When it comes to discussing gold, nothing irritates me so much as when people conflate gold bulls with gold bugs. While they are certainly not mutually exclusive, they are not equivalent. Adding to the frustration, there is a third type of person who has implied that gold bugs would rather invest in gold than in business. Warren Buffet, who I greatly admire, is one of the better-known culprits, citing Berkshire Hathaway’s performance over a long term versus the price of gold. Of course a business is a better investment than gold over the long term. Buffett’s observations should be filed under “Captain Obvious.” His counterpart, Charlie Munger, has even stronger thoughts on the pretty yellow metal. In an interview with Becky Quick, he was quoted saying, “Gold is a great thing to sew into your garments if you’re a Jewish family in Viennia 1939, but civilized people don’t buy gold – they invest in productive businesses.” (roughly 9:00 mark).

Why all the ire towards gold? Is a gold mining business not a productive business? Is Berkshire’s Dairy Queen more or less productive than a gold? Ice cream, after all, has very little productive utility outside of being an unnecessary (albeit delicious) part of one’s diet. To set the record straight, a gold bull is someone who is bullish on the price of gold over a given time frame. A gold bug is someone who thinks that gold is a superior store of value relative to paper money over a long period of time. A gold bug could very well hold plenty of investments in productive business, but may wish to hold the uninvested portion of their wealth in gold over a long period of time to preserve purchasing power.

My rant leads me to my trade idea. To justify the proclivities of the typical gold bug, there is no better metric to look at than the gold/oil ratio, which tells you how many barrels of crude oil one can buy with a single troy ounce of gold. This is an especially useful metric because oil is one of the largest economic input factors in almost everything we do.

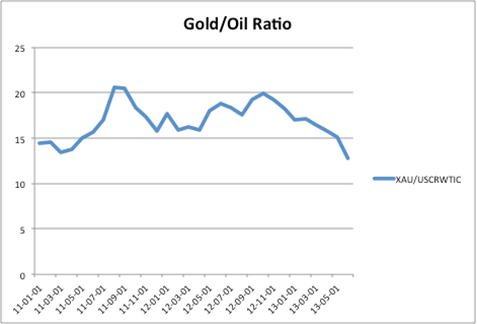

While there are certainly considerable fluctuations in between, it has reliably mean reverted around 15.8 for decades. For perspective, the average gold-oil ratio in 1983 was about 13.3, and this year so far, the average is about 15.7 and it is currently about 12.0. If that isn’t a testament to the long-run ability of gold to preserve value, then I don’t know what is.

Since the beginning of 1983, the ratio has been below 15.8 (the average for the time period) about 50.83% of the time. During the same time period, it has been above 12.00 for about 70% of the time. This leads me to believe that there is a potential trading opportunity in the near future to capture the reversion. Here is a chart of the monthly gold/oil ratio from 2011 to present:

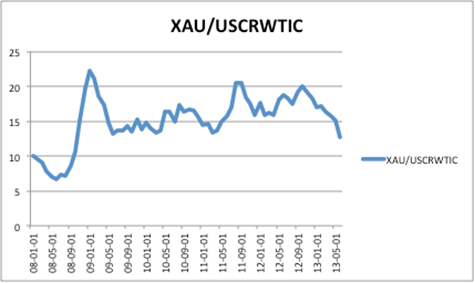

And going back even further to the beginning of 2008:

And going back even further to the beginning of 2008:

The trade can work for Gold bugs and bulls alike (or not work!) – it is a simple pairs trade: long gold and short crude. While some technical management of the trade would be necessary in between, historical precedent seems to say that the pair will revert. Another important point is to identify an optimal entry point; this depends on your personal capital, timing, and approach. Being that gold is often viewed as a put option against market tail risks (and the ratio is breaking lower), it might be best to wait until tail risks in Europe and Japan come onto the radar to put this trade on.

Thanks for reading.

Twitter: @maxmoore306 and @seeitmarket

No positions in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of his employer or any other person or entity.