To top it off, the Fed has been sending strong hints that it would like to move as early as December. Higher interest rates do not help gold, particularly so as potential interest-rate differential has given the US Dollar another tailwind.

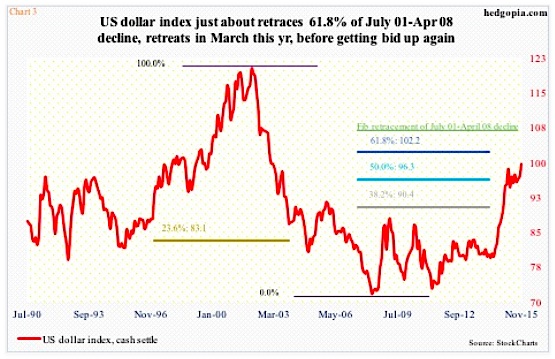

In fact, the next chart (see below) might hold the key as to if gold succeeds in stabilizing here or takes another leg lower. Between the July 2001-April 2008 decline, the US dollar index dropped 41 percent. The subsequent rally brought it close to retracing nearly 61.8 percent of the afore-mentioned advance in March this year before backing off.

The US Dollar Index has gone parabolic particularly since July last year. After a sideways/slightly down action since that March peak, it has regained momentum. If it continues to rally, will it stop at the 61.8-percent retracement?

Gold bugs hope so.

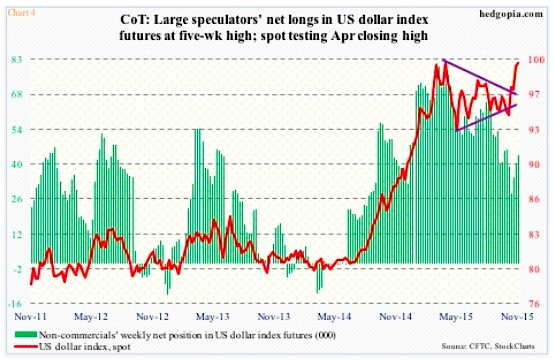

They can take solace in the fact that non-commercials are not as aggressive as they were in March when the US Dollar Index peaked. Back then, they were net long 81,270 contracts in US dollar index futures. As of November 10th, they were only net long 43,784 contracts, even though they have been adding in the past three weeks (Chart 4).

That said, price trumps everything, and on this score, the US Dollar Index acts well. Should it continue to attract bids, it is likely spot gold prices end up sustainably undercutting the July low. On the SPDR Gold ETF (GLD) the July low was used yesterday as a level to sell/initiate shorts. Rally attempts have persistently been repelled at resistance (see chart 5 below).

Given how oversold the Gold ETF (GLD) is on a daily chart, it is tempting to at least try selling put spreads or deploy short puts to position to go long at a lower price. But at this point in time, it is still attempting to stabilize, hence worth waiting.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.