As we look around the globe, we are seeing stronger global equities markets that have benefitted from what investors perceive to be a safer playing field. And this has shown up in lower bonds and gold prices, and a falling Volatility Index (VIX). The net result: The S&P 500 is up nearly 6 percent for February, on pace for it’s best February showing since 1998.

Note that this post went out to our email subscribers as part of our “Market Navigator” newsletter (subscribe here, it’s free).

In short, investors are feeling relieved after trading through a multi-month period that included a collapse in Crude Oil, a sharply declining Euro, the Swiss National Bank Franc-Euro peg removal, and the elections and debt showdown in Greece.

Don’t get me wrong, several issues still remain unresolved. But “price” has been pointing higher over the past several days. Are the markets getting tired after this big recent run? Let’s dig into the weekly review and see where we are at.

Our focus will be on three areas: 1. Macro Themes 2. News & Economics 3. The Week Ahead.

MACRO THEMES

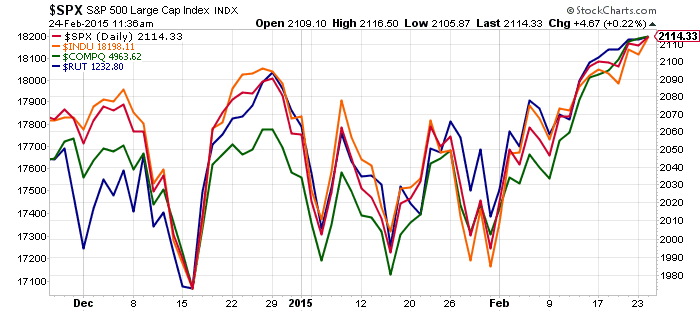

Over the past two weeks, the markets have been moving in sync. This tends to be bullish because it means that investors are pouring money broadly into the markets. As well, investors saw the major indices close the week at 52 week highs. And the start of this week has seen more of the same…

BUT there are a number of reasons why active investors should tighten up risk management over the very near-term.

Here are a few:

1. Sentiment – Any time things feel really good, it’s important to ride the wave but to also be conscientious of sentiment. When everybody gets uber bullish, the market can turn without notice. As a trader, I call it scale and trail… stay in the trade but take profits. For those with broader time frames, it will be important to see how the S&P 500 reacts to 2140-2170 if/when it gets there.

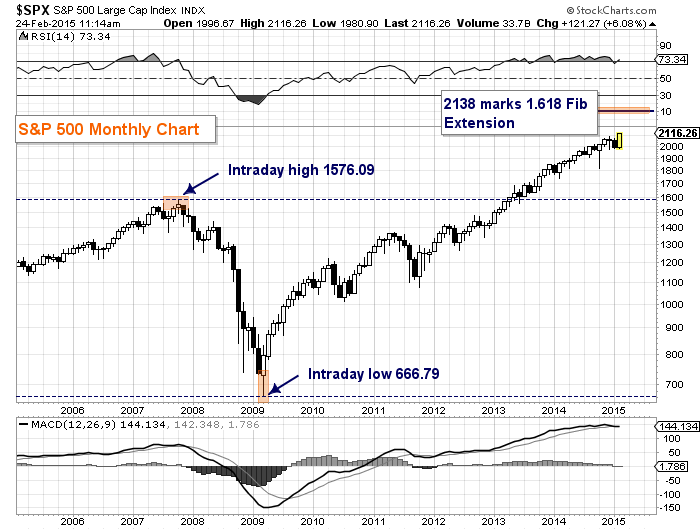

2. Overhead Levels– As I wrote about this weekend, the S&P 500 is nearing a major Fibonacci extension level at 2138. There are also short-term Fib extensions at 2124 and 2163 to watch. See the chart below.

S&P 500 Index – 10 Year Chart

3. Huge February 2015 – the S&P 500 is up nearly 6 percent for the month of February. Last week, I was quoted in MarketWatch that we were on track for the biggest February since 1998. This could mean more upside in the near to intermediate term, but the faster you rise, the closer you get to a pullback… even if it’s just 2 to 3 percent. Something to be mindful of, bull or bear.

A Look Around The Globe

Global equities had a good week. European equities continue to outperform. The DAX and FTSE are grinding higher, while the Euro is still battered near its 52 week lows.

Japan’s Nikkei 225 is perhaps one of the more interesting equity markets to watch from a technical perspective. It has been battling its 2007 highs for the past few months and finally poked its head above those highs (now at 14 year highs). Follow through is the key now.

Nikkei 225 – 20 Year Chart

Lastly, Emerging Markets (EEM) have perked up since December, but they have largely been a poor performer – down 12 percent from their August 2014 highs. There are pockets of strength, including China (FXI), India (INDA), the Philippines (EPHE).

Also read:

- German DAX Pushes Higher: Currency Hedged ETF Outperforming

- Why Italian Stock Market Is Readying For Liftoff

NEWS & ECONOMICS

- Greece bailout extension gives Greek stocks a boost. Europe kicks the can a little further down the road.

- This week’s US economic data calendar:

- TUESDAY: FOMC Chair Janet Yellen testifies in front of congress

- WEDNESDAY: FOMC Chair Yellen testimony continued, New Home Sales,

- THURSDAY: Core CPI, Durable Goods, Initial Jobless Claims, FOMC member Lockhart speaks

- FRIDAY: 4th Qtr GDP, pending home sales, FOMC member Stanley Fischer speaks

THE WEEK AHEAD

As mentioned, February is up nearly 6 percent already and this week will conclude the month. Immediate resistance lies at 2124, then 2138, followed by 2163. I would suspect a pullback or consolidation to begin shortly. That could be as simple as 1 to 3 percent pullback and/or some sideways action. Enjoy the continued bid under the market while it lasts.

And remember to always invest with discipline (i.e. stops). Have a great week.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.