This article was written by Colin McWey, CFA, Portfolio Manager.

The recent upward march of yields on the 10-year Treasury bond have brought volatility to growth stocks and growth investors… but may be welcome news to value investors.

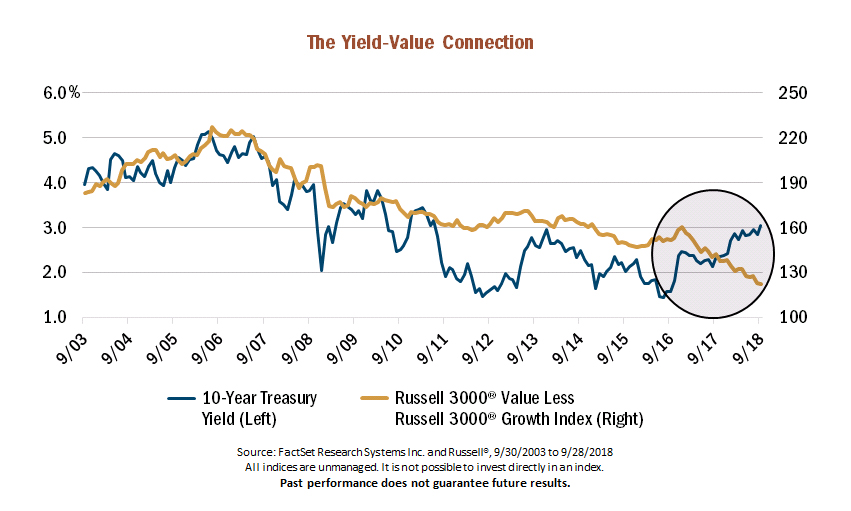

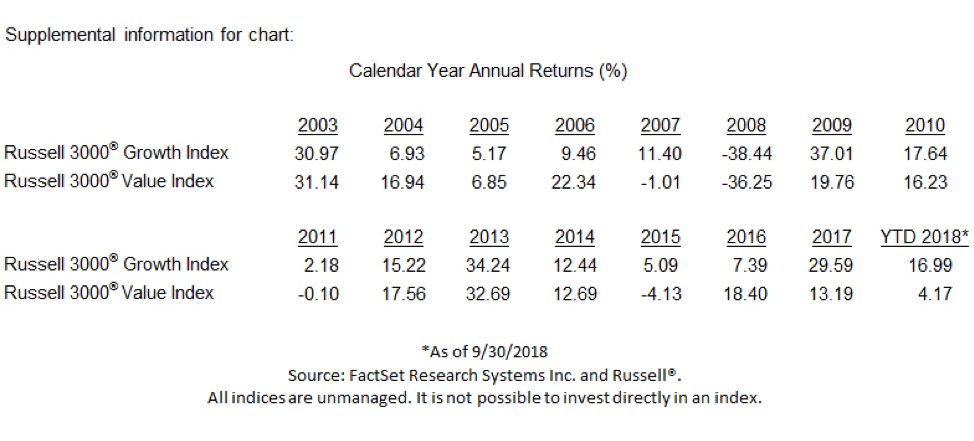

As you can see in the chart below, after peaking in 2006 yields spent the next 10 years drifting lower. The movement had a spillover impact on equities with investors abandoning value stocks and piling into growth stocks.

The logic behind the correlation between Treasury yields and value vs. growth stocks is straightforward:

– Low yields are seen as forecasting a tepid economy, which in turn leads investors to gravitate toward faster-growing companies they think will be able to produce earnings when others struggle.

– Conversely, rising yields usually reflect economic optimism which should translate to widespread growth. When sales growth is plentiful, more investors tend to focus on making sure they aren’t overpaying for growth. In short, attractive valuations matter more.

While the initial upturn in yields in 2016 provided little relief for value investors, we believe now that rates have consistently held above 3%, the rotation toward attractively priced equities could accelerate.

Heartland Advisors Disclosure: “Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Growth and value investing each have unique risks and potential for rewards and may not be suitable for all investors. A growth investing strategy emphasizes capital appreciation and typically carries a higher risk of loss and potential reward than a value investing strategy; a value investing strategy emphasizes investments in companies believed to be undervalued.

Data Sourced from FactSet.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.