The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Recent economic data suggests the domestic economy could skirt a recession

- Robust jobs numbers, declining inflation trends, and hope that earnings hang in there are areas the bulls point out

- Some firms, though, have issued cautionary profit outlooks

What’s the state of the consumer? Struggling amid still-high inflation and dwindling pandemic-related excess savings? Thriving in a bountiful jobs market that features improving real wages and the lowest unemployment rate since 1969? It seems there’s data to go either way at this point as recession fears ease. Both the December payrolls report and CPI reading suggest that a goldilocks economic outcome might not be so far-fetched. Of course, the x-factor is Chair Powell and the rest of the Federal Reserve.

Other hopeful signs are out there, too. Lower commodity prices, benign credit spreads, and a tick down in interest rates help to loosen financial conditions. The flip side is that scenario works to the detriment of the Fed’s mission to squash inflation sooner rather than later. We’ll know much more over the coming weeks as major U.S. and global corporations report Q4 results.

But some clues have already been left by major firms issuing preliminary earnings and sales numbers – some good, some quite cautionary. Let’s dig into a few key pre-announcements [sourced by Wall Street Horizon] and what they might mean for equities as we embark on an uncertain 2023.

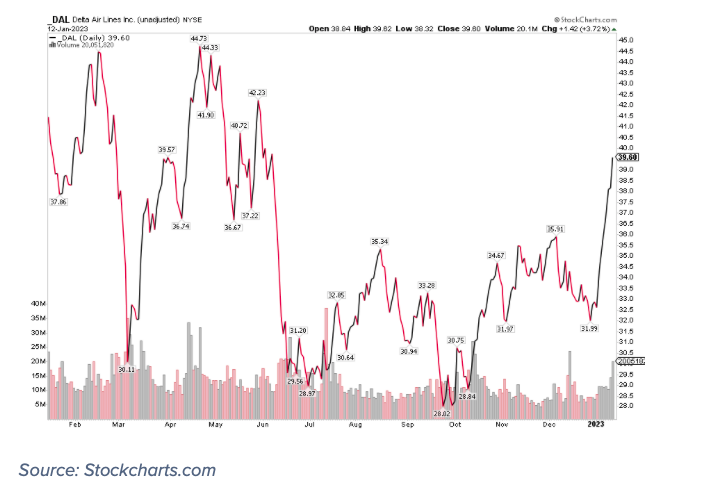

Soft Landing? How About a Bullish Takeoff in Airlines Stocks?

One of the major preliminary earnings reporters to cap off 2022 was a bellwether transports industry company within the Industrials sector. Delta Airlines (DAL) held an investor day back in mid-December, and at the event, the management team voiced optimism regarding its 2023 and 2024 free cash flow generation outlook. Consumers, while strained by some metrics, still want to travel while business travelers return to the skies for corporate gatherings.

As fuel oil prices retreat, the cost per available seat mile for DAL was down on a year-on-year basis, according to the investor day conference. As a result, on December 14, Delta raised its Q4 2022 EPS guidance from $1.00 – $1.25 to $1.35 – $1.40. Throw this in the ‘bullish on 2023’ category. Shares have taken flight since the start of this year. The stock ascended from $32 a few weeks ago to around $40 by mid-January.

On Friday, January 13, Delta reported better-than-expected top and bottom-line numbers, but shares traded lower initially due to reduced Q1 2023 EPS guidance. Still, the CEO said that $5 to $6 of per-share profits could be in the works this year due to solid revenue growth and costs that are in check.

Looking ahead, Delta’s management team is scheduled to speak at the Airfinance Journal Dublin 2023 conference on January 17 and 18, so be on guard for potential stock volatility then.

Delta Airlines Rallies Following Bullish Preliminary Earnings and Guidance

Also, American Airlines (AAL) took flight last week after it upped Q4 revenue and profit forecasts along with raising its margin expectation. Keep your eye on AAL later this month when it reports on January 26.

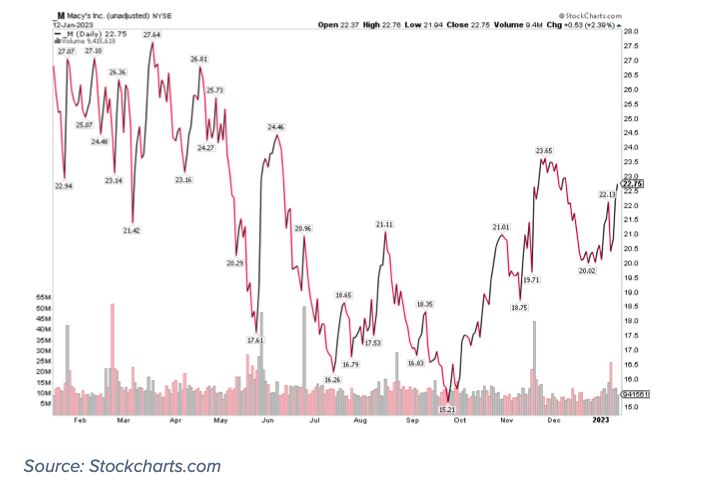

Harsh Retail Reality?

The bears still have plenty of arrows in their collective quivers. One is a downbeat outlook from prominent retailer Macy’s (M). The $6.2 billion market cap department store firm in the Consumer Discretionary sector updated Wall Street to what it expects for fourth quarter sales and profit results. Revenue is now seen in the $8.16B – $8.40B range versus an $8.3B street forecast. EPS is expected to be in the $1.47 – $1.67 range compared to the $1.61 consensus.

That preliminary figure implies a considerable yearly revenue decline during the most important period on the calendar for a retailer. We won’t know the final results until Tuesday, March 7 BMO when it’s slated to release both same-store sales and Q4 full earnings results. Macy’s preliminary earnings announcement goes in the ‘not so hot’ bag.

Macy’s: Shares Struggle in December, But Bounce Back in the New Year

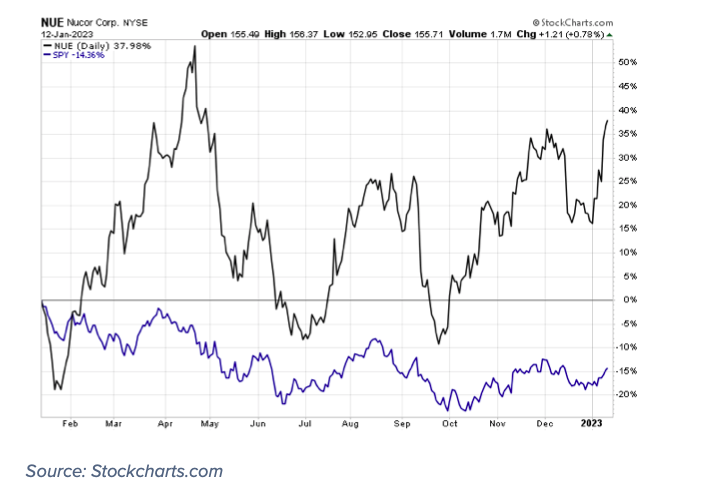

A 2022 Winner

Finally, let’s home in on another cyclical company with less exposure to the end consumer. Nucor (NUE) is a steel and steel products manufacturer with sales in the U.S., Canada, and Mexico. The $40 billion market cap Materials sector company has been a big winner for investors in the last year. While the S&P 500 is down about 15% from 12 months ago, this Charlotte-based steel industry stock has surged almost 40%.

Wall Street Horizon’s data tracking shows a confirmed preliminary earnings event back on December 15. Amid macro uncertainty and CEOs’ continued dismal view of the global economy, the steelmaker voiced to the street that it still expects positive full-year 2022 bottom-line numbers compared to the total from 2021. NUE shares wavered in the weeks following the news, but then rose to fresh 8-month highs by mid-January. The actual Q4 reporting date comes on January 26, so don’t let this one get lost in the shuffle during that busy week of earnings releases.

Nucor Steel Notches New Rebound Highs, Outperforming the S&P 500

The Bottom Line

First-half recession or goldilocks? It seems investors are slowly gravitating to one side. Of course, we will probably end up somewhere in between. With a hefty number of firms issuing preliminary sales and profit outlooks, the corporate world is trying to signal certain messages to investors. It’s clear that some parts of the economy remain in a boom while others are encountering much tougher comps from late-2021’s unusual time of stimulus and super-low interest rates. So far, traders are generally looking past the bad news.

Stay tuned to our earnings season coverage at Wall Street Horizon. You can keep ahead of market-moving volatility catalysts with our industry-leading corporate event data that helps traders identify key dates so that they can effectively manage risk.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.