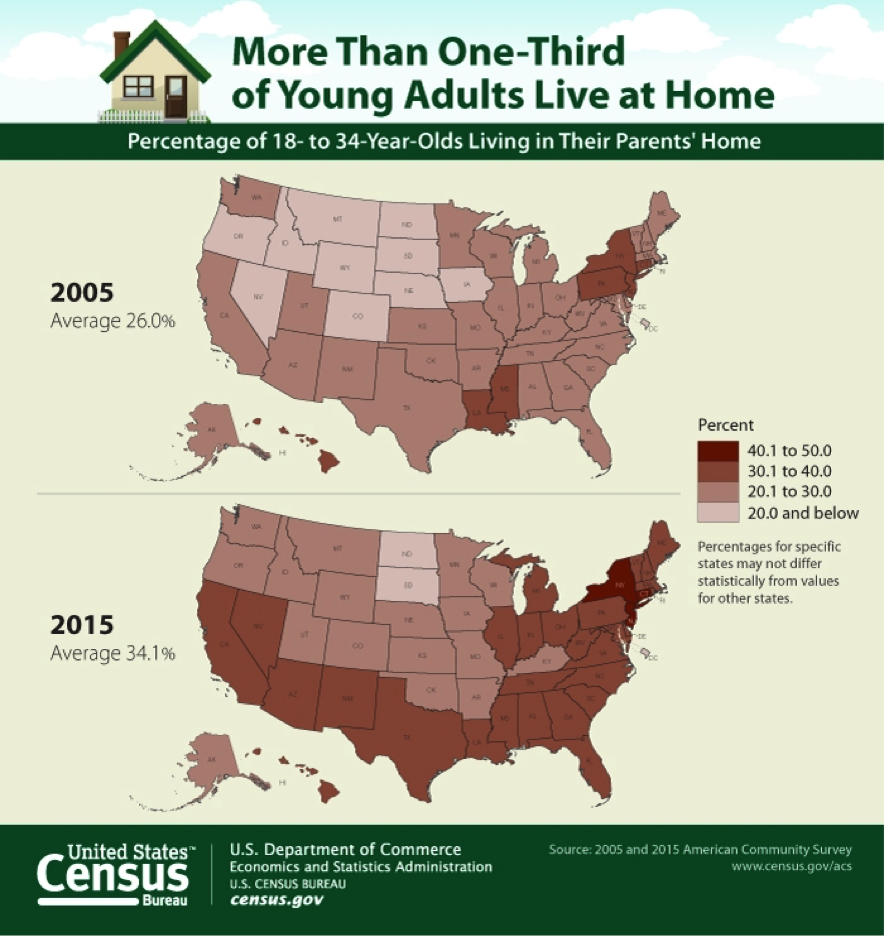

Looking at the chart below, it’s amazing the percentage of young adults living at home. Another reason why I believe housing strength will continue in the future.

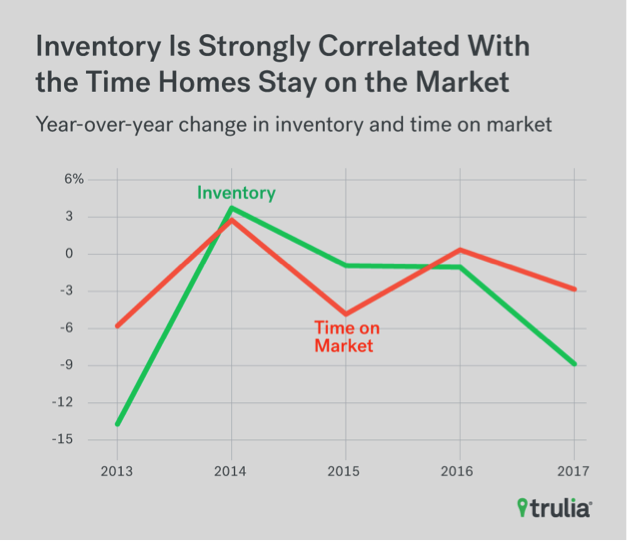

Another positive for housing when reading this note and chart from Trulia:

“U.S. home inventory tumbled 8.9% over the year in the second quarter of 2017, and has now fallen for nine consecutive quarters. Inventory today is a full 20% less than it was five years ago. As a consequence, homes are being snapped up by homebuyers at the fastest clip since we started keeping track in 2012.

For example, 57% of homes in 2012 were still on the market after two months while today that number stands at 47%”.

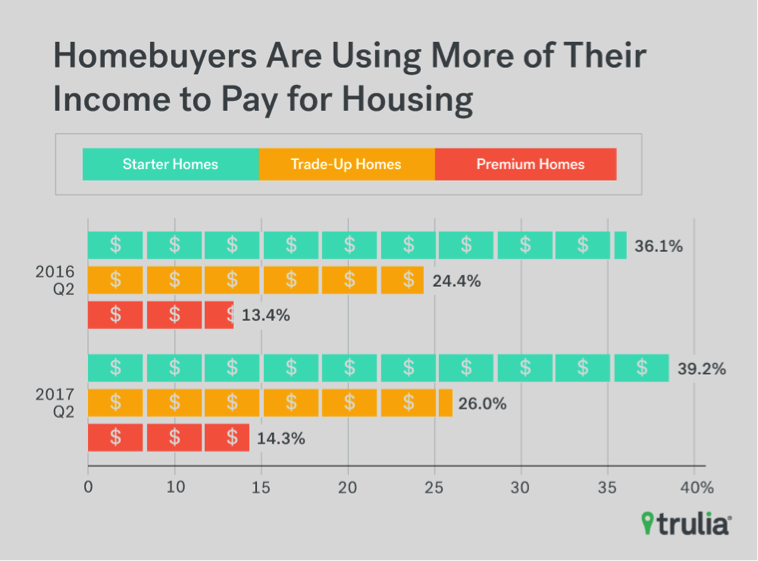

Interesting to note how homebuyers are using more of their income to purchase starter homes!

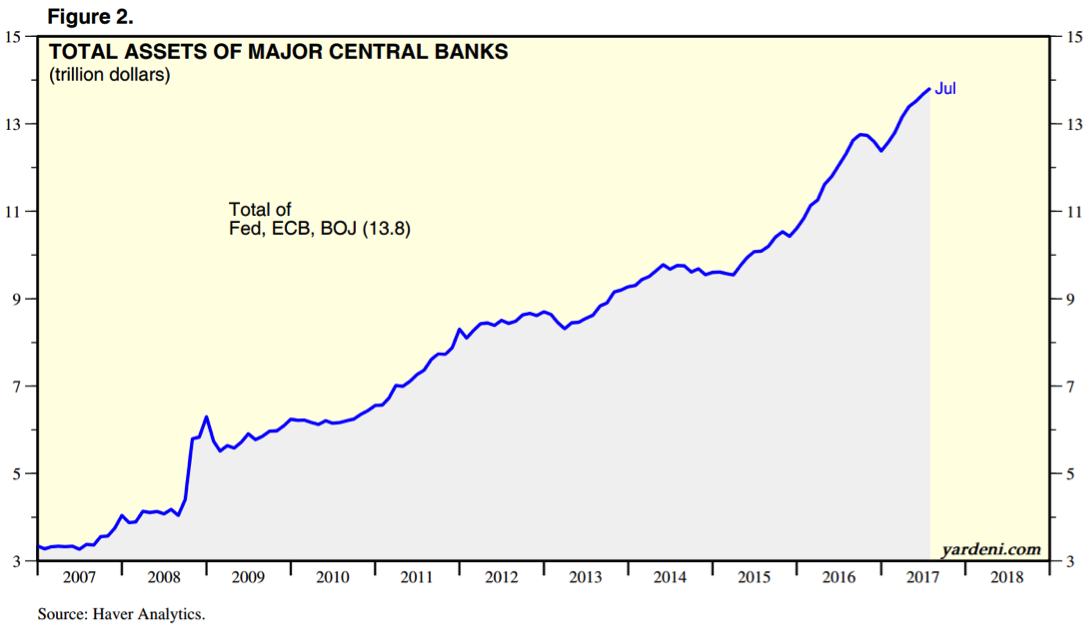

Central bank balance sheets continue to grow has put a prop under the market for now. Will there be a rubber band effect once they start tightening?

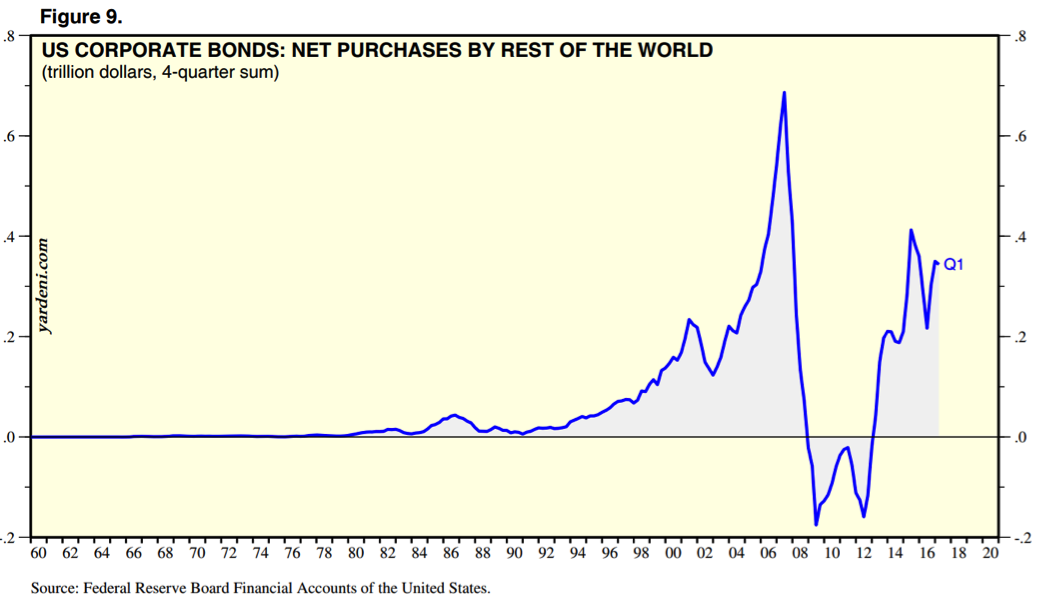

Foreign investors continue to buy plenty of U.S. corporate debt. U.S. corporate debt looks super attractive relative to foreign government and corporate debt thanks to unprecedented Central Bank policy.

The overall picture remains positive despite some potential geopolitical shocks to the global economy. With constant negative media/newsletter coverage of all the problems in the world, the S&P 500 is only off a few percent off the all-time highs and continues to show relative strength. Seasonality weakness and a headline driven market may pose short-term shocks to global markets over the next few months.

Twitter: @MacroTrader4

The author or his clients may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.