The Federal Reserve is due to release their next formal policy statement April 27 at 2:00 pm ET

Fed’s Constant Assistance Is A Two-Sided Coin

The Federal Reserve stepping in to assist financial markets is not particularly new or surprising but with a dual mandate that includes keeping inflation in check, the central bank’s “bailouts” cannot go on indefinitely. The recent Fed-assisted rise in crude oil impacts inflation expectations, which brings to mind the Federal Reserve’s Jackson Hole keynote address by Stanley Fischer:

“Because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2% to begin tightening.”

In 2016, thus far, the Fed has been content to keep interest rates hovering above zero. By reviewing how they decided to put off any additional Fed rate hike (s) and the impact on inflation expectations, we can understand why the Fed’s market-friendly stance has limits, which may begin to adversely impact asset prices in the not too distant future.

Federal Reserve May Hike Interest Rates Four Times In 2016

In what now seems almost comical, Federal Reserve Vice Chairman Stanley Fischer said on January 6, 2016 the Fed may raise rates four times in calendar year 2016. As a reference point, the S&P 500 opened at a level of 2,011 on January 6. Text of the full Reuters story.

After Stocks Tanked, Fed Started To Amend Their Script

Between the “four rate hikes” proclamation day and January 20, the S&P 500 dropped from 2,011 to 1,812. By January 27, the Fed started to show some concern about plunging financial markets. From MarketWatch:

The Federal Reserve on Wednesday expressed less eagerness to hike interest rates, as the central bank showed concern over both the economy and the faltering stock market.

By February 1, Stanley “we plan to hike four times this year” Fischer had shifted to what was described as a “barely any interest rate hikes this year” stance. In twenty-six calendar days Fischer skipped all the way from four hikes to basically zero-to-one hike. From MarketWatch:

Federal Reserve Vice Chairman Stanley Fischer said Monday the U.S. central bank was worried the global market selloff could sap the strength of the U.S. economy, suggesting the market’s expectations of barely any interest rate hikes this year could turn out to be right.

A Simplified Look At The Bailout Mechanism

The economy, markets, and monetary policy have an almost infinite number of moving parts. However, a few charts can sum up the Fed’s bailout process as well as the adverse impact on inflation expectations.

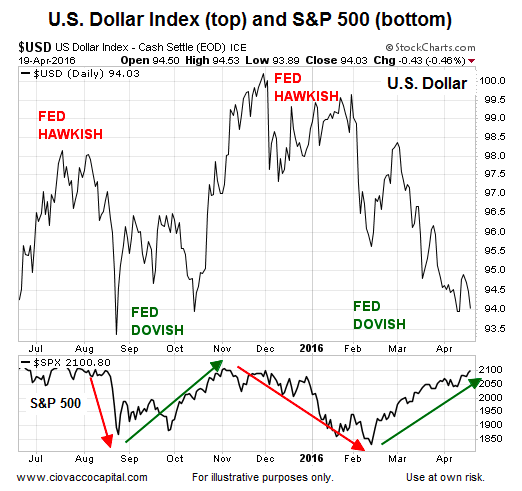

All things being equal, low interest rates tend to have a stimulative effect on the economy. Since monetary policy impacts the relative value of currencies, lower rates also tend to equate to a weaker U.S. dollar. Corporate earnings tend to benefit from a weaker U.S. dollar, which is pleasing to U.S. equity investors.

Rates And The U.S. Dollar

There are also a wide variety of ETFs that fall into a “weak-dollar-friendly” category, including oil (USO), energy (XLE), materials (XLB), and emerging markets (EEM). While it is far from a direct correlation, the chart below shows stocks tend to perform better when the Federal Reserve talks about keeping interest rates lower longer (dovish) versus periods when the Fed hints at additional rate hikes (hawkish). The Fed’s tone, not surprisingly, is impacted significantly by movements in the stock market.

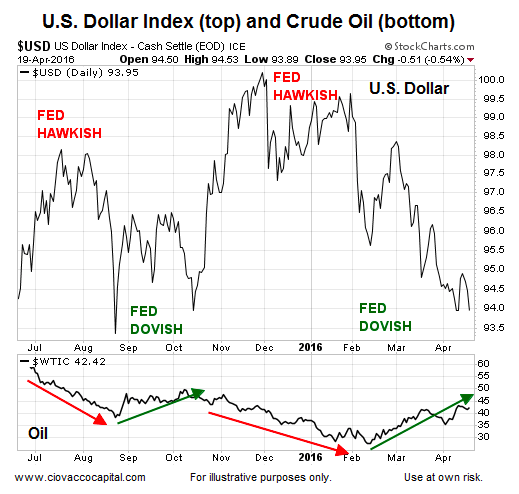

Oil Prefers Lower Rates

Since many credit agreements in the oil patch are tied to the price of crude oil, the recent waterfall plunge in oil prices started to have a negative impact on the credit markets, especially junk bonds (JNK). Oil and wounded credit were undoubtedly a part of the Fed’s 26-day flip from “four hikes” to “barely any interest rate hikes this year”. Remember, oil falls into the weak-dollar-friendly category.

Bailouts Are Not All Fun And Games

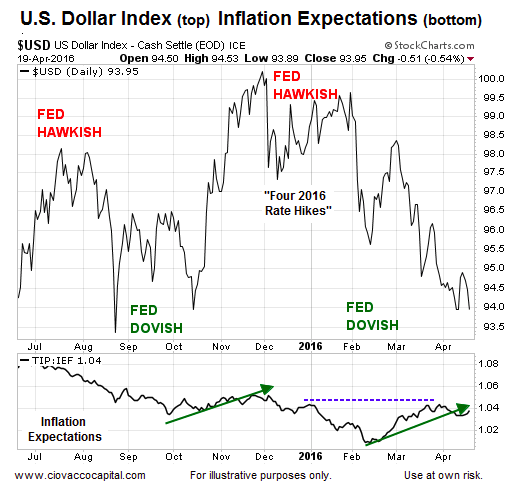

We can use the ratio of Treasury inflation-protected securities (TIP) to intermediate Treasuries (IEF) as a way to monitor inflation expectations. With sharply rising oil prices come rising inflation expectations… and the possibility of a fed rate hike. Notice the dotted blue horizontal line shows the inflation expectation ratio has returned to the same level that prompted Mr. Fischer to proclaim four Fed rate hikes may be needed in 2016. It is not likely the Fed allows inflation expectations to go unchecked forever. As shown via the charts below, a hawkish Fed can dampen inflation expectations. A hawkish Fed means a Fed that is talking about raising interest rates sooner and/or more frequently, which impacts the U.S. dollar, stocks, and crude oil as well. So will we see that Fed rate hike soon?

Core CPI Rose 2.2%

The benchmark for U.S. inflation is the consumer price index (CPI). With crude oil prices tanking between mid-year 2014 and early 2016, CPI has benefited from a muted energy component; other components have not been so tame. From CNBC:

The so-called core CPI, which strips out food and energy costs, inched up 0.1%. That was smallest increase since August and followed a 0.3% increase in February. In the 12 months through March 2016, the core CPI rose 2.2% after gaining 2.3% in February. The Fed has a 2.0% inflation target.

continue reading on the next page…