Investors have reason to cheer as many global stock market indices are in rally mode as winter starts.

Below is a brief global equities update with analysis, insights, and a few charts.

Global Equities Update – November 13

Stock market momentum remains favorable for a number of U.S. and European markets.

The S&P 500 is well above support and on its way to our long-term target of 3180.

We took off our tactical sell on the S&P 400 Mid Cap Index (MDY) as the index has started to break above the recent highs.

S&P 500 Index “weekly” Chart

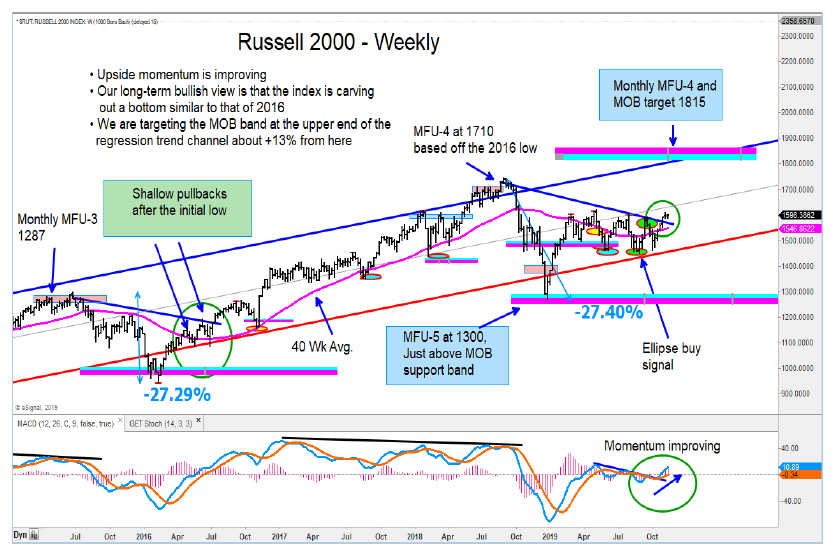

Russell 2000 Index “weekly” Chart

The Regional Bank ETF (KRE) continues to look bullish. We are highlighting both the short and intermediate-term targets.

Industrials, as measured by the XLI, have broken out. We see +8% upside from here.

We are going long the Kospi 100 as that index has cleared the upside of its 2-year channel.

German DAX Chart

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.