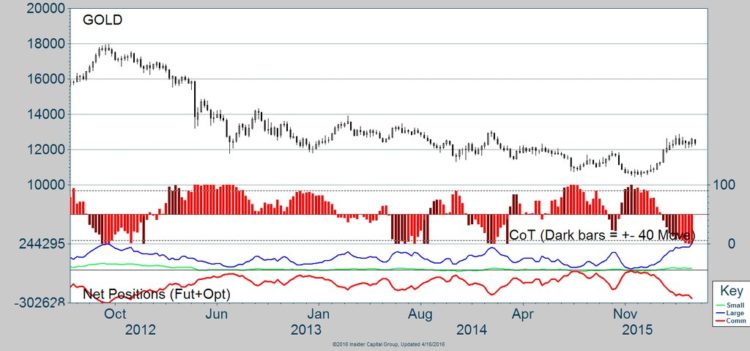

When it comes to futures markets, we can often turn to the Commitment of Traders (COT) report for insight into how certain traders are positions within a specific market. Looking specifically at gold COT data, we are seeing a large degree of separation between two types of traders – Large and Commercial.

Those classified as ‘large traders’ are often hedge funds, trend traders, and institutions while ‘Commercial Traders’ are those that actually use the product within their business which is why they are often considered the ‘smart money.’

Right now we are seeing Commercial Traders extremely net-short gold futures while Large Traders appear to be doing all they can to buy more contracts. Do the Commercial Traders know something the rest of the market doesn’t?

I have no idea, and truthfully it doesn’t matter. Historically this degree of disagreement has ended in the Commercial Traders favor, we’ll see if this time is any different and if we see gold prices weaken in the weeks ahead.

Gold COT Data Chart – Commitment of Traders

Thanks for reading.

The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

Twitter: @AndrewThrasher

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.