Our view continues to be bullish on the broader equity markets in the U.S., Europe, and select markets in Asia and emerging markets.

Today we share our technical investing outlook (brief) by global region for September.

U.S. Markets

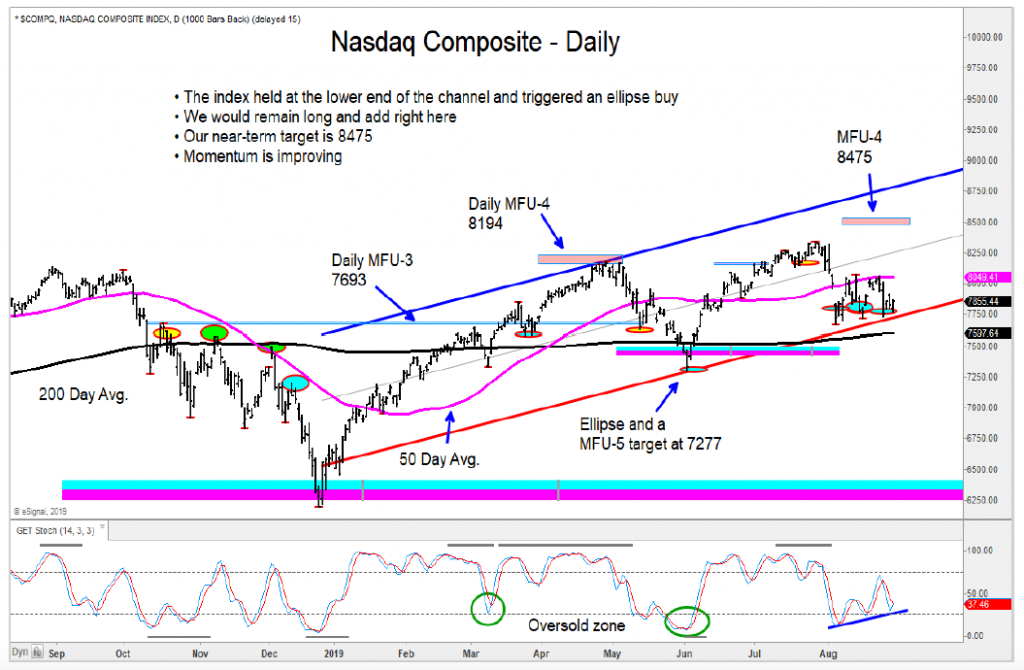

The buy triggered in recent weeks remains in effect for the S&P 500 Index INDEXSP: .INX, Nasdaq Composite INDEXNASDAQ: .IXIC, Russell 2000, Mid-Cap 400 and the Dow Transports.

The long-term 40-week average for both the S&P 500 and Nasdaq Composite is moving higher, which is positive.

The Dow Utilities are into our target area, and we would not be chasing stocks in this group.

European Markets

Germany’s DAX is down into support with momentum at an oversold level. The index recently triggered an ellipse buy, which is positive.

The CAC and Spain’s IBEX are down to support areas that need to hold.

Italy’s FTSE MIB held at its ellipse buy zone and is rallyingfrom its rising 40-week average.

Asian Markets

The Aussi All Ords remains in a weak position short-term as the MFU-4 target capped the high.

The Nikkei is holding its ellipse buy zone and needs to turn up from here.

Emerging Markets

The Hang Seng is holding at support with momentum divergence. We are on alert for improvement from here.

We remain cautious the Kospi 100.

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.