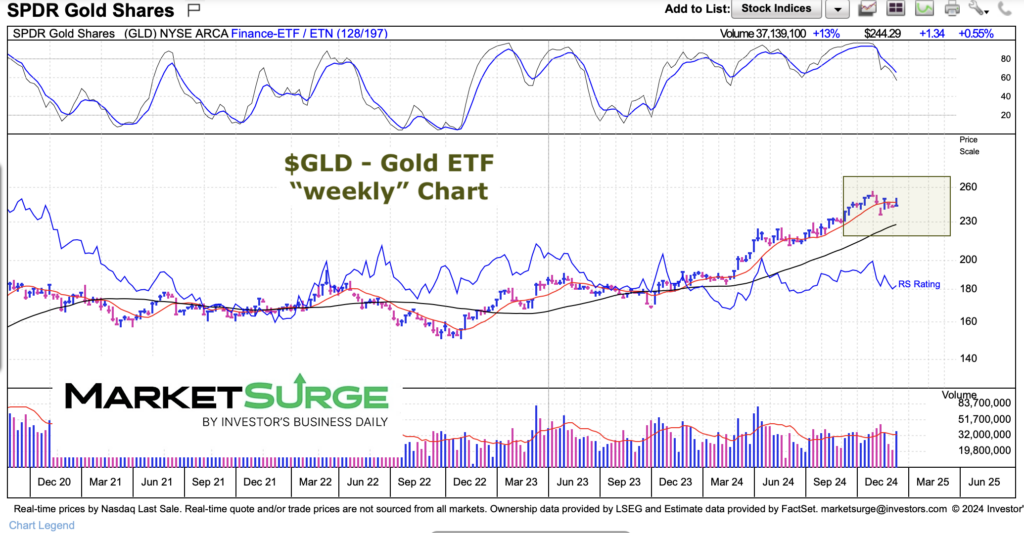

It’s been a stellar year for gold and silver and the precious metals sector.

After breaking out over $2200, gold surged to $2800+ and was/is long overdue for some consolidation / backing and filling.

This is normal. However, how this plays out could be a weeks-long or months-long sideways trade or a deeper pullback that holds above the $2200-$2300 price area… or $210-$215 on GLD etf.

Momentum has turned down but price is trying to hold up. This is a good sign, but we’ll have to see how the next 3-5 weeks play out to see if this is a 10 percent pullback / consolidation or a more prolonged deeper pullback.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$GLD Gold ETF “weekly” Price Chart

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.