December was a fairly uneventful month as activity across the global markets was light due to various holidays. On a personal note, I went sledding with my 4 year old nephew and 3 year old son, and we had a blast. This activity did not add to GDP, nor did it affect exports or imports. Oil prices did not react to this news, although we expended a tremendous amount of energy.

Chinese markets were similarly unaffected. We did not leverage our financial situations, nor did we deleverage them. Actually, no money was spent at all. Basically, in terms of government statistics, there was no economic activity whatsoever. And it was awesome.

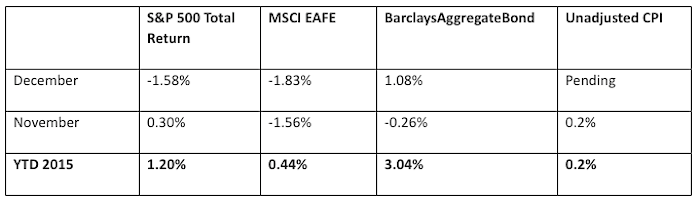

Okay, enough with the fun, let’s look at last month. As the weak close to the month may have been a “tell” for the early year damage across the global markets. By the numbers:

Stocks & Bonds

The S&P 500 drifted lower in December, finishing lower for the year on a price-basis, and somewhat higher on a total-return basis. Bonds moved slightly higher, the limited direction in markets a sing of a slight ‘risk-off’ movement – so safe-haven markets drifted a bit higher.

Commodities & Currencies

NYMEX crude oil prices sold off another 14% in December, finishing 2015 with a historic loss of about 40 percent. Interestingly, the dollar drifted slightly lower by about 1% in December. Normally after a central bank raises rates, as the Fed recently did, a currency might appreciate.

For the year, however, the dollar was up about 10%. Market commentators believe that the Fed rate increase was already priced into the market prior to the action, perhaps explaining the lack of dollar strength in December. The U.S. dollar index rose over 3% in November, and for the year is up about 8.5%. This relative strength is starting to impact exports and corporate profits, and could increase further when the Fed raises rates.

Looking across the global markets, we saw a strengthening dollar. This is also part of the story behind weak oil prices. And Gold fell again in December and finished the year down over 12% – perhaps also due to a stronger dollar. Gold has fallen from its peak several years ago of over $1,900 per ounce and has seen trading dip down near the $1,000 per ounce level. As the Fed raises rates, money market and government bonds become relatively more attractive, since gold distributes no dividend or interest payments.

Economy

The ISM Manufacturing PMI in December came in at 48.2, weakening from the prior month reading of 48.6. Oddly, despite a strengthening dollar, exports moved up in December and imports moved down. This is the opposite reaction one would expect with a strengthening dollar. One month of data is certainly not enough to define a trend, however. Inflation through the month of November was up 0.5% over the last 12 months, certainly nowhere near the Fed’s target of 2.0%. On a positive note, holiday sales increased 7.9%, according to data from MasterCard Spending Pulse, which tracks consumer activity.

Summary

The U.S. economy continued an anemic recovery in 2015, although most major data points were positive rather than negative. The story is much the same in Europe, although the ECB is keeping their foot on the accelerator with regards to monetary easing, while the Fed has entered a chapter of rising rates. Emerging markets (and global markets by default) continue to be hurt by the slowdown in China, collapsing commodity prices, and their weakening currencies.

Risk of a credit crisis in China and its accompanying yuan devaluation remains, in my opinion, the #1 threat to global growth. If the Central Committee of the Communist Party of China manages a soft landing, that would be a positive for the global economy. Many financial folks seem to be enamored of the ‘efficiency’ of the central government in China, which can make the mess of capitalism look bad. I remain skeptical of dictatorship, ‘communist’ or otherwise, from both a pragmatic as well as philosophical standpoint.

2016 will likely contain many of the same plotlines and characters as 2015, although of course we maintain a diversified approach to safe guard against any large market disruptions.

Happy New Year, and I hope you have plenty of time this year for meaningful activities which add absolutely nothing to GDP.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.