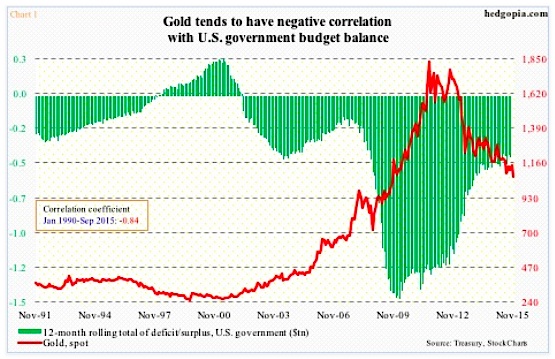

Gold bugs should be wishing the U.S. government begins to run larger deficits. There are tons of reasons why Gold prices have been languishing since the peak in September 2011, but as it turns out gold prices have a negative correlation with the federal government’s budget balance.

Post-Great Recession, the U.S. government began to rack up increasingly large – and larger – budget deficits. The 12-month rolling total peaked in February 2010 at $1.48 trillion. As early as April 2007, this was a tiny – relatively speaking – $145 billion.

When the green bars in Chart 1 (below) peaked in February 2010, gold was trading at $1,119/ounce. Gold prices continued to rally until the peak in September 2011 at $1,924. The budget deficit by then had shrunk to $1.3 trillion. And it has kept shrinking. Gold keeps making new lows, with shallow rallies in between.

In September, the 12-month rolling total of deficit was nearly $439 billion, gold closed out the month at $1,115. The metal since has dropped further to $1,069.

With the latest drop, gold prices are sitting on an important level.

Back in July 1999, it made a low of $253, before beginning a multi-year rally. As stated earlier, Gold prices peaked in September 2011. The subsequent decline has already retraced 38.2 percent of the 12-year surge. Followers of Fibonacci retracement give special importance to 61.8 percent, which would have occurred if gold were to drop all the way to $891, which, as things stand now, is quite a ways away.

In the meantime, gold has retraced 50 percent of that advance. As a matter of fact, it is literally sitting on that retracement (see chart 2 below). More often than not, this level tends to provide support. Should that be the case here, a decent bounce/rally can occur.

Gold remains way oversold on a daily basis, and rapidly approaching oversold conditions on a weekly basis. But what are the odds of that happening?

Ever since gold prices peaked in September 2011, gold has stopped responding to loose – or ultra loose – monetary policy. In fact, the September 2011 peak occurred shortly after QE2 (U.S.) ended. But gold never got going when QE3 began in September 2012. Even now, both Japan and the Eurozone are in the midst of QE, and China has been aggressively deploying traditional stimulus measures. Gold does not move. Consumer inflation is subdued.

continue reading on the next page…