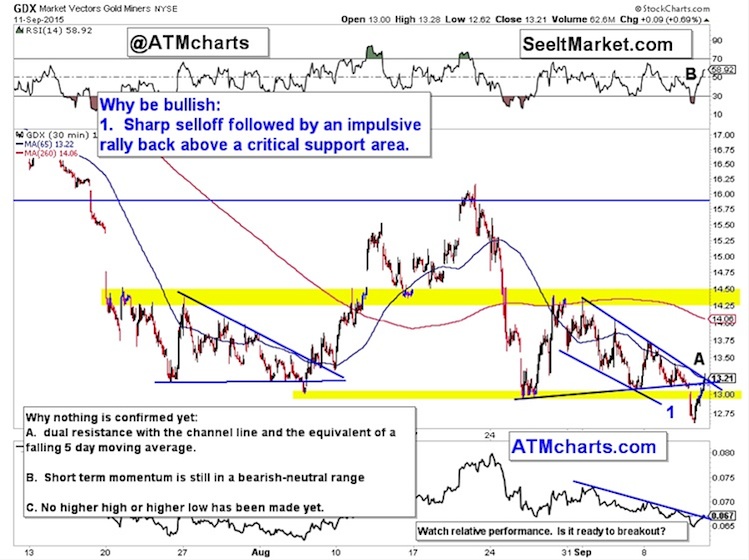

A few weeks ago, I wrote about the junior gold miners and their MASSIVE recent false breakdowns. Friday, we saw an attempted sell-off below key support in the group that failed. Check out the intraday chart (30 MIN) of the Gold Miners ETF (GDX) – it was quite telling. The impulsive rally after Friday morning’s sell-off was a strong signal from the group.

Although we see some very positive signs, let’s note that no rally is confirmed yet. Price has failed to make a higher high or even a higher low. Also GDX has also only rallied into downtrend resistance and the falling 5 day moving average.

Here’s a look at two of the top holdings of the Gold Miners ETF (GDX): Newmont Mining Corp (NEM) and Goldcorp Inc (GG) on a weekly timeframe.

One common theme for the gold miners: momentum divergences.

Now, let’s switch gears and take a look at some of the false breakdowns across select junior gold miners stocks – see charts of Seabridge Gold (SA), Sandstorm Gold (SAND), and IAMGOLD (IAG).

As you can see, they are holding above the false break down levels for now.

Again, the common theme across all of these charts is the absence of downside momentum. That’s exactly what you want to see when looking for a market to turn from bearish to neutral or bullish.

Calling a turn for the Gold Miners is pre-mature. That said, there are many conditions lined up that suggest a major turn may be underway. It’s worth watching GDX to see if a further turn is completing. Risk-reward wise this is one of the most interesting groups on my radar in this choppy mess of a stock market.

Thanks for reading!

Twitter: @ATMcharts

Author has a position in related gold miners ETF (NUGT) at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.