The S&P 500 is very close to our 3180 target and overbought on a short-term basis.

We are going neutral on a near-term view within the context of a bullish long-term uptrend.

Here’s a look at the chart…

S&P 500 Index “Weekly” Chart

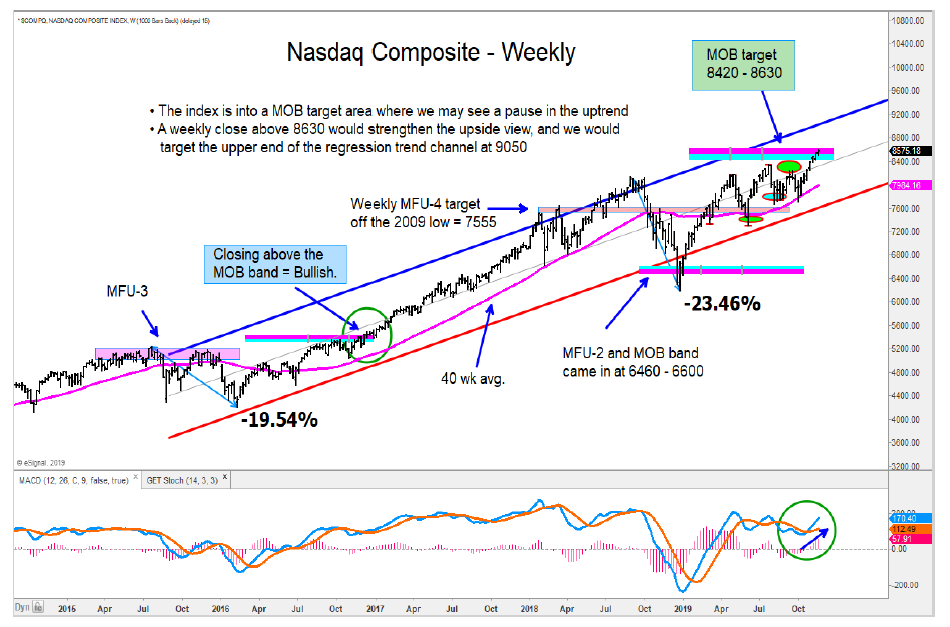

The Nasdaq Composite is also into a target zone, and we expect a pause/pullback to occur.

This index is also going to a neutral view short-term.

Nasdaq Composite “Weekly” Chart

We got the buy signal in the Health Care Sector ETF (XLV) and see higher prices from here.

The 20+ Year T-Bond ETF (TLT) has a buy signal in place.

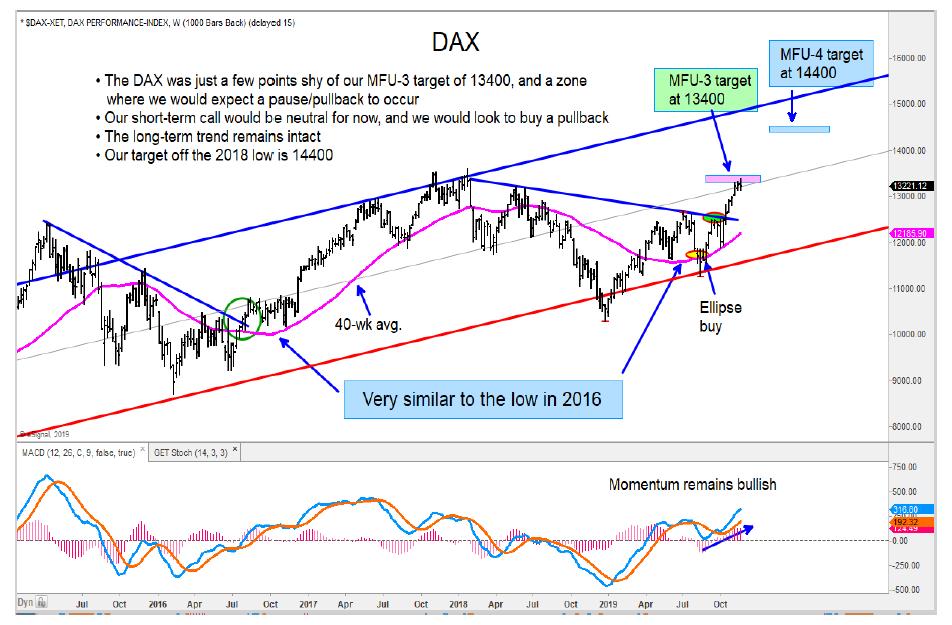

The DAX goes to a neutral call, and we have a short-term sell on Italy’s FTSE MIB.

German DAX Chart

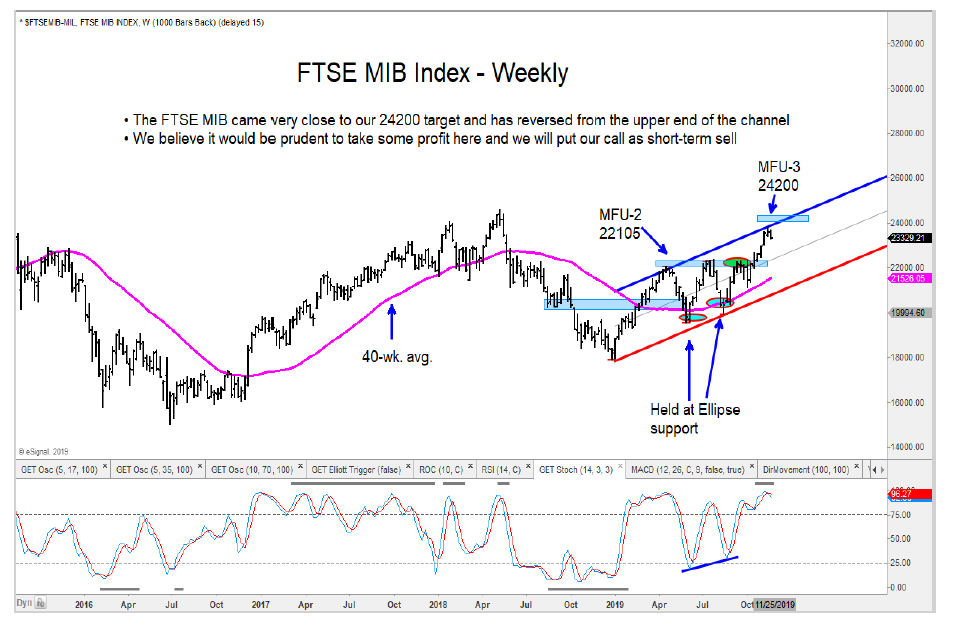

We are going to a short-term sell on Italy’s FTSE MIB as that index is close to our target, but reversing from its channel resistance.

FTSE MIB Chart

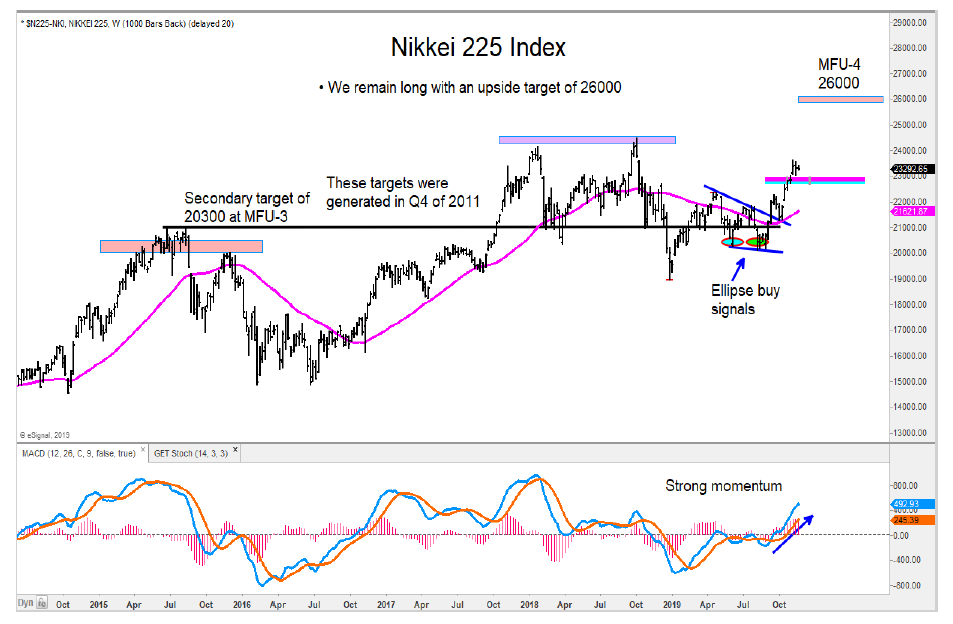

The Nikkei is trading above support, and we expect much higher prices from here.

Nikkei 225 Index Chart

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.