The price of Gold and the Gold ETF NYSEARCA: GLD have raced higher in August.

In fact Gold reached up as high as 1565 this week before falling back a bit.

The rally is being spurred by investors seeking “safety” from global trade and economic concerns, as well as a volatile stock market.

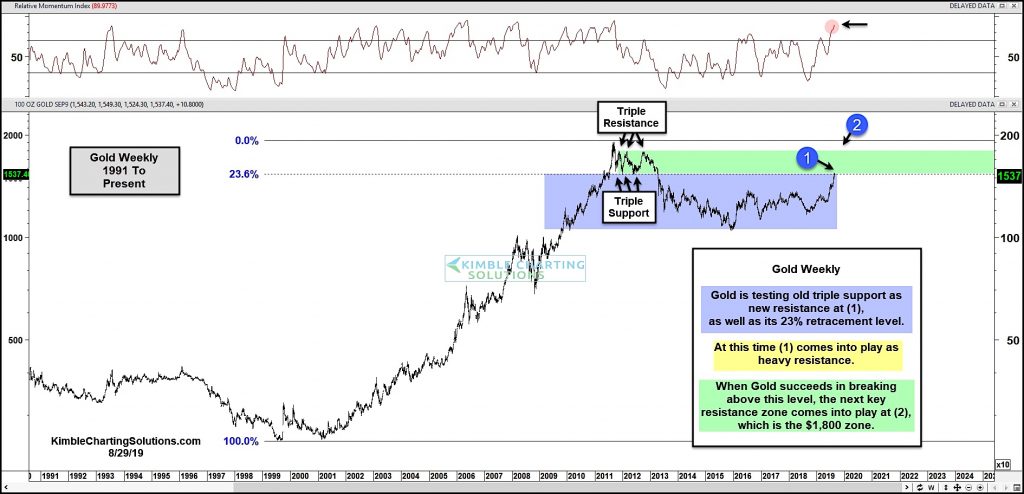

Today’s chart of the day highlights the Gold rally from a long-term perspective.

As you can see, Gold is testing an old price support level that is now resistance at (1).

This price area isn’t any ordinary resistance level: After gold peaked in 2011, it represented the 23.6% Fibonacci level and triple support.

So this is an important breakout test in gold. When gold succeeds in breaking out above this level, it will likely target the $1800 level at (2).

Stay tuned!

Gold Price “Weekly” Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.