviewing the facts, you can make your own call.

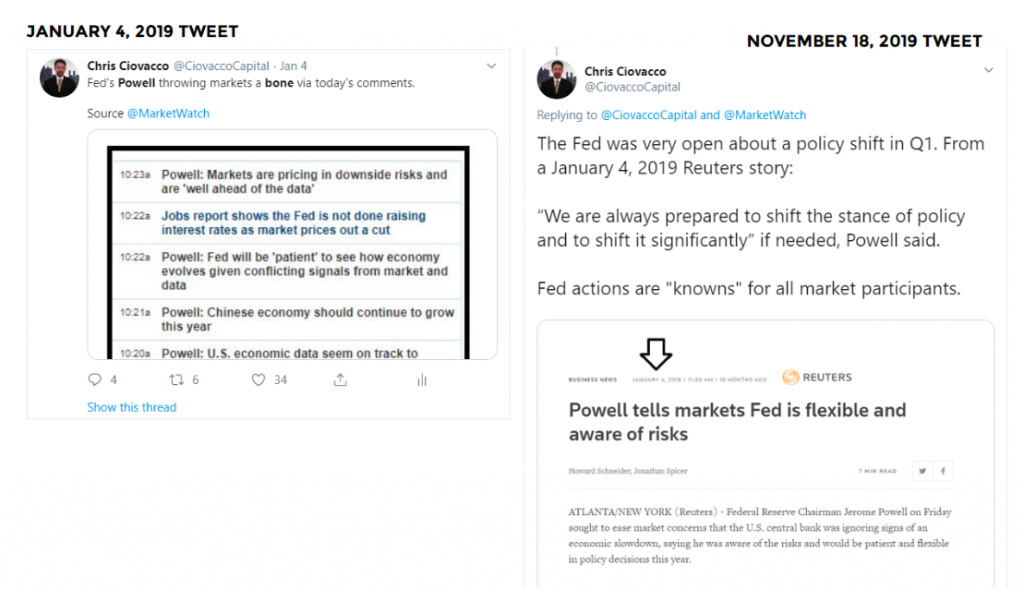

The Fed Tipped Their Hand In January

On January 4, Fed Chairman Powell made remarks telling market participants a major policy shift could be at hand. Since those remarks, the Fed has implemented an incremental strategy that has been more favorable to the stock market.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.