Is this not becoming exhausting? Tariffs on, delayed, on again, softened for autos/agriculture then all delayed again.

Our sympathy goes out to the liquor store staff that have to keep removing and restocking the bourbon.

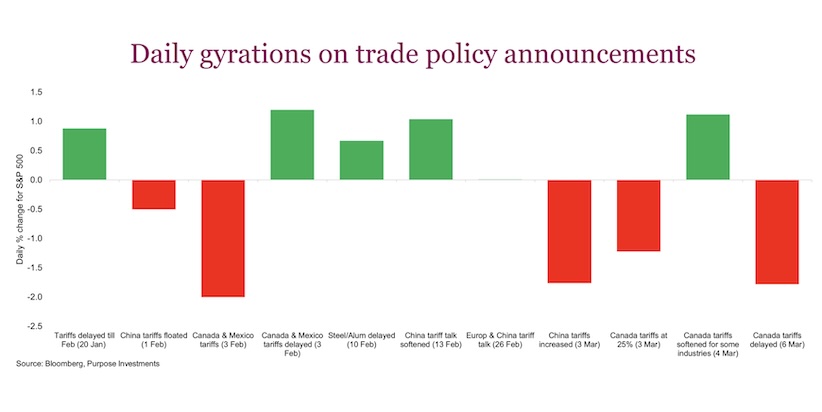

It would appear the market is becoming exhausted as well, or at least fed up. Daily gyrations have clearly risen, just looking at how many +/-1% days on the S&P 500 Index (INDEXSP:.INX) we have experienced over the past few weeks.

The bigger issue is the market reaction function appears to be changing. Early on during this tariff policy news barrage, tariff implementation news was bad while delays were good for markets. But the one-month delay for Canada and Mexico tariffs announced on March 6 elicited no bounce for oversold markets. This market appears to want more than delays to tariff uncertainties.

The markets had been rather patient with all this policy flip floppery during the first month and a half of 2025. But not since then. It is increasingly causing decision paralysis for companies. And we have often cited that markets dislike uncertainty more than bad news. Bad news can be priced in relatively quickly, uncertainty cannot. Sadly, uncertainty is the only constant at the moment.

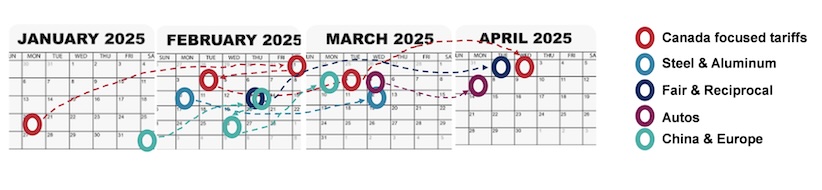

Here is a calendar edition of the key tariff policy announcement dates and deferrals (just follow the dotted lines connecting the coloured circles, if you can). Not surprising, this has pushed the U.S. Trade Policy Uncertainty index to higher levels than seen at the peak of the China-US tariff tussle in 2019. This is a text analysis index based on newspapers’ content. We’re not sharing the chart as it simply looks like a line going straight up!!

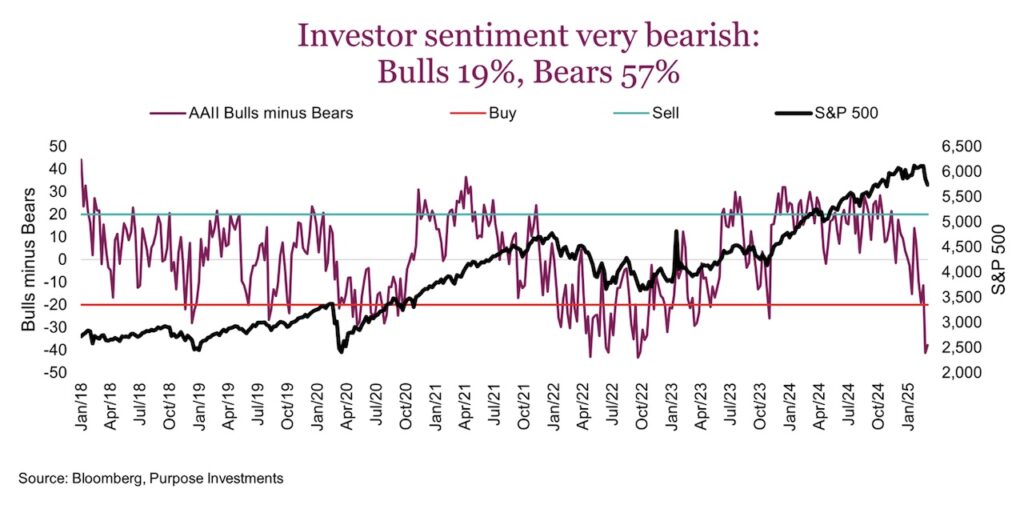

The uncertainty has also started to weigh on investor mindsets. The American Association of Individual Investors has a weekly survey that dates back over 30 years. The survey asks a sampling of investors whether they think the market will be higher, the same or lower in six months’ time. Survey results on Feb 27 had an astonishing 19% bullish and 61% bearish.

The last time there was a reading over 60% bearish was September of 2022, with the S&P 500 at the time down 23% from its high. This February reading came when the S&P 500 was down -3%. The past week’s survey is about the same, 19% bullish and 57% bearish and now we have an S&P 500 down about -7% from its high.

The chart below shows the % bullish minus the % bearish, alongside the S&P 500. The general rule is when the bulls minus bears (net sentiment) is below -20, it is time to buy. Historically, this is a contrary indicator for market direction. With any indicator, sometimes they work and sometimes they don’t. Early in the 2022 S&P 500 bear market, net sentiment hit the -20 mark but the S&P had almost -18% more to go. While this is a very intriguing potential buy signal, is a -7% drop in the S&P 500 enough?

The next big tariff period is in early April. Not just because the one-month delay for Canada / Mexico tariffs land around that time, but the trade-finding reports are also due. This is some 20+ trade reports expected to land on the President’s desk from various sources/industries on trade fairness, which will certainly nudge towards more tariff announcements.

Sentiment readings more bearish than during Covid, S&P trading just below its 200-day moving average with an RSI of 32. It does make a case for some buying. After all, if you wait for good news the market will have already moved on without you. We are waiting though, -7% just isn’t enough given the magnitude of uncertainty.

We also believe there is going to be an economic growth scare in the coming months, that may create better opportunities. A lot of economic activity appears to have been front loaded to get across before any potential tariffs. And we will start seeing the labour impact from DOGE efforts next month. Add to this the general uncertainty for businesses to make decisions on hiring, expanding, M&A. More on all this in a future Ethos.

Our expectations for 2025 are for a more challenging market given headline noise, that will have big swings in both directions (hopefully in both directions). Eagles won the Superbowl with defence over a high-powered offence, believe this will play out in the markets as well — a year for defence and being opportunistic.

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.