This article is by Bill Nasgovitz, Chairman and portfolio manager.

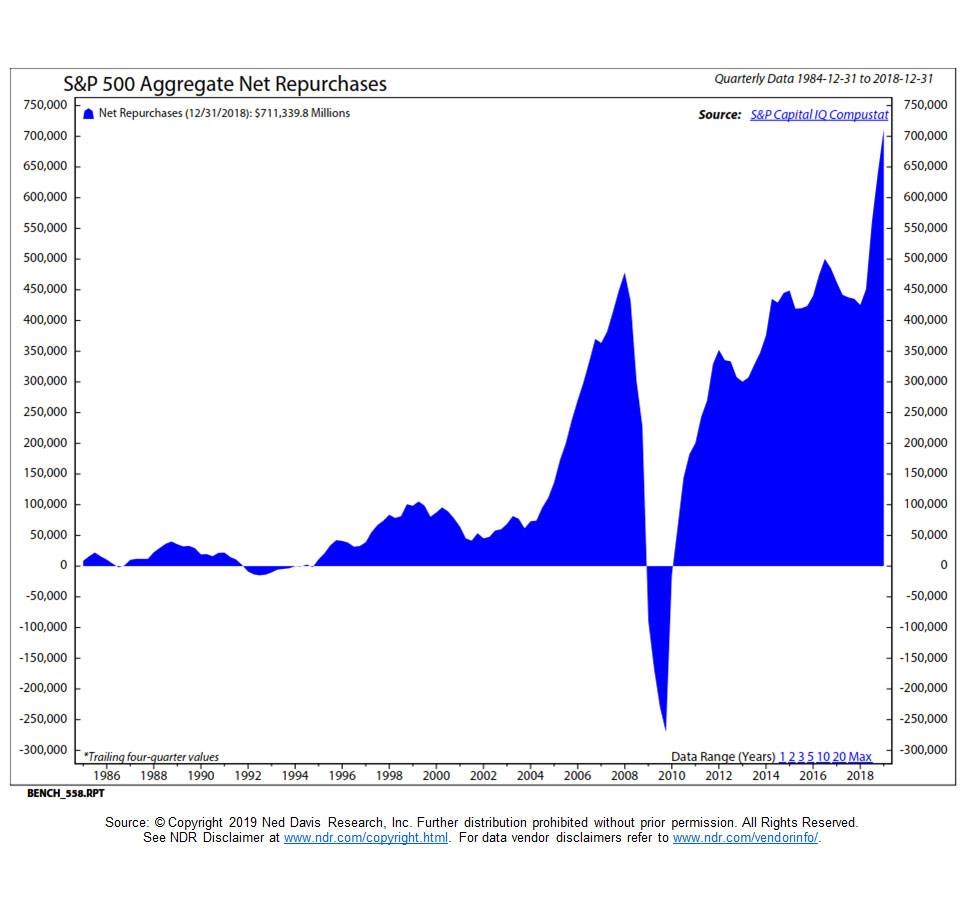

Egged on by record levels of repurchases, as shown above, politicians have been quick to condemn stock buybacks as the driving force behind everything from income inequality to slow economic growth.

It’s a useful story for elected officials casting themselves as the defender of the little guy. But is it accurate? Are stock buybacks a bad thing?

Not always.

Our complaint has been with management teams using debt to finance the purchase of shares at peak valuations.

But what about a business trading well below intrinsic value and generating robust free cash flow? Rather than taking the risk of buying another business why not invest in your own?

Take Dick’s Sporting Goods, Inc. (DKS) for example.

The national sporting goods chain has invested in beefing up its on-line sales capabilities, increased its dividend by 17%, and repurchased 9.6 million shares—nearly 10% of its float—on the open market.

Based on our active research and estimates, the stock offers an earnings yield of nearly 8%,a compelling opportunity in a challenged retail industry.

What makes these efforts, including the stock buybacks / share repurchases, noteworthy is management’s ability to do all three while maintaining a robust balance sheet with a net cash position.

We think the story of Dick’s highlights the value of digging beneath the headlines and rhetoric to get the full story. It is an approach we continue to follow and one that we believe benefits our shareholders over the long haul.

So the great stock buyback bonanza needs to be assessed on a case by case basis.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

As of 3/31/2019, Heartland Advisors on behalf of its clients held approximately 0.45% of the total shares outstanding of Dick’s Sporting Goods, Inc. Statements regarding securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future holdings are subject to risk.

Dividend-paying stocks cannot eliminate the risk of investment losses. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Definitions:Buyback: the repurchase of outstanding shares (repurchase) by a company in order to reduce the number of shares on the market. Free Cash Flow: is the amount of cash a company has after expenses, debt service, capital expenditures, and dividends. The higher the free cash flow, the stronger the company’s balance sheet.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.