Gold continues to act as if it expects a hike as soon as this month. The FOMC meets on the 16th-17th. On Friday, post-August jobs report, the SPDR Gold ETF (GLD) shed 0.3 percent. The two-year Treasury yield was unchanged at 0.71 percent, even as the 10-year gave back five basis points to 2.13 percent. Two-year notes tend to be sensitive to market expectations for the fed funds rate.

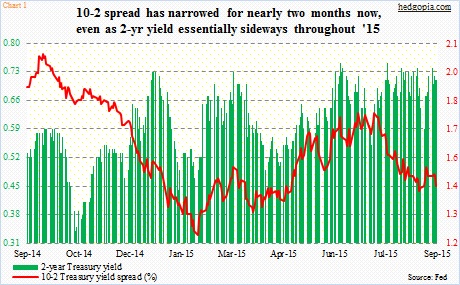

It is interesting how two-year yields have persisted in the 0.7-percent range throughout this year. In the middle of October last year, it was yielding 0.34 percent, rising to 0.73 percent toward the latter days of 2014, and have since essentially gone sideways (Chart 1 below).

Even as the two-year seems to be expecting a hike, the yield curve is sending a different message. The 10-2 spread (difference between 10- and 2-year Treasury yields) has persistently narrowed the past couple of months. The long end of the curve is worried… does not seem excited by prospects of a rate hike.

Gold prices for now are responding to the message coming out of the shorter end of the curve.

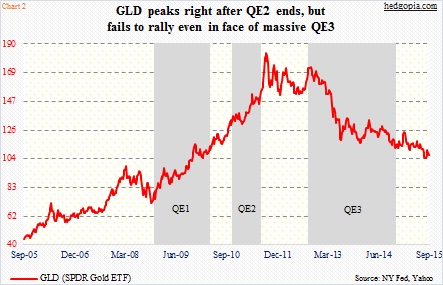

As well, Gold gave the cold shoulder to Mario Draghi’s, European Central Bank president, comments a day earlier. Mr. Draghi said the current program of €60 billion/month asset purchases are intended to run until the end of September 2016, or beyond, if necessary. That is as good a hint as any that more stimulus might be on the way. One would think gold would rally on this, it did not. It is worth recalling that the metal peaked in September 2011, a couple of months after QE2 ended in the U.S., but never got going once QE3 started in September 2012 (Chart 2 below).

With that said, it must be pointed out that the gold ETF’s (GLD) daily chart last week did look like it was itching to go lower in the near-term. If it is just technicals that are dictating the price action near-term, then it is not much of a concern.

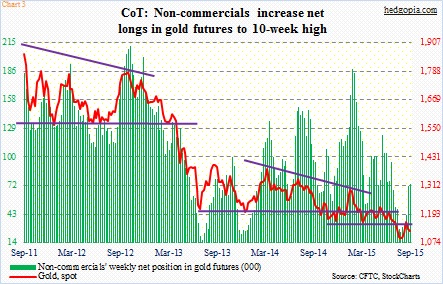

In fact, per the COT report, non-commercials have indeed been adding to net longs in gold futures – up north of 48,000 contracts in the past five weeks (Chart 3 below).

But then again, resistance held on GLD last week. In the first couple of sessions, the gold ETF did try to rally but got rejected on Tuesday at – you guessed it – the 110 region.