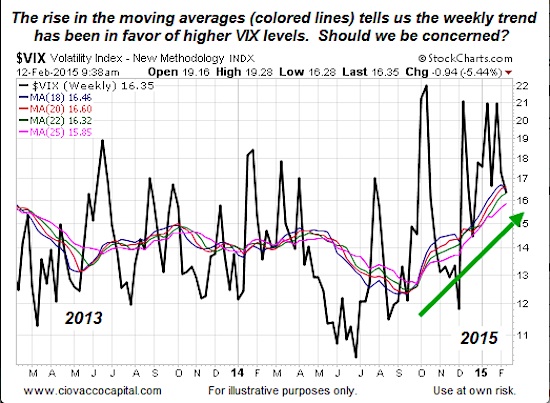

VIX Moving Averages Are Pushing Higher

In the weekly chart of the VIX “Fear Index” below, notice how the moving averages have been climbing higher since mid-2014.

A logical question about a higher VIX is summed up in the tweet below:

The recent rise in the VIX is relevant, but it should not be keeping us up at night, nor is it a reason (in isolation) to become bearish. The daily chart of the VIX below shows a period when the VIX more than tripled in value. Did stocks tank as the VIX moved higher? No, in fact when the VIX popped from 10.36 to 38.20, the S&P 500 gained 47%.

The VIX Is About Volatility, Not Fear

The moral of the story is there is nothing wrong with having the VIX in your stock market toolkit. However, the VIX needs to be used in the proper context to be more helpful to longer-term stock investors. From Yahoo Finance:

The thing is, the VIX never measured ‘fear’. It measures expected volatility.

Given the Fed may be raising rates soon and renewed concerns about the stability of the euro, it seems logical the market is expecting higher volatility in the months ahead, and perhaps a higher VIX. However, volatility can occur within the context of a longer-term bullish trend in stocks (see 1995-1997).

Thanks for reading. Have a great week!

Follow CCM on Twitter: @CiovaccoCapital.

Author holds positions in securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.