Three years ago yesterday, I shared a chart highlighting why Gold may underperform for years to come. The chart looked at the correlation between the Swiss Franc and Gold and how both were tagging ascending long-term resistance at the same time.

Three years ago yesterday, I shared a chart highlighting why Gold may underperform for years to come. The chart looked at the correlation between the Swiss Franc and Gold and how both were tagging ascending long-term resistance at the same time.

The chart is shown again for your reference below. It was the centerpiece of a post entitled, “Swiss Franc Is Suggesting That Gold Will Be Flat-To-Down For Years To Come!”

Gold vs Swiss Franc Chart (from September/2011)

It seemed crazy to question Gold at that time, but since that post, Gold has experienced one of its worst 3-year declines in 40 years. Check out the updated performance chart below. I’ve included year-on-year and rolling 3-year performance.

So what does Gold and the Swiss Franc look like today?

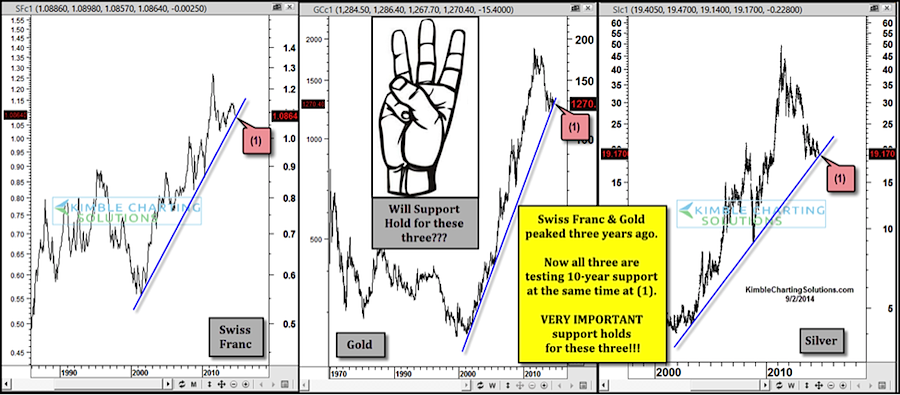

The 3-pack above reflects that Gold, Silver, and the Swiss Franc are all hitting support lines at the same time, that date back over 10 years.

It remains very important for these three that long-term support holds. If it doesn’t, the three year bear market in these could experience a new leg down. One thing the metals have going for them at the time that they didn’t three years ago, is sentiment. It was easy to find Gold & Silver bulls three years ago, now the sentiment picture looks a good deal different.

Despite bullish sentiment being much lower, the 10-year support lines are key to the next big move in Gold, Silver and the Swiss Franc! Keep your eye on these three, this is a rare and important pattern set these three find themselves in… and all at the same time!

It is critical that support holds here for each of these!!!

Follow Chris on Twitter: @KimbleCharting

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.