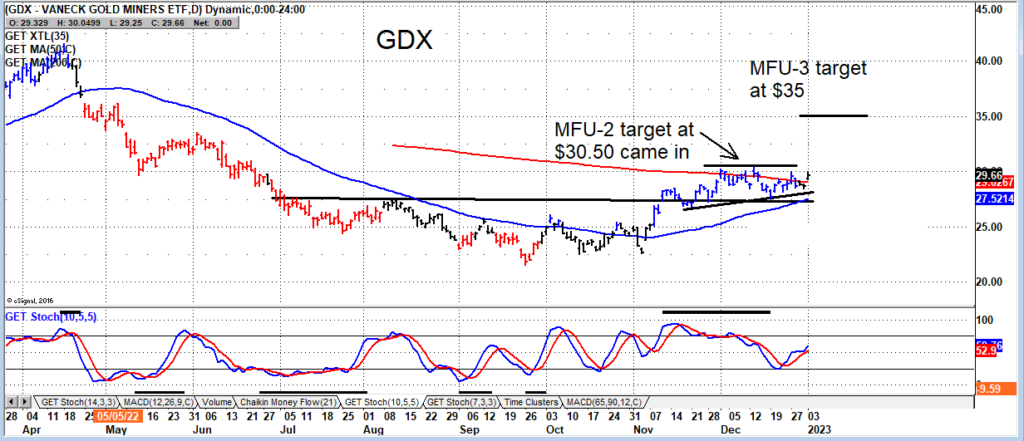

Back in late November, we highlighted a buy signal for the Gold Miners ETF (GDX) on the formation of the bullish “cup with handle” pattern. The price of GDX then hit our initial money flow unit 2 target of $30.50.

The MFU-2 price target offered a pullback or pause where by gold mining bulls could add to the trade.

The pullback has been very orderly and not deep at all, which we read as short-term traders taking profit. In some, this is a mild consolidation that looks very bullish.

I think price is bullish right here and I would add on a close above $30.50 with the next price target being at $35. A move below the 50-day moving average of $20.50 would cancel this bullish trade.

$GDX Gold Miners ETF Chart

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.