Has The Federal Reserve Waited To Hike Rates?

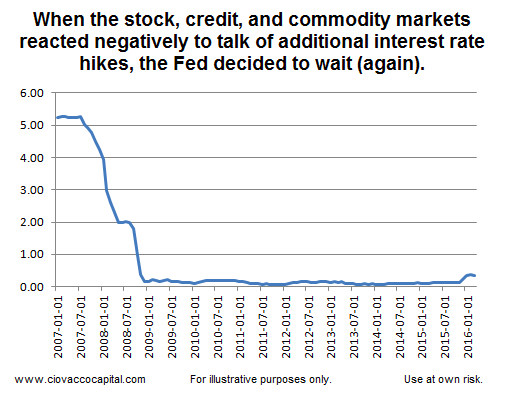

Anyone, including Stanley Fischer, who understands the lag between monetary policy and inflation knows at some point the Federal Reserve will have to raise interest rates due to rising inflation expectations. Fischer noted back in August 2015 the Fed “should not wait until inflation is back to 2.0% to begin tightening”. Crude oil has rallied strongly in recent weeks, meaning it will no longer be a silent member of CPI in 2016. The chart of the Federal Funds Rate below shows the Fed has raised interest rates a mere 0.25% after keeping them at zero for several years.

Oil Was Not The Fed’s Only Concern In Late January 2016

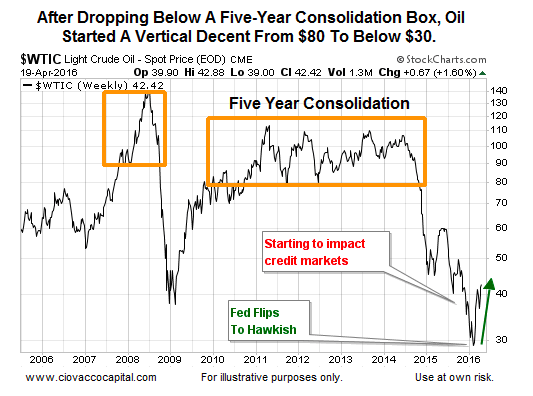

Clients and long-time followers know “the longer a market goes sideways, the bigger the move we can expect” once the range breaks. The chart of crude oil prices below provides a real world example. The left side of the chart shows the financial crisis breakdown; the right side shows the more recent plunge.

Fed Received “We Need Help Calls”

Central banks often have dialogues with their global counterparts; sometimes the dialogue takes the form of a call for help. From Reuters:

Confronted with a plunge in its stock markets last year, China’s central bank swiftly reached out to the U.S. Federal Reserve, asking it to share its play book for dealing with Wall Street’s “Black Monday” crash of 1987.

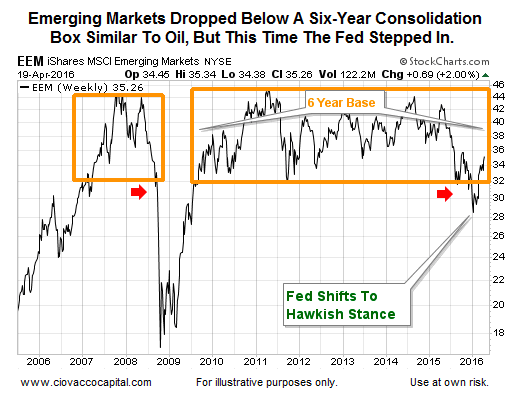

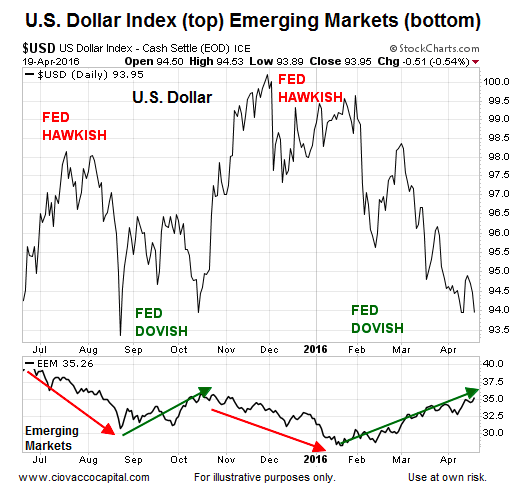

Compare the pre-plunge look of the crude oil chart above and the early 2016 look of the emerging markets chart below. It is easy to understand why many experienced money managers had converted to a defensive stance in early 2016. After the Federal Reserve talked about multiple hikes in 2016 (which tends to push the U.S. dollar higher), the weak-dollar friendly EEM ETF broke down from a six-year pattern of sideways action, which is a very, very vulnerable look as shown via the recent crash in crude oil.

Like crude oil, emerging markets benefited from the Fed’s about face on interest rates between early and late January 2016. If the Fed decides to take a more hawkish tone, it could throw a wet blanket over many of the current rallies in cyclical/weak-dollar friendly ETFs.

Yellen To Double-Down On Wealth Effect?

With earnings declining for several quarters, it is possible Janet Yellen has decided to double-down on the wealth-effect theory of economic stimulation. From The New York Times:

Ms. Yellen told the Economic Club of New York that the economy “had proven remarkably resilient,” and that the Fed expected better days ahead. She said the Fed still intended to pursue a careful, patient course toward higher interest rates as the economy improved. The cautious tone of her remarks, however, suggested no rate increase was likely at the Fed’s next meeting, in April, shifting the eyes of Fed watchers to its subsequent meeting in June. “I consider it appropriate for the committee to proceed cautiously in adjusting policy,” Ms. Yellen said. Stocks jumped and bond yields fell in the moments after the publication of Ms. Yellen’s remarks, part of a now-familiar pattern in which markets celebrate signs of economic softness and Fed restraint because that means interest rates will stay lower for longer.

Fed Statement Next Week

The Fed may break their recent pattern of being dovish when stocks are on the ropes and hawkish when stocks are hovering near their recent highs. However, the public remarks made on Monday, April 18, by the President of the Boston Federal Reserve remind us that it is unlikely the Federal Reserve can remain in stock/oil/emerging market friendly mode indefinitely. From Reuters:

The Federal Reserve is set to hike interest rates more rapidly than investors currently expect, a top Fed official said on Monday, again pushing back on what he said was investors’ too pessimistic view of the U.S. economy and monetary policy. It was the second time in as many weeks that Boston Fed President Eric Rosengren warned that futures markets, which see only one modest rate hike in each of the next few years, are off the mark. He said U.S. inflation was now “much closer” to the Fed’s goal.

Fed Can’t Postpone Hike Indefinitely

It is also possible the statements made in Jackson Hole last year, rising inflation expectations, and the chart of interest rates below cause the Fed to replace the dovish script with the hawkish script.

“Because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2 percent to begin tightening.”

Pop In CPI Could Spook Markets

We all know that hawkish Federal Reserve statements tend to put a drag on asset prices, but what many may not be familiar with is the market’s reaction to a well-above expectations inflation reading, which would force the Fed to raise interest rates at a faster than anticipated rate. The Fed is well aware of this possibility given they have done next to nothing to prepare for such an event.

Putting The Rally In A Different Light

If the Fed shifts to the hawkish camp (i.e. Fed rate hikes), as shown in this week’s stock market video, the current rally in risk assets may not be as impressive as it appears at first blush, which speaks to hawkish vulnerabilities. Nothing would surprise us given the recent actions of the Federal Reserve, including a decision to double-down on the wealth effect.

Thanks for reading.

More from Chris Ciovacco: Has The Reflation Trade Turned A Bullish Corner For Stocks?

Twitter: @CiovaccoCapital

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.