Last Thursday the markets were upbeat on the expectation that UK voters would vote to remain a part of the European Union.

Then on Friday morning we learned that the ‘consensus’ was wrong and that the people of the UK voted to once again control their country’s destiny.

The historic Brexit vote caught many analysts, investors, and pundits off guard. And the markets plunged:

The Japan stock market closed down 8%.

The German stock market opened down 7%.

Spain and Italy traded down double digits.

And the S&P 500 Index fell over 3.5%

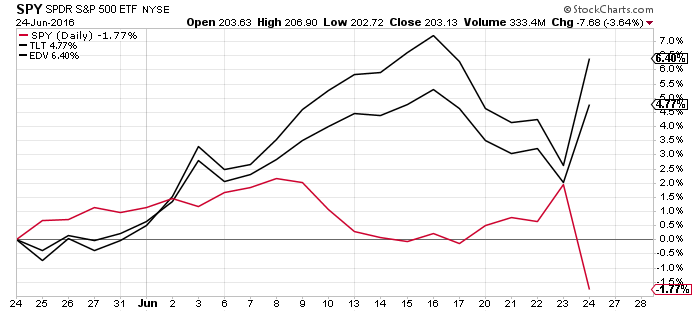

Based on data that continues to show that the economy is slowing (worldwide) I made the choice to move out of growth stocks around July of 2015. Since then, my accounts have heavily invested in US Treasury Bonds. I’ve held positions in the 20+ Year US Treasury Bond ETF (TLT) as well as the Extended Duration ETF (EDV). Though a few bumps, this positioning has been positive.

10 Year US Treasury Bond yields are hitting are near all-time lows at 1.57%.

Being positioned heavily in US Treasury Bonds hasn’t come without controversy – just about everyone in the financial media thought it was crazy. It wasn’t; it isn’t.

Can treasury bond yields go lower? Yes. Just look at what has happened with the German 10-year Bund. In the last year it’s yield has been as high 1.02%. It is currently yielding 0.09%. That’s correct—people buying that bond now get 1/10th of 1% in interest. Few thought the German Bund could decline that much and the same can happen in the US. That’s why I am so concerned—countries around the world need to figure out how to spur economic growth and lower bond yields ahead will probably continue until they solve the growth equation.

And that’s been good news for my TLT and EDV positions. Here’s a one-month chart of the SPDR S&P 500 (SPY) vs TLT and EDV.

I am very concerned about what is going on in the markets and the economy worldwide. Because of that, I will remain invested in US Treasury bonds. They are still one of the safest instruments in the world.

By the way, I’ve also been short the major stock market indexes. That hurt a bit as U.S. stock markets moved back up near all-time highs. But Friday’s decline helped those “trading” positions quite a bit.

Global growth is in hibernation-mode. And the historic Brexit vote simply confirmed that. Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.