This update serves as a brief analysis of several global stock market indices.

The report below includes price targets and several chart images from world equity markets.

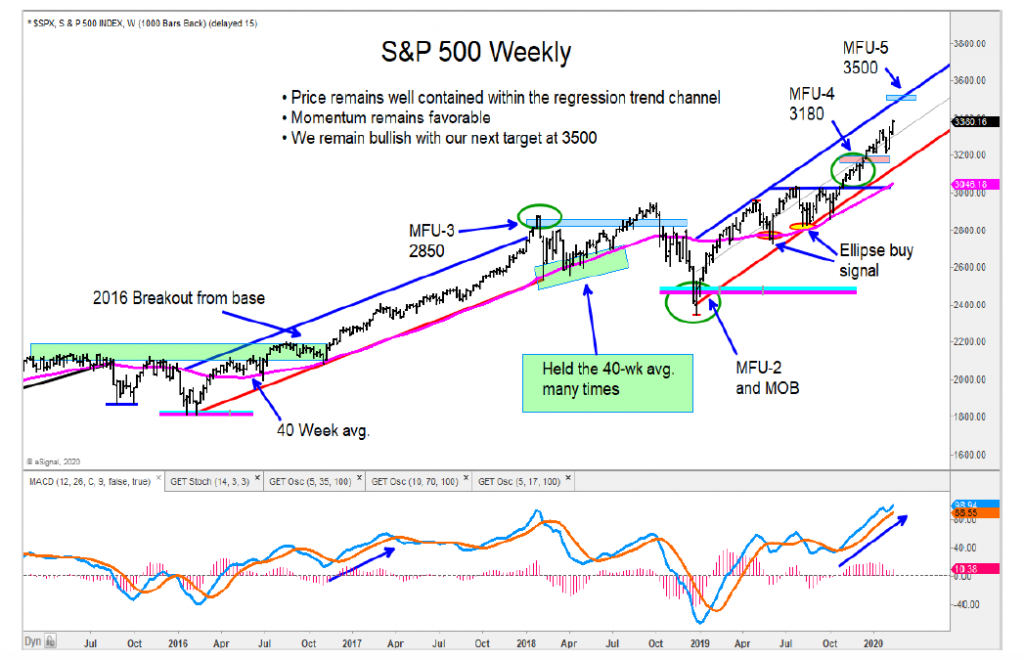

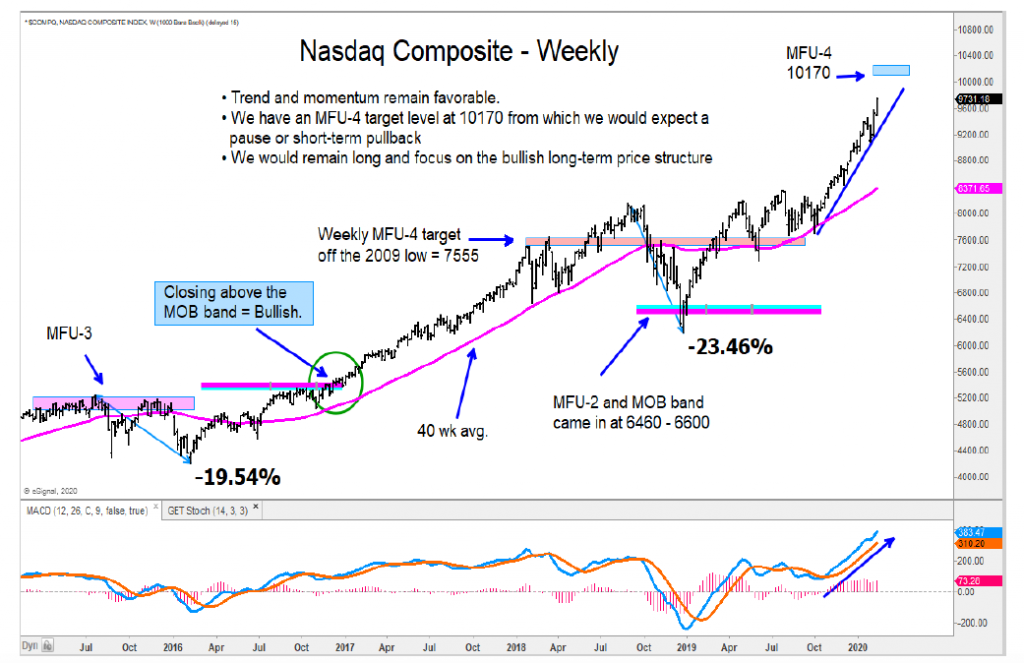

U.S. Equity Markets

The uptrend and momentum remains very favorable for the S&P 500 and Nasdaq Composite.

The monthly chart of the Russell 2000 has a MACD buy in place. This is similar to what we saw off the 2013 and 2016 lows.

Upside momentum for the Dow Jones Utilities remains strong. The stock index is close to its next target zone.

I highlight a long-term chart of the Value Line Geometric Index, which recently inflected up with a MACD buy signal. A sign that the broad market is improving.

The relative chart of high vs. low momentum favors being long high momentum.

The iShares Software ETF (IGV) is making its way above a recent target zone. We highlight ten timely buys that are not very extended.

U.S. vs. Europe continues to show that you want to be overweight the U.S. market.

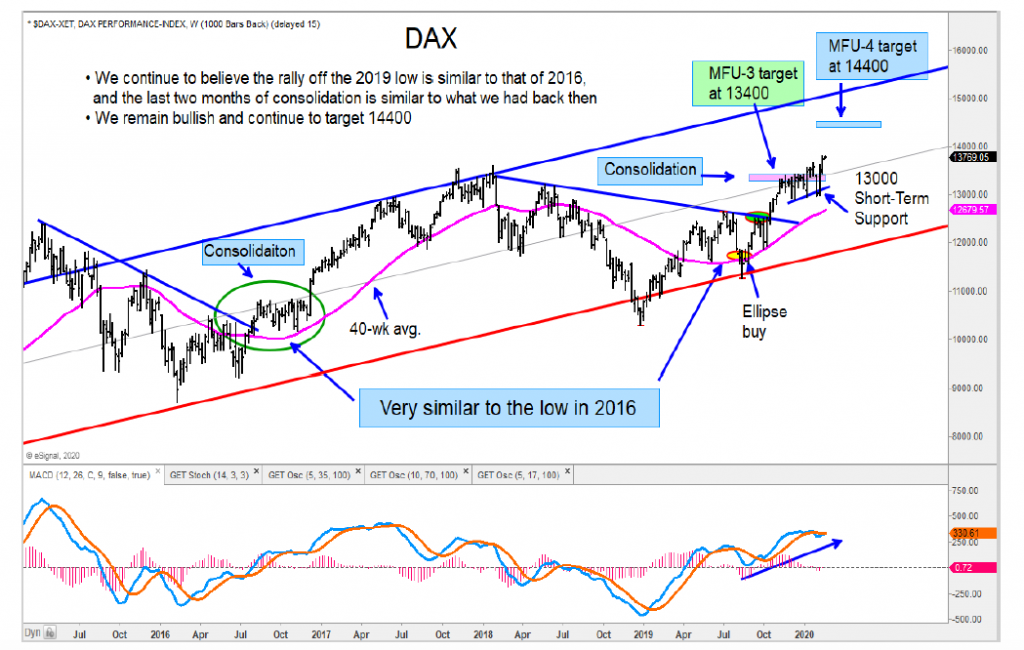

European Equity Markets

I would be adding to the DAX as that index continues to higher above its MFU-3 target zone.

Upside momentum is picking up for Italy’s FTSE MIB, we would be adding.

Spain’s Ibex achieved its initial target where we would expect a pause/pullback to occur. We would be buyers of near-term weakness.

Asian Equity Markets

The Nikkei is pullback short-term, but still above support.

I would be adding to the Hang Seng on strength that breaks the index above 29100.

Emerging Markets

I would remain on the sidelines for China’s Shanghai Composite given the Coronavirus headlines.

The Kospi 100 remains favorable and looks poised for another move higher.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.