Given limited resources, it should be no surprise that we aim to maximize the value of our everyday purchases. In most cases, we seek to optimize between acquiring the best product at the most reasonable price.

Intriguingly, most investors do not apply the same discretion when investing their hard-earned wealth. Think about the problem: we seek value when we spend our wealth, but few seek value in protecting and growing their wealth.

In this article, we give a blind taste test. From this, we hope to show you how the lack of discernment, blindly picking stocks based on cache, and yesterday’s momentum is winning out over the logic of maximizing value through prudent intellectual rigor.

Blind Taste Test

Imagine going to your favorite winery and being presented with three bottles of wine. The bottles do not have labels or prices. You smell each wine’s aroma and then take a sip from each bottle. After the tasting, you decide to buy the bottle of wine you like the most.

The vintner then shares with you the price of each bottle. Taste and cost are the two factors that you must weigh to make a decision. Wine snobs may disagree, but to be honest, do you need anything more to buy a bottle of wine? While impossible to quantify, most people will unknowingly compute a ratio of sorts comparing the taste to price. The ratio will likely dictate the decision-making process.

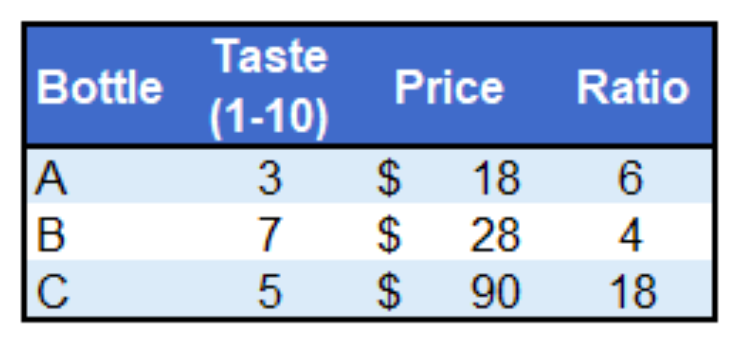

Our wine buying calculus may look something like the table below. The taste scale is from 1 to 10, 1 for the worst, and 10 for the best.

The ratio column allows us to compare price to taste. The wine with the lowest ratio is the one, by our assessment, that provides the best taste per dollar. Which wine would you choose?

We opt for wine B. While it’s not the cheapest, it is the tastiest. Importantly, it gives us the most value per dollar.

Blind Equity Valuations

Now, let’s do a similar exercise comparing three stocks.

Instead of using a price to taste ratio, as above, we provide a host of fundamental data and ratios to help you pick a favorite. We leave out the names of the companies and the stock tickers.

Put your imaginary blindfold on and pick your favorite stock.

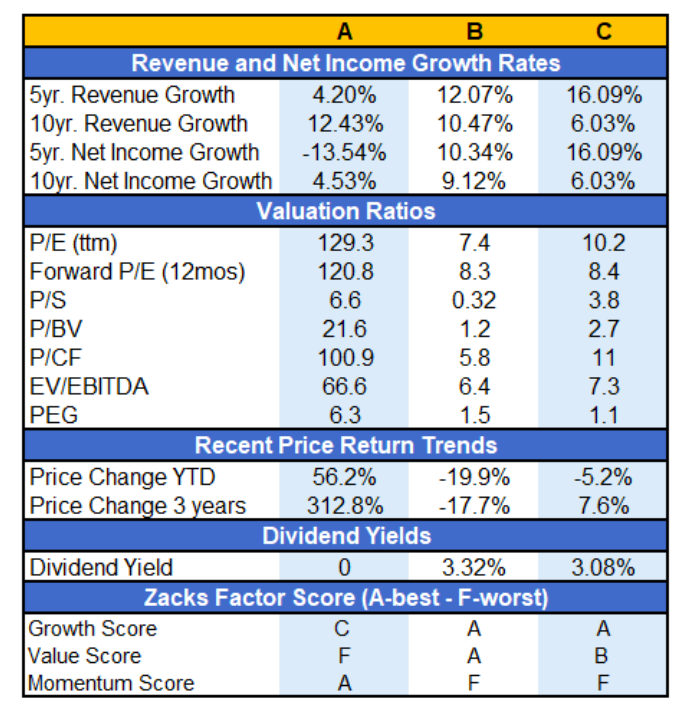

Stocks A and B are in the retail trade, and stock C is in the medical industry. Specifically, stock A is classified by Zack’s as Retail/Restaurants, stock B as Retail/Pharmacies, and stock C as Medical/Biomedical and Genetics.

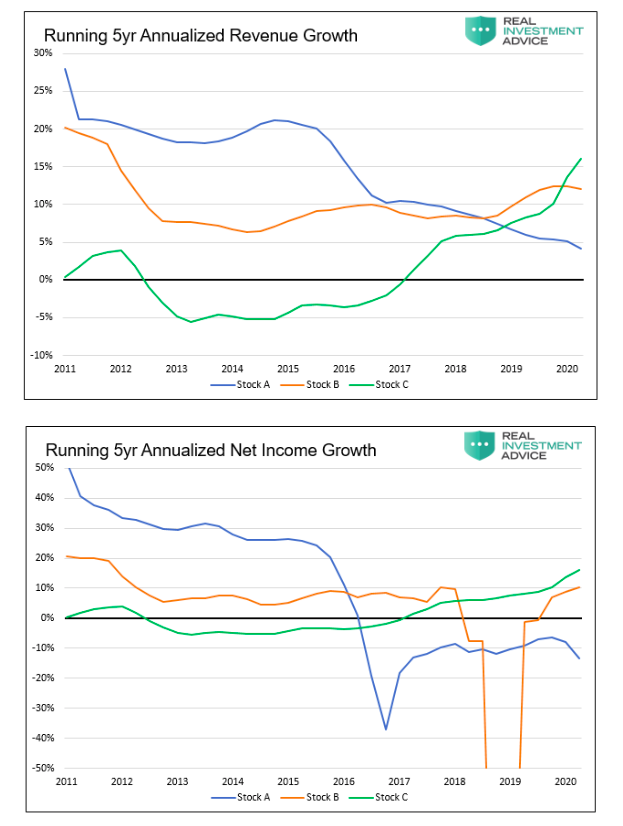

Ownership of stocks, just like ownership of any corporation, represents a claim on the future earnings and cash flows of the company. As such, we share recent revenue and net income growth trends of the three companies.

We now have some appreciation for sales and earnings trends over the last decade. You can think of this to some degree as taste. The table below offers more clues about “taste” as well as price and value.

The Moment of Truth: Pick a stock

Now comes the moment of truth. We gave you a sample of three companies. We fully recognize you are missing insight into each company’s prospects. With that said, these are well-established companies in very competitive businesses. Trends of the past five and ten years should provide useful guidance for future growth.

Now pick the stock you would prefer to own.

Did you pick the stock with the surging stock price, high momentum score, and extreme valuation ratios? Or did you choose from one of the two others with cheap valuations, decent dividend yields, yet poor price performance?

If the object was to pick the stock that did the best in prior periods, the answer is easy. You, however, now must select the stock most likely to provide the best returns in the future.

Which one gives you the most value for the money?

Remove Your Blindfold

- A is Chipotle (CMG).

- B is CVS (CVS).

- C is Bristol Meyers (BMY).

Summary

Like wine, investors have their preferences for types of stocks. We know the allure of chasing a stock like Chipotle (CMG) is powerful. Who does not want triple-digit gains? If we could invest in hindsight, we would all choose CMG. Unfortunately, all gains and losses are in the past. We can only look forward and try to assess which stocks will provide us with the greatest reward per dollar cost in the future. Most frequently, that strategy also includes protection against steep losses.

With CMG’s lofty valuations and relatively weak earnings and revenue trends, is it worth paying many multiples of the cost of CVS and Bristol Meyer (BMY)? Maybe CMG investors are banking on a surge in sales and a sharp reduction in their competition. Possibly there are new bestselling products or innovative product lines to which they will shift. If so, CMG may be at a more reasonable price than we portray. One thing is sure, CMG must sell a lot of burritos to justify their current valuation.

From a pure momentum-based short-term (speculative) trading perspective, CMG may be worth reviewing. However, to maximize the value of our investment dollars in the longer run, we vastly prefer value stocks like CVS or BMY.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.