In a 2013 See It Market article, we covered how trends can assist in investing and trading. Given their recent weakness relative to the S&P 500, it is fair to ask:

Have trends been helpful in terms of avoiding the long periods of underperformance in gold and oil?

A Picture Is Worth A Thousand Words

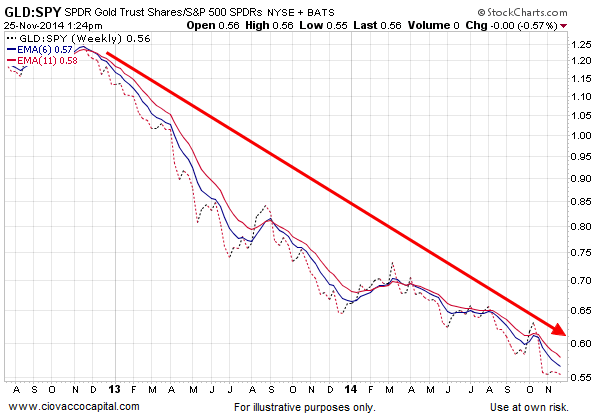

The weekly chart below shows the performance of the SPDR Gold Trust ETF (GLD – Quote) relative to the SPDR S&P 500 ETF (SPY – Quote). As you can probably tell, these are ETFs representing Gold and the S&P 500 respectively. Over the past two years, the vast majority of the time it has been easy to say “stocks are a better place to be relative to gold”. If gold turns soon, which it may, and goes on to outperform stocks for the next five years, we know one thing with 100% certainty; the chart below will not miss the turn.

GLD:SPY Ratio Chart

Black Gold, Texas Tea

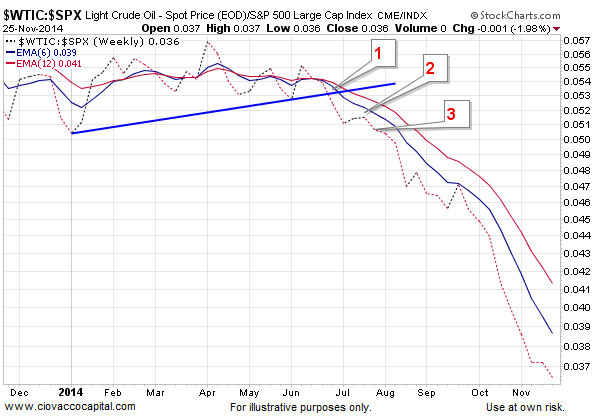

The story is similar for oil looking back over the last five months. Using our three-steps needed for a change in trend: (1) oil relative to stocks broke a trendline, (2) made a lower high, and (3) a lower low. Since then, the bearish trend has dominated the chart.

WTI:SPY Ratio Chart

Moral Of The Story

The same concepts can be used on 60-minute and daily charts, which highlights the need to understand your timeframe. On our timeframe (longer), it has been easy to stay away from gold and oil. Day traders may have had plenty of good set-ups to prudently trade both commodities over the past five months.

Is it always important to have oil and gold outperform the S&P 500? If you are looking to diversify, the answer is no. Under our systematic approach, we prefer to stay away from areas of clear underperformance since the odds of success are better elsewhere. The good news is trends can be helpful under countless market approaches and timeframes.

Thanks for reading.

Follow Chris on Twitter: @CiovaccoCapital

Author holds a position in SPY at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.